- Category

- World

How Russia's Shadow Fleet Saves the Country's Oil Industry and the Threats It Poses to the World

Thanks to hundreds of old tankers, Russia manages to sell oil worldwide, earning up to a third of its budget from this trade.

Until February 2022, Russia was a full-fledged member of the global oil market, exporting its oil products to numerous countries under generally accepted rules. However, after the start of the full-scale invasion of Ukraine, sanctions were imposed on the industry, and several countries stopped accepting Russian oil. This hurt the industry, prompting the Kremlin to take measures to save it. One such measure was the creation of a shadow fleet to transport Russian oil. So what is the shadow fleet, and what threats does it pose?

What Is the Shadow Fleet?

The term "shadow fleet" is somewhat arbitrary. It refers to vessels, usually oil tankers, with complex ownership structures that often turn off their location transponders or even falsify their coordinates during voyages. This fleet is often divided into "gray" and "dark" categories, depending on certain characteristics and the type of oil they carry. The "gray" fleet typically hides the owner, while the "dark" fleet hides the origin of the oil products. All other fleets are considered "clean" or "cleared fleet."

The concept of a "shadow fleet" existed before Russia began using it. It was initially used to describe tankers transporting oil from Iran and Venezuela when those countries faced sanctions on oil exports.

Characteristics of the Shadow Fleet:

Lack of Insurance: These ships often do not have insurance from reputable British insurers, and some have no insurance at all. This creates the risk that in case of an accident, there would be no party responsible for addressing the environmental consequences like an oil spill.

Aging Vessels: These tankers are typically old, making accidents a matter of time. VOX reports that for the first time in years, maritime safety conditions have deteriorated rather than improved. Despite this, demand for such tankers remains due to the availability of buyers.

