- Category

- War in Ukraine

Why Russia’s Finances Are Not as They Seem, with New Sanctions Pushing Putin Toward Unpopular Decisions

2025 marks the first year since the full-scale invasion of Ukraine that Russia’s oil and gas revenue will fall short of covering military expenditures. Russia urgently needs to develop new methods to circumvent sanctions or reduce spending, including on the war effort.

A key component of Russia’s budget: Oil sales

The extraction and export of hydrocarbons form the backbone of the Russian economy, underpinning its ability to finance the war in Ukraine. Favorable pricing and successful sanctions evasion have helped Russia adapt its economy to a wartime footing, enabling a prolonged war of attrition in Ukraine. However, new sanctions introduced last week have significantly complicated Russia’s ability to finance its war.

Over 400 entities and individuals in Russia's energy sector, including service providers, insurers, and extraction companies, are now under sanctions. According to the US Treasury, measures were taken to fulfill G7 commitments to reduce Russian energy revenues, including targeting two major oil producers.

The Russian budget relies on oil and gas revenues for more than 30%. In monetary terms, oil and gas revenues of the Russian federal budget in 2024 amounted to over 11.13 trillion rubles ($110 billion), while in 2023, these revenues were about 9 trillion rubles ($90 billion). Russia's revenues increased due to favorable pricing conditions and a mechanism to circumvent sanctions through the "shadow fleet" built by Russia for this purpose.

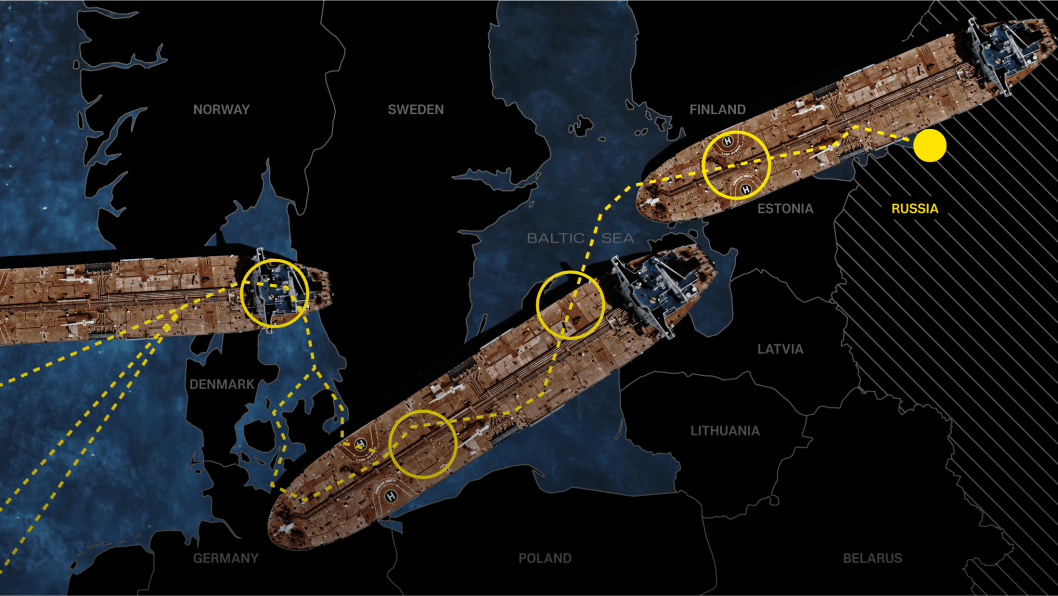

However, bypassing restrictions will now be much more challenging. "Particular emphasis has been placed on restrictions that prevent Russia from avoiding the 'price caps' on oil imposed by the G7 countries. The sanctions list includes 184 tankers. This decision is complemented by the closure of access for residual vessels belonging to the Sovcomflot company, eliminating loopholes in the international sanctions system," emphasized Andrii Yermak, Head of the Office of the President of Ukraine.

Notably, the sanctions list includes companies such as "Gazprom Neft" and "Surgutneftegaz," along with their subsidiaries, which together accounted for about 20% of all Russian oil production. Oil, in turn, provides up to 80% of Russia's oil and gas budget revenues.

Signals have already emerged from Russia's main oil buyers, India and China, indicating that they will not purchase oil transported by sanctioned tankers. Consequently, if Russia does not find new ways to circumvent sanctions in the near future, the country will face significant difficulties in selling oil, along with reductions in production, exports, and, consequently, revenues.

