- Category

- Latest news

How Some EU States Increased Russian Energy Imports in 2025, Spending Nearly $12B Despite Backing Ukraine

European nations—including some of Ukraine’s strongest allies—continue to import billions of euros’ worth of Russian energy, even as they supply Kyiv with military and humanitarian aid, Reuters reported on October 10, citing data from the Centre for Research on Energy and Clean Air (CREA).

Now entering the fourth year of Russia’s full-scale invasion, the European Union remains in a contradictory position: funding Ukraine’s defense while indirectly financing Moscow’s war machine through continued purchases of oil and gas.

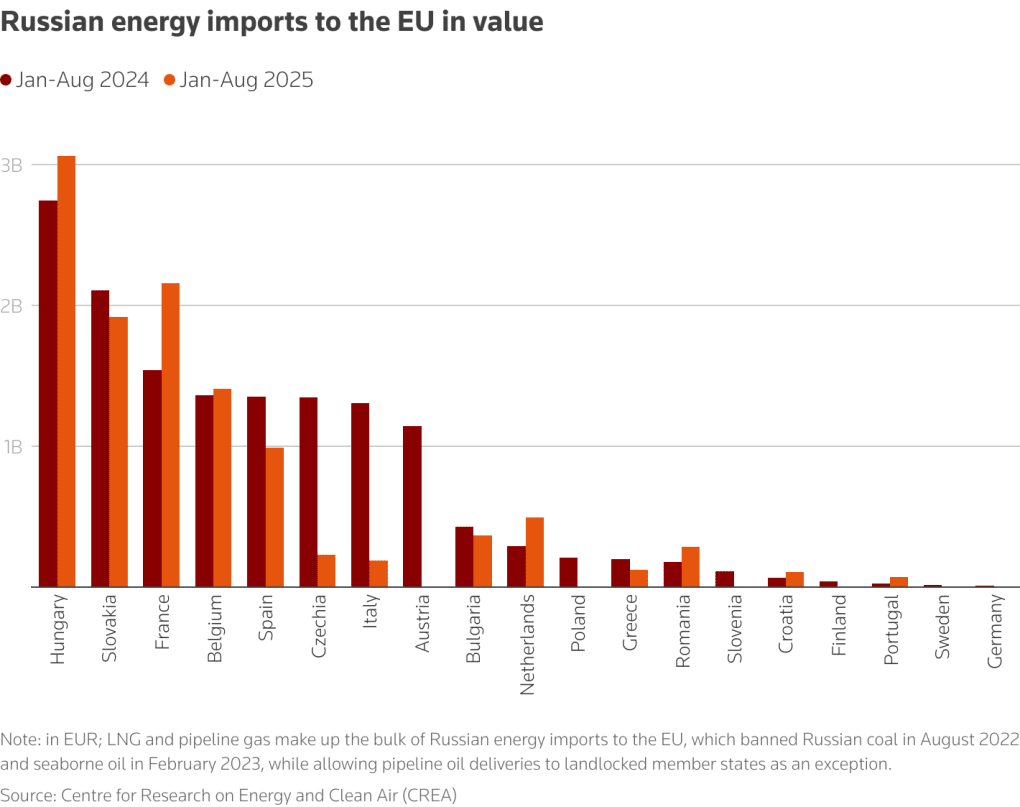

According to Reuters, the EU has reduced its reliance on Russian energy by about 90% since 2022. Yet between January and August 2025, member states still imported more than $11.9 billion in Russian oil and gas. Seven EU countries actually increased their imports compared to last year—including France, where purchases rose 40% to about $2.4 billion, and the Netherlands, up 72% to roughly $538 million.

“The Kremlin is quite literally getting funding to continue to deploy their armed forces in Ukraine,” said Vaibhav Raghunandan, EU–Russia specialist at CREA, describing the situation as “a form of self-sabotage” by some European nations.

