- Category

- War in Ukraine

The Billion-Dollar Supply Chain Behind Russia’s Weapons-Making Machines: Who’s Selling?

Despite tightening sanctions, Russia has managed to acquire over 22,000 CNC (computer numerical control) machines and essential parts worth $18.2 billion since 2023, fueling its weapons production. CNC machines are key components in the manufacturing of nearly all types of modern weapons.

Russian military industry is critically dependent on CNC machines

CNC machines allow for the rapid production of the necessary high-precision components made of metal and other hard materials, which are required for the production of the vast majority of defense products. Earlier, United24 media was able to identify dozens of such machines at Russian defense plants.

The Economic Security Council was able to analyze customs data from the beginning of 2023 and the first seven months of 2024. The data showed that despite the tightening of sanctions and export restrictions, imports of critical CNC equipment and components to Russia continue.

Between January 2023 and July 2024, more than 22,000 CNC machines, components, and consumables were delivered to Russia for a total of $18.2 billion. While China is Russia’s primary supplier of CNC machines and components, European countries still account for a significant portion of these critical imports. The machines and their components are supplied through intermediaries in third countries.

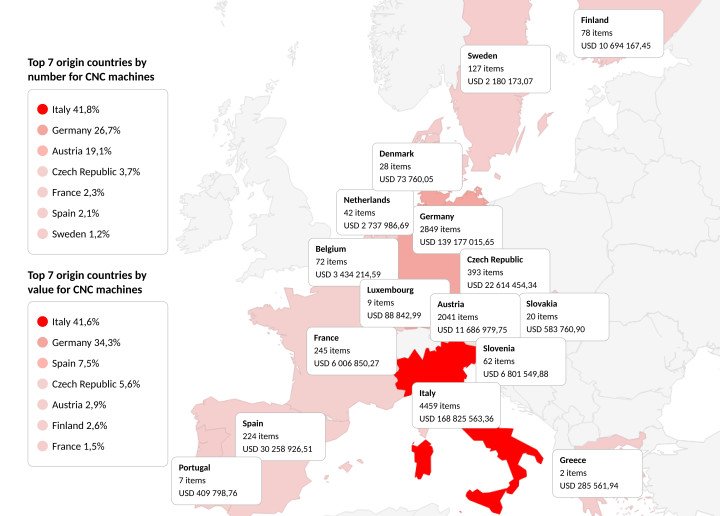

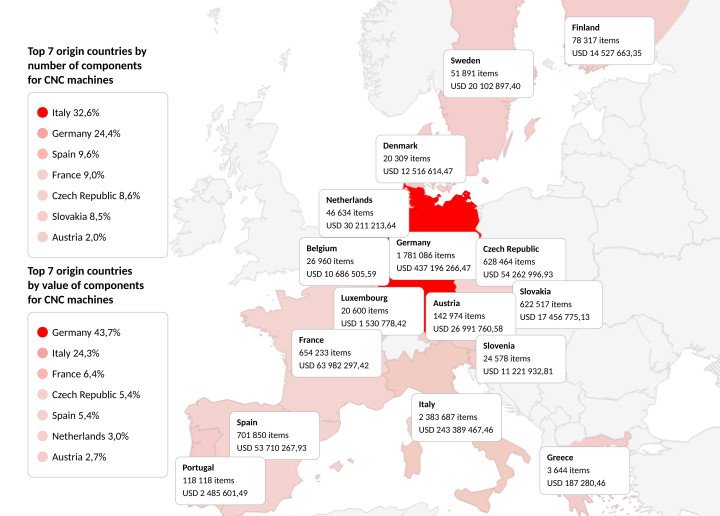

During the same period, Russia received more than 10,000 CNC machines worth more than $403 million, as well as related components and consumables produced by companies located in EU member states worth more than $1.1 billion (most of which came from Italy and Germany). Switzerland also accounts for a significant share of imports.