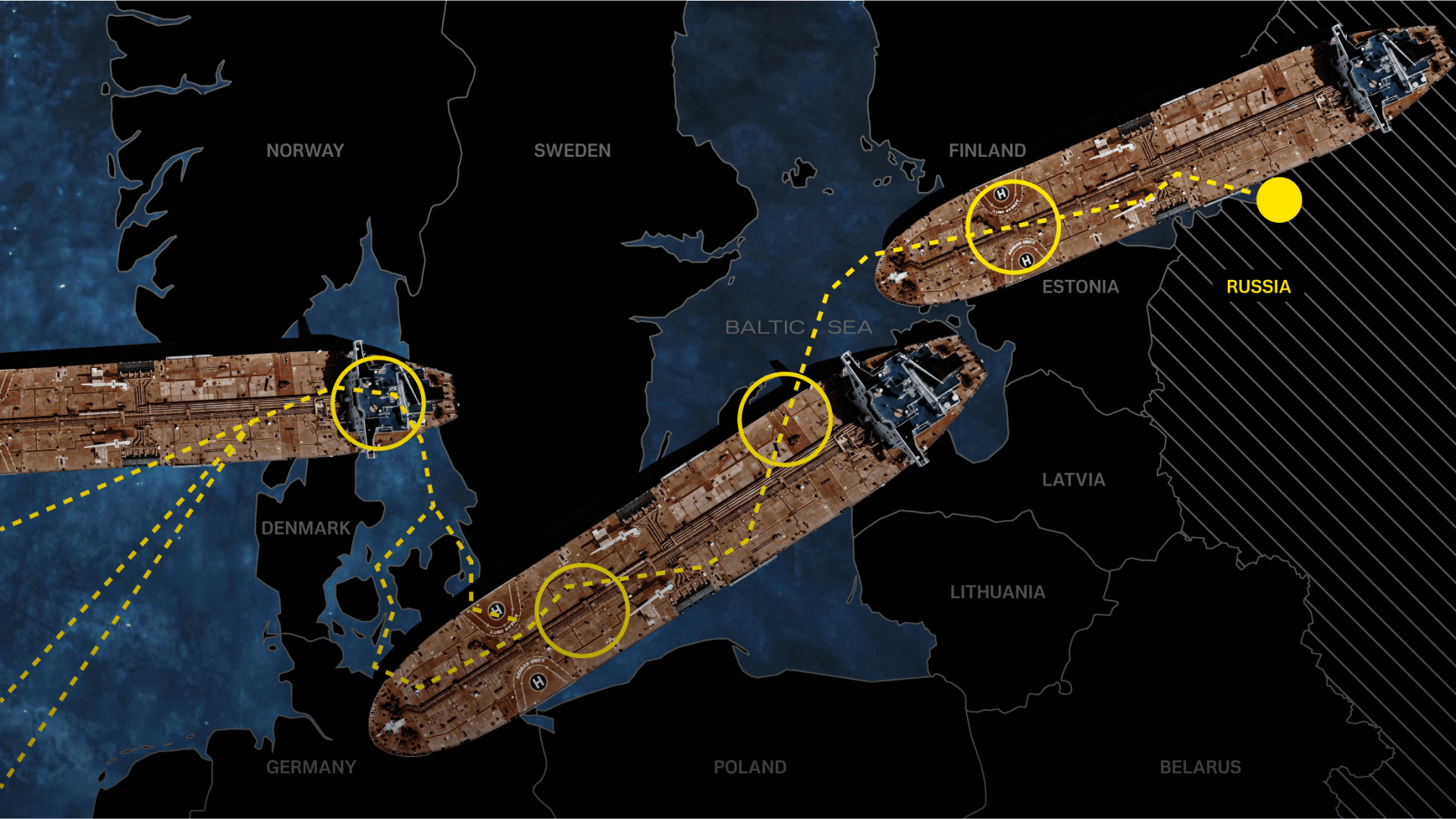

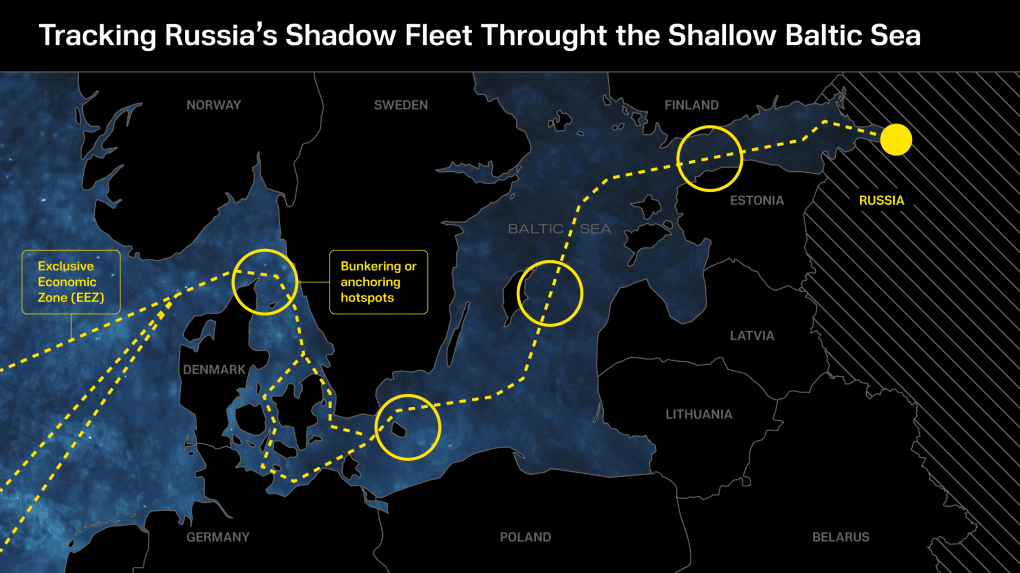

Restricted Access: Without insurance and facing sanctions, these vessels are barred from some ports, leading them to conduct oil transfers at sea, mixing Russian oil with oil from other countries to obscure its origin. Such at-sea transfers are considered a potential source of accidents.

Estimates suggest that 10% to 18% of the world’s tankers make up the shadow fleet. With around 9,800 to over 12,000 tankers globally, about 1,500 to 1,800 belong to the shadow fleet.

How Many Tankers Are Involved in Russia’s Shadow Fleet?

The exact number of tankers involved in transporting Russian oil is unknown, as estimates vary. The construction of this fleet began at the end of 2022 when Russian oil companies started buying old tankers to form their own fleet. Prices for a single tanker ranged from $35 million and up, depending on the urgency and the seller's willingness to transfer the vessel to Russia.

By the end of 2022, Russia reportedly had over 200 tankers. By March 2023, CNN reported about 600 tankers of various capacities. Today, Russia may directly or indirectly control 1,400 to 1,800 tankers, making it the largest operator of a shadow fleet.

