- Category

- Latest news

Ukraine Launches First Project Under US Minerals Deal, Targets Lithium Investment

Ukraine has taken its first tangible step in implementing a high-profile minerals agreement with the United States. This development was reported by The New York Times (NYT) on June 16, citing Ukrainian government officials.

The Ukrainian government has approved initial steps to open the Dobra lithium deposit—one of the country’s largest—to private investors, according to NYT. If successful, it would mark the first project to advance under the broader US-Ukraine minerals agreement signed more than a month ago.

Citing Ukrainian officials, NYT reports that among the leading contenders to bid on the Dobra site is a consortium including TechMe—a US-backed energy investment firm—and Ronald S. Lauder, a longtime ally of former President Donald Trump. The group has been pressing the Ukrainian government since late 2023 to allow open bidding.

Under the terms of the agreement, half of Ukraine’s revenue from mineral extraction would be channeled into a joint US-Ukraine investment fund. The proceeds would be reinvested into Ukraine’s economy, while the United States would receive a portion, which former President Trump has described as partial repayment for past US aid.

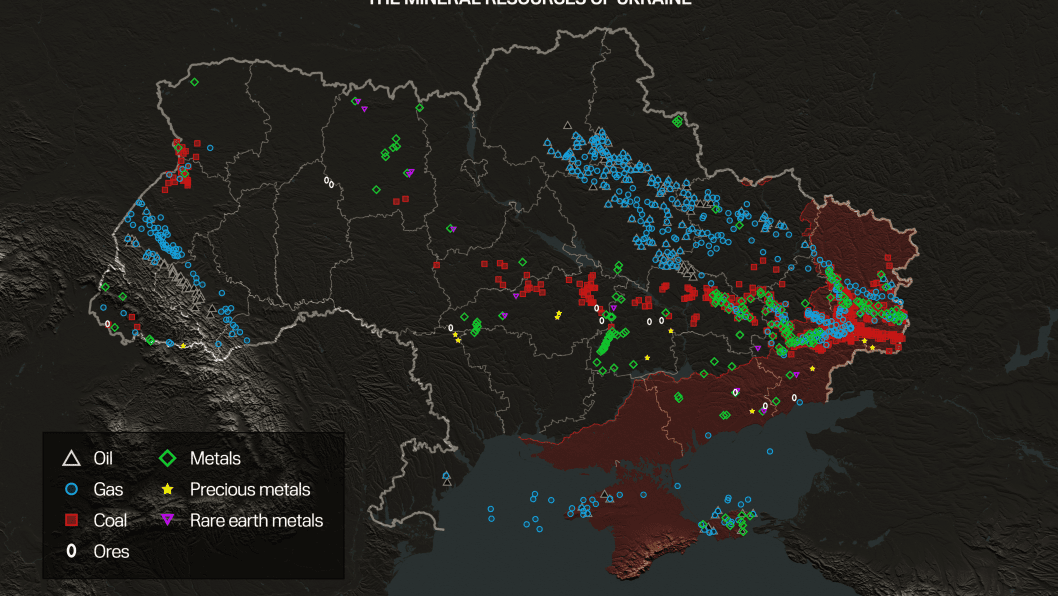

As part of efforts to promote the deal, Ukraine’s Economy Minister Yulia Svyrydenko recently led a delegation to Washington. She presented mining opportunities for critical minerals such as lithium, graphite, and titanium—resources essential to electric vehicle batteries and military technologies. In meetings with US Treasury Secretary Scott Bessent and others, she emphasized the strategic benefits of bilateral cooperation.

NYT reports that the Biden and Trump administrations alike have viewed Ukraine’s mineral reserves as a potential alternative to China’s dominance in global supply chains. Ukraine is believed to hold deposits of nearly half of the 50 critical minerals identified by the US government. These include Europe’s largest titanium reserves and a substantial share of lithium.

Still, according to NYT, experts note that while the potential is significant, most projects may take years—possibly a decade or more—to become fully operational. This is due to challenges such as outdated geological data, infrastructure impacted by the ongoing war, and investor caution stemming from past issues with transparency.

To help build confidence and encourage long-term investment, many stakeholders are advocating for production-sharing agreements. These arrangements offer tax breaks, legal protections through international arbitration, and the security of long-term cooperation with the Ukrainian government. The Dobra lithium project is expected to follow this model, laying a structured path toward responsible and sustainable development.

To accelerate returns, Minister Svyrydenko has proposed expanding the joint investment fund’s scope to include Ukraine’s growing defense industry. As The New York Times notes, Ukrainian factories are producing drones, shells, and artillery at far lower costs than Western counterparts—but lack the investment needed to scale.

“This is about making the fund more attractive to the United States,” said Natalia Shapoval of the Kyiv School of Economics. “If you want a fast return in Ukraine right now, you invest in defense.”

Earlier, it was reported that Ukraine could possess as much as 20% of the world’s titanium reserves, potentially making it a major global player in the extraction of this critical strategic metal.

-c439b7bd9030ecf9d5a4287dc361ba31.jpg)

-72b63a4e0c8c475ad81fe3eed3f63729.jpeg)