Budget challenges predated sanctions

Despite the increase in revenues from oil and gas sales in previous periods, the Russian Ministry of Finance was forced, at the end of 2024, to resort to the largest issuance of federal loan bonds totaling 4.7 trillion rubles (approximately $45 billion).

In simple terms, this money was essentially "printed." Since there was no market demand for these financial instruments, they were purchased by state-controlled banks, which subsequently used them as collateral for refinancing at the Central Bank of Russia. The traditionally conservative Russian Ministry of Finance simply had no other options to cover the ever-growing expenditures of the Russian budget.

Despite the evident budgetary challenges, this did not prevent Russia from increasing its planned war spending in 2025 to a record $142 billion.

Year | 2022 | 2023 | 2024 | 2025 |

Russia defense budget | $86.4 billion | $109.5 billion | $112 billion | $142 billion |

In practice, this means that starting in 2025, even the largest revenue source of Russia's federal budget from oil and gas sales will not cover war expenditures

Even before the tightening of sanctions, the Russian economy faced significant imbalances. However, this did not deter Russia from increasing its military budget.

Despite Putin's claims during Russia's year-end press conference that the Russian economy is "stable and reliable" and boasts a 4% GDP growth, objective indicators suggest that the Russian public finance system is struggling to sustain war financing.

Although Russia managed to maintain or even increase its revenues from oil and gas sales, the funds accumulated in the "National Welfare Fund" (a reserve fund created to reduce dependence on energy resources, where windfall profits from energy sales in past decades were directed) have decreased by $121 billion. Moreover, the fund's liquid assets have dwindled to only $53.3 billion, compared to $113 billion on its accounts before the full-scale invasion.

Year | 01.01.2022 | 01.12.2024 |

The volume of assets in National Welfare Fund | $182 billions | $121,5 billions |

Volume of liquid assets in National Welfare Fund | $113 billions | $53,76 billions

|

A significant portion of the fund was allocated to saving Russian infrastructure companies, and it is unlikely that this money will be returned to the fund, at least in the short term. Additionally, a substantial part of the fund was directed toward covering budget deficits, which amount to tens of billions of dollars annually in Russia.

In fact, the fund has decreased to the level it was at in 2008—the year it was established—spending all the savings accumulated over the past 15 years. This has not gone unnoticed among Ukraine’s partners.

“Even with some 40 percent of Russia’s budget going to the military, the Kremlin can’t produce enough materiel to replenish its capabilities. Mr. Putin has burned through nearly two-thirds of rainy-day funds that Russia built up over decades, robbing the country’s future to pursue its imperial past,” wrote Lloyd Austin and Antony Blinken in an op-ed.

The only way out is through unpopular decisions

In 2025, Russia's total budget expenditures are expected to reach a record 41.47 trillion rubles ($400 billion), with defense spending accounting for 32.5%. The Russian Ministry of Finance plans to increase revenues from 35 to 40 trillion rubles, although similar expectations in previous years have not been realized despite sanction evasion and favorable pricing conditions.

Even under favorable circumstances, the Russian Ministry of Finance was forced to draw funds from the National Wealth Fund (NWF) and print money, fueling inflation. The official inflation rate stands at 9%, although the prices of popular consumer goods have risen much higher—sometimes by 60% to 90%. This forced the Russian Central Bank to raise the key interest rate to 21%, pushing many businesses to the brink of survival.

In 2025, the Ministry of Finance plans to borrow around 5 trillion rubles ($5 billion) domestically but, due to a lack of demand, will effectively “print” about 10% of Russia’s entire budget, further driving inflation.

-bc762b8983e20ee63a97f76b0a5b1f09.png)

Russia’s access to external borrowing markets is closed, and its ability to sell energy resources has been significantly curtailed by US sanctions. Ukraine has not renewed its gas transit agreement, which will cost Russia approximately $5 billion. Under these conditions, Russia will need to find a record $142 billion to fund its war in Ukraine.

Given these factors, Putin is left with a set of “unpopular” tools:

Further depletion of the NWF, increasing the volume of printed money and consequently accelerating inflation.

Devaluation of the national currency, leading to a significant reduction in real incomes for the population.

Substantial tax increases for both businesses and Russian citizens.

If Russia does not urgently find new ways to bypass sanctions, we could witness several—or even all—of these measures simultaneously in 2025.

-206008aed5f329e86c52788e3e423f23.jpg)

-347244f3d277553dbd8929da636a6354.jpg)

-f88628fa403b11af0b72ec7b062ce954.jpeg)

-554f0711f15a880af68b2550a739eee4.jpg)