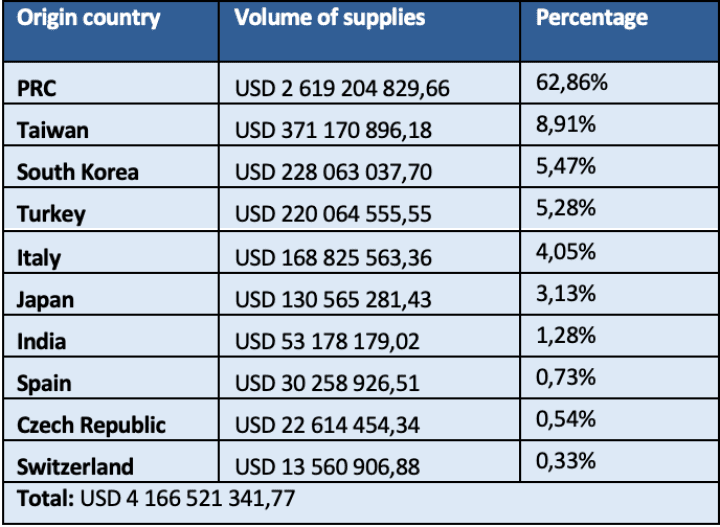

Between January 1, 2023, and July 31, 2024, more than $4 billion worth of machine tools were supplied to Russia. Manufacturers from Asia, including China, Taiwan, and South Korea, are leading the way in deliveries.

The share of manufacturers from European countries is much smaller but still significant. For example, Russia was able to import products from Italy worth more than $168 million.

In addition, Russia was able to get several dozen machine tools from EU subsidiaries in different regions.

Russia buys even more components than new machines

Prior to the full-scale invasion of Ukraine, Russia's dependence on imports of CNC machines was 70-90%. For related original components, this figure is even higher—80-95%.

“Russia’s reliance on imported CNC machines and components presents a strategic opportunity to strengthen sanctions enforcement. The EU and its partners should focus on eliminating supply routes and ensuring comprehensive oversight to limit access to these critical technologies,” noted Vladyslav Vlasiuk, the Presidential Commissioner for Sanctions Policy.

Russia uses the new CNC machines to expand its military production capacity, while imports of components and consumables are critical for maintaining existing equipment at Russian military plants.

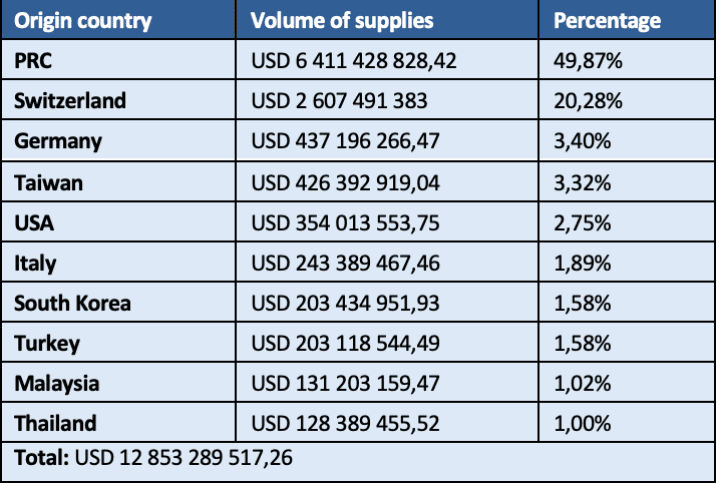

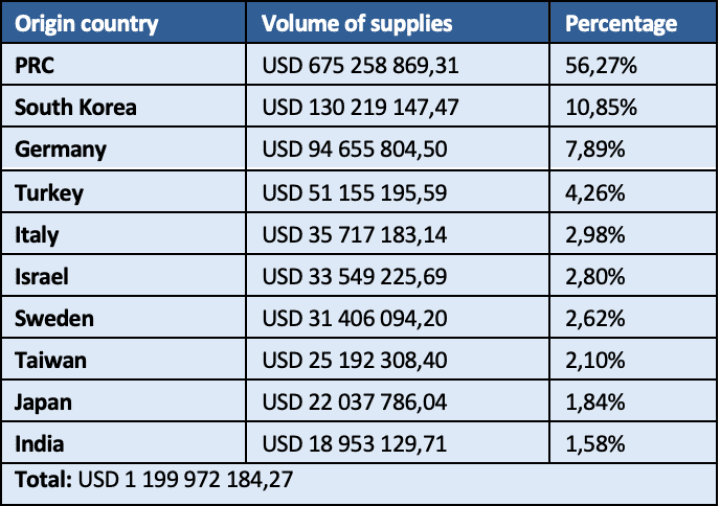

In monetary terms, imports of such components significantly exceed imports of new machines, reaching more than $12.8 billion (almost 50% of those were produced in China) were supplied to Russia.

