- Category

- Business

How Ukrainian Drones Are Driving Russian Oil Prices Down

Ukraine’s once understated drone campaign is now haunting Russia’s oil infrastructure. This escalating offensive is slashing the Kremlin’s oil profits and exposing a critical vulnerability in Russia’s war machine.

In September 2022, Russia began attacking Ukrainian cities with Iranian Shahed drones. It took Ukrainian special services a little over a year to provide an adequate asymmetric response. Since the beginning of 2024, Russian oil refineries have been systematically hit by Ukrainian drones, which has a tangible impact on the Russian economy. Despite concerns from Ukraine's partners that this could lead to a rise in global oil prices, these attacks have had the opposite effect.

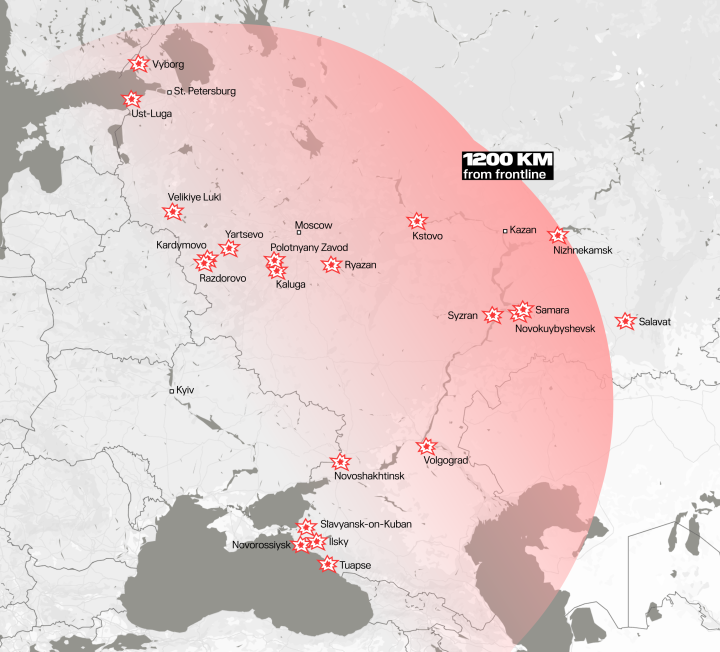

Since the beginning of 2024, Ukrainian special services have conducted dozens of successful operations using Ukrainian-made drones, targeting oil refineries in the European part of Russia, located up to 1000 km from the front line.

According to US intelligence, Ukrainian drone strikes have disabled about 14% of Russian oil refining capacity since the beginning of 2024. As of mid-March, domestic prices for gasoline and diesel fuel in Russia have increased by 20-30%. To mitigate the impact of these attacks, Russia has banned gasoline exports and started importing petroleum products from Belarus, with plans to import from Kazakhstan.

In March, the Financial Times reported that the United States had allegedly urged Ukraine not to strike Russian oil refineries and other energy infrastructure, as it was concerned that this could lead to higher energy prices and further escalation.

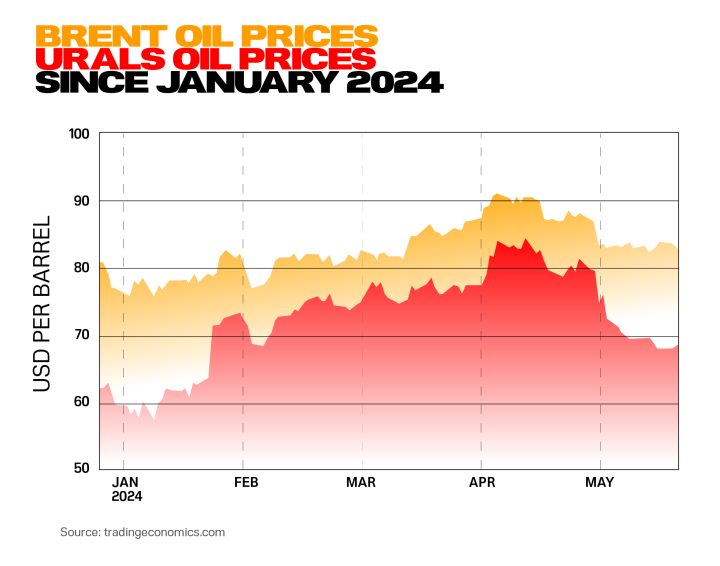

However, there has been no significant increase in energy prices; on the contrary, this has led to a fall in Russian oil prices compared to other oil grades.

