- Category

- War in Ukraine

European Leaders Push to Seize Russia’s Frozen Billions for Ukraine. Why Now?

European leaders are ramping up calls to confiscate Russia’s frozen assets to arm Ukraine. Meanwhile, reports suggest Moscow may offer those funds for reconstruction—on its own terms.

“Enough talking, it’s time to act! Let’s finance our aid for Ukraine from the Russian frozen assets,” said Polish Prime Minister Donald Tusk, along with several other points concerning European security. A day earlier, Lithuanian President Gitanas Nausėda expressed a similar view regarding these Russian assets.

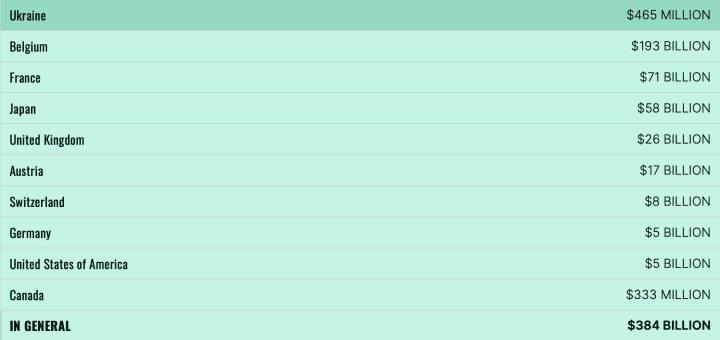

Estimates indicate that between $300 billion and $400 billion in Russian assets have been frozen globally, a significant portion of which consists of gold and foreign exchange reserves. However, exact figures have not been publicly disclosed.

This year, Ukraine is expected to gain access to $50 billion from its allies, funded by the interest generated from Russia’s frozen assets. Meanwhile, Ukraine has long proposed that its partners directly use these assets to procure weapons.

In an interview with American podcaster and blogger Lex Fridman, Ukrainian President Volodymyr Zelenskyy revealed that he had suggested to former U.S. President Donald Trump the idea of using Russia’s frozen assets to purchase American weapons.

The United States made a significant legislative step toward confiscating Russian assets in early 2024. On April 23, 2024, the U.S. Congress passed the bipartisan “REPO Act” (Rebuilding Economic Prosperity and Opportunity for Ukrainians Act). The legislation allows for the transfer of Russian sovereign assets to finance Ukraine’s reconstruction. However, the law has yet to be applied in practice.

The United States controls a relatively small portion of Russia’s frozen assets, as the majority are located in European Union countries. Of the total frozen assets, approximately $5 billion are held in the U.S. Talks on potentially “unfreezing” the assets were reportedly held between U.S. and Russian delegations in Saudi Arabia.

The European Union holds the key to the majority of these assets, with $200 billion stored in Belgium’s international securities depository, Euroclear. By the end of 2024, the institution had earned €6.9 billion in interest income from investing the frozen Russian assets, up from €4.4 billion in 2023.

As European leaders voiced support for using these assets to bolster Ukraine’s defense, media reports surfaced indicating that Russia might agree to use the funds for Ukraine’s reconstruction—provided that part of the money is allocated to rebuild Russian-occupied territories of Ukraine.

However, such reports may be part of Russia’s strategy to delay the use of these funds for Ukraine’s defense.

President Zelenskyy has stated that the war has already cost Ukraine $320 billion, with $200 billion provided by the United States and the EU. Utilizing the frozen assets held in Europe could significantly strengthen Ukraine’s defense capabilities and sustain its fight, especially as Russia faces increasing financial difficulties in funding its war.

Over the past three years, Russia’s direct budget expenditures on the war have totaled approximately $300 billion. However, the actual costs are considerably higher, as state banks have shouldered a significant portion of the expenses by offering subsidized loans to the defense sector, with repayment prospects uncertain.

In 2025, Russia’s war-related budget expenditures are expected to reach a record $141 billion. It will also be the first year that Russia’s oil and gas revenues will fall short of covering war expenses. Meanwhile, the Russian National Wealth Fund—used to cover Russia’s budget deficit—has enough reserves to last only one year if the deficit remains at previous levels.

Russia is unlikely to accept the prospect of $300 billion being used to support Ukraine’s defense, as its financial resilience appears more fragile than Russian leader Vladimir Putin portrays. If the war and associated expenditures continue at the planned pace, Russia will likely face difficult financial decisions this year due to its worsening fiscal situation.

-206008aed5f329e86c52788e3e423f23.jpg)

-347244f3d277553dbd8929da636a6354.jpg)

-f88628fa403b11af0b72ec7b062ce954.jpeg)

-554f0711f15a880af68b2550a739eee4.jpg)