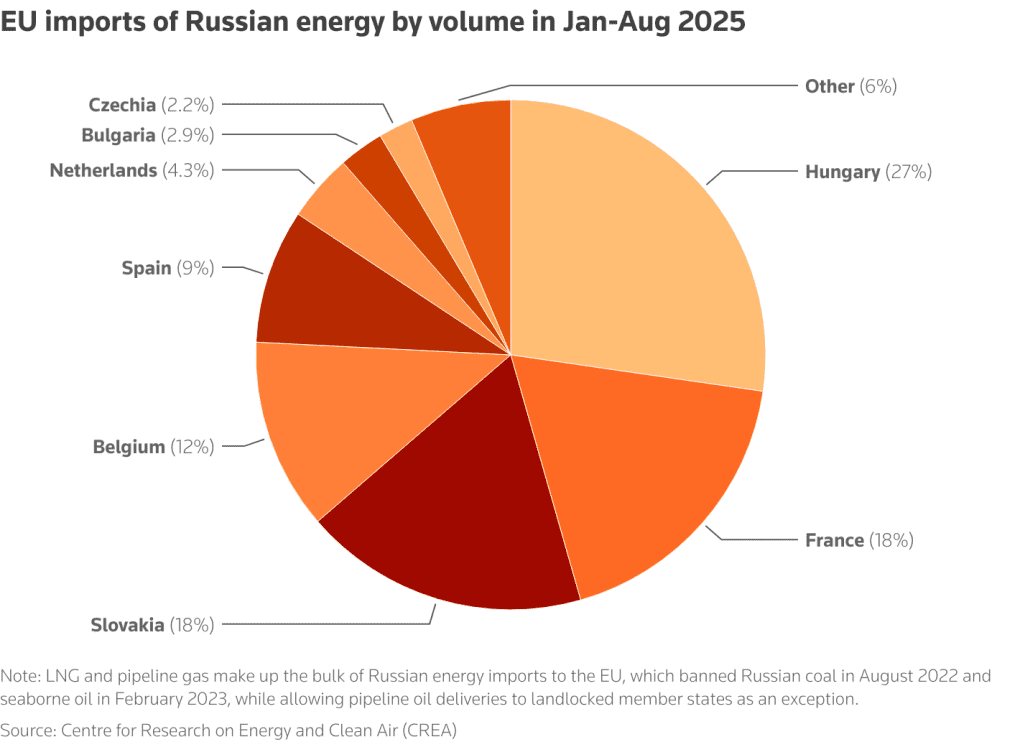

While much of the imported liquefied natural gas passes through ports in France and Spain en route to other EU markets, the flows still contribute significant revenue to Moscow’s wartime economy.

The issue has come under renewed scrutiny following criticism from US President Donald Trump, who called European energy purchases from Russia “embarrassing” and urged the EU to cut ties immediately.

The French energy ministry told Reuters that the higher import value reflected gas transiting through France to other European customers, reportedly including Germany. The Dutch government said it supported phasing out Russian energy but could not block existing long-term private contracts until new EU legislation is enacted.

The EU has already banned most Russian crude and fuel imports and plans to accelerate its ban on Russian LNG to 2027, a year earlier than previously scheduled. LNG currently makes up nearly half of the bloc’s total Russian energy imports.

Despite the reductions, CREA data show the EU has imported over $230 billion worth of Russian energy since the invasion began—more than the $180 billion in military, financial, and humanitarian aid the bloc has allocated to Ukraine over the same period, according to the Kiel Institute.

Countries such as Hungary and Slovakia—which maintain close ties with Moscow—remain major importers, together accounting for about $5.4 billion of this year’s total. But even staunch supporters of Ukraine, including Belgium, Croatia, Romania, and Portugal, also saw increases in 2025.

European energy companies including TotalEnergies, Shell, Naturgy, SEFE, and Gunvor continue to import Russian LNG under long-term contracts signed before the war. TotalEnergies told Reuters it would maintain deliveries from Russia’s Yamal project until official EU sanctions prevent it.

Industry analysts said that, without a full legal ban, companies risk penalties for breaching binding contracts. “In the end, market players are buying this LNG, not countries,” said Ronald Pinto of Kpler, adding that French imports are often rerouted to Belgium and Germany.

The European Commission declined to comment on the 2025 import figures but reaffirmed that the gradual phase-out is designed to protect member states from price shocks and energy shortages.

For now, however, as Reuters notes, European money continues to flow to both Kyiv and Moscow—sustaining Ukraine’s resistance and Russia’s aggression at the same time.

Earlier, it was reported that Indian refiners are poised to lift purchases of Russian crude in the coming months as discounts on Urals widen and supplies remain ample.