It’s important to note that not all of these vessels are constantly transporting Russian oil. Experts include a tanker in the count if it has even once transported Russian oil, violating the imposed restrictions, such as the $60 per barrel price cap aimed at limiting Russia's foreign exchange earnings used to fund its military and the war.

What Threats Does the Shadow Fleet Pose?

One of the primary concerns is the lack of insurance coverage in case of accidents, raising the potential for ecological disasters. Legitimate fleets are insured by major internationally recognized insurers, ensuring clear plans for addressing accidents and providing compensation. The shadow fleet, however, is often insured by local companies with limited coverage. For example, Russian insurer "Ingosstrakh" may cancel insurance if a tanker is found to be carrying oil sold above the price cap.

This makes the issue of compensation for potential accidents more of a formality. This is especially concerning in the Mediterranean Sea, where many oil transfers between tankers take place. Experts also point to risks in the Baltic Sea, where Russia's shadow fleet operates and where there has already been an accident involving an empty tanker, which mitigated the potential damage.

After the introduction of the price cap on Russian oil, the volume of oil transported by the shadow fleet increased, as Russia sought new ways to bypass sanctions. This has led to the emergence of a shadow market, undermining global efforts to improve economic and maritime safety. Such schemes also impact tax collection, facilitate money laundering, and lead to funds being deposited in offshore accounts.

Russia continues to use its oil revenues to fund the war, investing the profits into building a militarized economy that supports its full-scale war in Ukraine. Experts note that this impacts not only Europe but the global community. A tougher stance against the shadow fleet and secondary sanctions targeting individual entities like shipowners and ports, as well as entire countries that assist Russia, could be a potential solution.

In conclusion, the shadow fleet helps Russia maintain its oil exports worldwide, particularly to China and India (with 82% of its exports going to Asia-Pacific regions) and facilitates oil transfers in the Mediterranean. Through the shadow fleet, Russia can bypass restrictions and present its oil as originating from other sources. For instance, a Russian tanker can transfer oil to another tanker at sea, deliver it to a refinery in a third country, which then sells the refined product as its own—making the oil Russian in practice, but not in name.

It’s worth noting that oil and gas revenues currently make up at least a third of Russia’s budget, roughly equivalent to what it plans to spend on the war in 2024.

What Are the Threats of the Shadow Fleet?

One of the main threats highlighted by the international community is the issue of insurance in case of accidents, which poses potential environmental risks. The "clean" fleet is insured by large, internationally recognized insurers, ensuring a clear action plan in the event of accidents and a source of compensation for dealing with potential incidents. In contrast, the shadow fleet is often insured by local companies with limited coverage. The Financial Times provides examples of Russian insurers explicitly stating that compensation may not be paid if environmental damage occurs. An example is the Russian insurer "Ingosstrakh," which issues insurance to the Russian shadow fleet but will cancel coverage if it is discovered that the tanker is carrying oil sold above the price cap.

As a result, insurance coverage—and thus compensation for potential accidents—is more of a formality. This is particularly concerning for the Mediterranean Sea, as oil transfers between tankers often occur there. Experts also point to risks in the Baltic Sea, where Russia’s shadow fleet operates, and where there has already been an accident, although the tanker involved was empty, preventing a disaster.

Sanctions also play a significant role. After the introduction of the price cap on Russian oil, the volume of oil transported by the shadow fleet increased, with Russia increasingly seeking ways to circumvent sanctions. This has led to the creation of an entire shadow market that runs counter to the global community's efforts to improve safety and economic conditions, particularly at sea. These schemes affect tax payments, facilitate money laundering, and result in funds being deposited in offshore accounts.

Finally, there is the issue that Russia continues to fund the war using oil revenues, channeling profits into building a militarized economy, which has led to the full-scale war in Ukraine. Experts understand that all of this affects Europe and the global community as a whole. A possible solution could be a tougher stance against the shadow fleet and secondary sanctions, targeting specific legal entities like shipowners or ports, as well as entire countries that assist Russia.

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-605be766de04ba3d21b67fb76a76786a.jpg)

-88e4c6bad925fd1dbc2b8b99dc30fe6d.jpg)

-206008aed5f329e86c52788e3e423f23.jpg)

-7ef8f82a1a797a37e68403f974215353.jpg)