Switzerland supplied over 20% of the components. The total value of European components supplied to Russia from EU manufacturers exceeds $1 billion. At the same time, components manufactured by subsidiaries of European brands in third countries were supplied to Russia for more than $6.9 million.

Since late 2023, members of the sanctions coalition have intensified efforts to block Russia’s access to CNC equipment through stricter sanctions and export restrictions. The EU’s 12th sanctions package imposed significant restrictions on the export and re-export of CNC machines and related components to Russia. The EU’s 14th package provides for tighter control of parent companies, including CNC machine manufacturers, over their subsidiaries in third countries.

Despite these measures, Russia's access to foreign CNC machines, their components, and consumables has been preserved, the analysis reveals. The main problem is that Russia is building new chains to circumvent existing restrictions by reorienting itself to supplies from China. Chinese companies dominate these exports, with South Korean products ranking second in terms of imports.

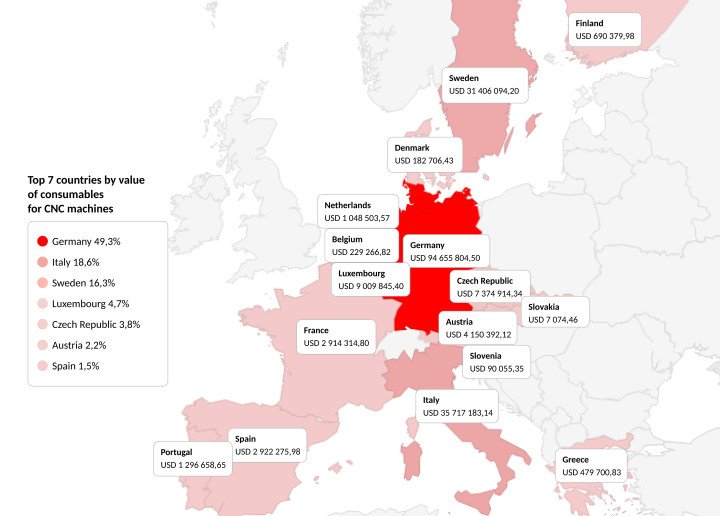

During the review period, Russia imported nearly $1.2 billion worth of consumables for CNC machines. Of this total, approximately 16%—or over $192 million—came from manufacturers based in European countries.

In addition, over $2.6 million worth of consumables supplied to Russia were produced by subsidiaries of European brands in third countries.

The National Security Council of Ukraine emphasizes that, despite Russia maintaining access to the market for machine tools and their components, further exports should be prevented. Analysts from the Council recommend that the EU supranational bodies and the governments of individual member states should enhance oversight over compliance and due diligence practices employed by the operators associated with the EU. They suggest the following steps:

A. Extend all export and re-export bans and restrictions on CNC machines and related components that apply to EU parent companies (including the “No Russia” clause) to the activities of European manufacturers' subsidiaries in third countries.

B. Investigate all cases of products manufactured by third-country subsidiaries of European operators being delivered to Russia, as mentioned in this document and its annexes.

C. Provide detailed and strict instructions to European manufacturers of CNC products to investigate, stop, and prevent the supply of their products and technologies to Russia.

D. Align the obligations for sanctions compliance and due diligence between parent and subsidiary companies. In particular, require both parent and subsidiary companies to implement the same comprehensive measures to prevent, terminate, and investigate instances of their products being supplied to Russia. Furthermore, the parent company should be held accountable for the compliance or non-compliance of its subsidiaries with these obligations.

E. Enhance oversight by European manufacturers over the activities of their third-country subsidiaries, especially those in the PRC. Oblige both parent companies and related subsidiaries to conduct regular physical (on-site), photo and video inspections of the end user and end-use of products manufactured in third countries.

F. Introduce clear types and scope of liability for parent companies regarding the activities, negligence, or violations of sanctions and export restrictions by their subsidiaries. In particular, in cases where the parent company knew or should have known about the violations or negligence of its subsidiaries and failed to take appropriate measures to prevent them.

“Sanctions can only succeed if supported by robust enforcement mechanisms. It is crucial for the EU and companies operating within its jurisdiction to ensure strict compliance with export restrictions and prevent any circumvention through third countries,” stated Vladyslav Vlasiuk.

-206008aed5f329e86c52788e3e423f23.jpg)

-554f0711f15a880af68b2550a739eee4.jpg)

-1afe8933c743567b9dae4cc5225a73cb.png)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)