"Statistics indicate an increase in the discount between the prices of Russian URALS oil and BRENT. Prices diverged quite widely for the first time since the beginning of 2024. I assume that one of the main reasons is the strikes on Russian oil refineries and fuel supply channels to the central regions of the Russian Federation," says Ukrainian financial analyst and former member of the NBU Council Vitaliy Shapran.

According to Shapran, pushing Russian oil onto the market will lead to its cheapening, as it replaces Russia's fuel exports since the lack of oil storage facilities in Russia does not give them the opportunity for price maneuvering in this situation.

A similar global oil phenomenon occurred at the start of the COVID-19 pandemic. As the world economy contracted, oil prices plummeted to negative values due to insufficient storage for the existing production levels. While countries like the US have natural underground storage (like salt caverns), Russia lacks such resources.

Even before the full-scale invasion of Ukraine, Russia sought similar geological formations, like karst caves, but to no avail. Constructing artificial storage is typically not cost-effective. This lack of storage makes Russian oil highly vulnerable, as it must be refined and sold quickly. Shutting down wells is often a more expensive option.

In practice, Russia's inability to refine all its domestically produced oil forces it to export crude to neighboring countries. This leaves Russia needing to import refined petroleum products like gasoline and diesel. While beneficial for these neighboring countries, this situation is extremely disadvantageous for Russia.

The export of petroleum products is very vital for the Russian Federation. The country depends on the export of oil and other energy carriers, in particular petroleum products, which account for about 30 percent of the country's budget revenues.

However, an even greater role in financing is played by the foreign exchange earnings that Russia receives from the sale of energy resources, because with significant foreign exchange earnings, Russian financial institutions adjust budget revenues through devaluation and other fiscal instruments. Taken together, these factors are critical to financing the war in Ukraine.

At the same time, Ukraine already has significant potential to reduce Russia's foreign exchange earnings and damage the Russian economy by striking energy infrastructure. And we are talking even about those regions that were previously considered relatively protected due to their remote location.

At the beginning of April, Ukrainian special services conducted an operation to strike at a record distance of 1200 km. The object of the attack was an oil refinery in Tatarstan. "The April 2 strikes are the first Ukrainian strikes on Tatarstan, and the distance of the targets from Ukraine's borders is a significant breakthrough and a turning point in Ukraine's demonstrated ability to strike long-range targets deep in the Russian rear," the Institute for the Study of War stated in an analytical report.

According to ISW, such Ukrainian strikes are a necessary component of Ukraine's campaign to use asymmetric means to weaken the industries that supply and support the Russian army.

And today we can already see the first signs that such steps are working. "Breaking the correlation between URALS and BRENT, and maximizing the discount to the level of the first half of 2023, and then fixing it within the price ceiling, can significantly affect Russia's oil export revenues in the second half of 2024," Shapran says.

In his opinion, the second quarter of this year will be relatively successful for the Russian Federation, as URALS prices have been above $60 per barrel for a long time. "However, the revealed trend clearly indicates the correctness of the chosen direction of strikes and may positively affect oil and fuel prices in the Black Sea region as early as June," the analyst says.

The evolving situation demonstrates Ukraine's growing capacity to disrupt Russia's war machine through unconventional tactics. As these attacks continue, their impact on Russia's economy and ability to wage war may become increasingly pronounced.

-206008aed5f329e86c52788e3e423f23.jpg)

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-4390b3efd5ecfe59eeed3643ea284dd2.png)