- Category

- War in Ukraine

Why a BRICS Currency Is an Unrealistic Dream Today

At the BRICS Summit in Kazan in October 2024, Russian President Vladimir Putin spoke about a unified currency for the alliance. But this vision remains far from reality.

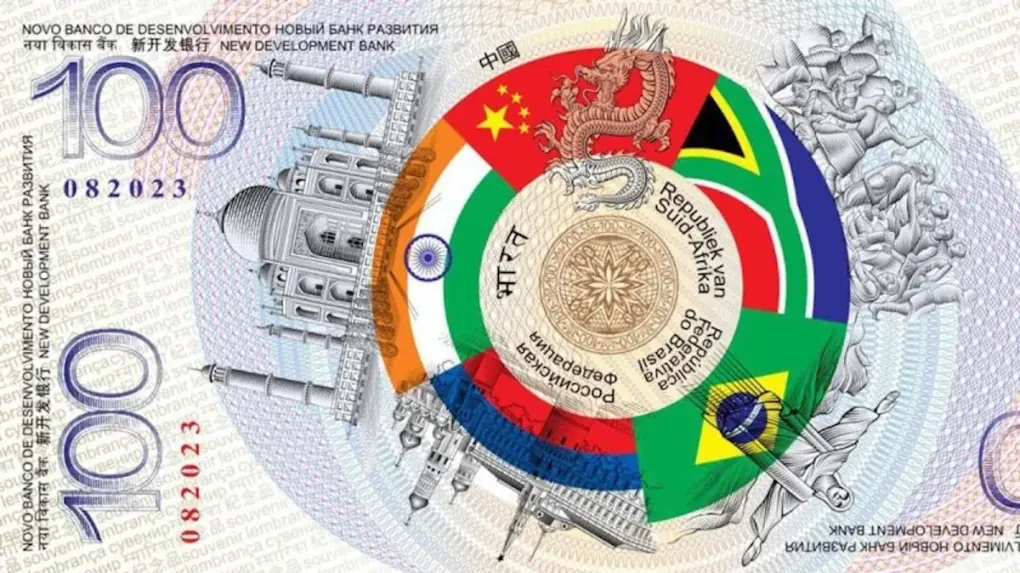

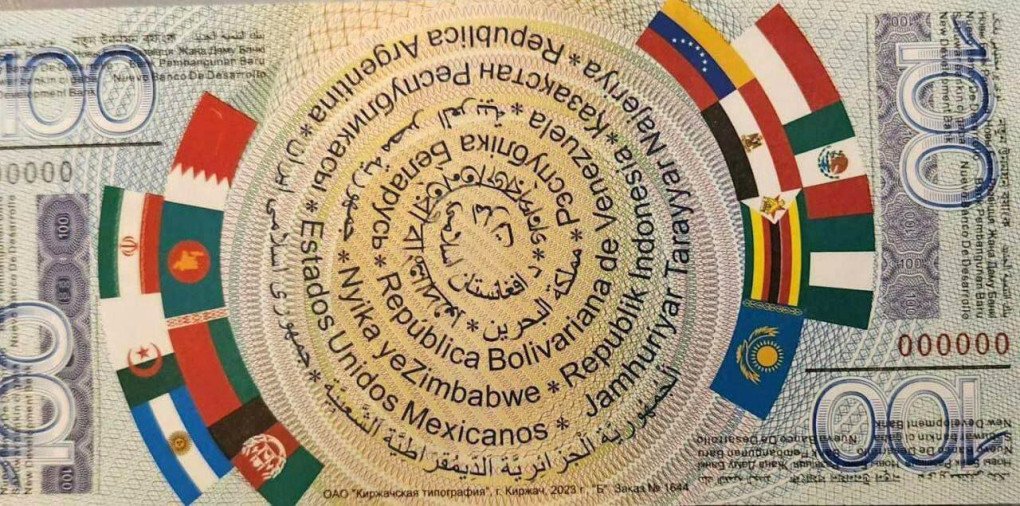

During the BRICS Summit, chaired by Russia this year and held in Kazan, Russian President Vladimir Putin presented a piece of paper he called the "BRICS Currency." For Putin, who often emphasizes the need for economic de-dollarization, this idea is a fixation: reducing dependence on Western currencies like the dollar, euro, and pound.

The idea isn’t new; even within BRICS, it's been discussed for over 15 years. But no steps have been taken to bring it closer to reality, nor are any expected in the foreseeable future. Leaving aside each BRICS country's foreign policy approach, the creation of a BRICS Currency is currently impossible for one main reason:

A bank is required.

As this involves multiple countries, the euro serves as a better comparison, being a shared currency among more than two dozen countries within the European Union. The dollar, in contrast, primarily serves the United States—a powerful, trusted economy, making it a less comparable case here. So, let's return to the euro.

The journey to introduce the euro officially took about a decade, though de facto work toward it spanned nearly 40 years. As early as 1962, representatives from the European Economic Community, founded in 1957, started discussing the need for a unified financial policy among member countries. In 1979, Europe established the European Monetary System and the Exchange Rate Mechanism, creating a precursor to the euro, and national banks began to collaborate closely.

One of the most crucial institutions created on the path to the euro was the European Monetary Institute in 1993. Its mission was to create a common currency for the EU, a process that lasted seven years until January 1, 1999, when the first countries adopted the euro as a shared currency.

Not all EU countries use the euro as their main currency; only 20 do so currently. The transition process took years, with countries gradually adopting the new currency. For instance, Croatia joined the single currency system only in 2023, Lithuania in 2015, and Latvia in 2014.

The European Monetary Institute eventually became the European Central Bank (ECB).

The ECB coordinates cooperation among eurozone central banks and sets economic and monetary policy for the EU. It has a president and several decision-making bodies, and no single country holds unilateral influence over the ECB.

While debates continue about the dominance of the dollar in international transactions, the main barrier remains the absence of necessary institutions among BRICS countries to create their currency.

There is no equivalent of a "BRICS Central Bank" that could work with the central banks of Russia, India, China, Brazil, and South Africa to establish a single currency.

This is partly due to significant differences in how these countries govern, the size of their economies, and their foreign policy interests. Creating such a central bank would require opening national banking systems to each other, trusting a central organization, and following a unified policy.

Currently, BRICS has the New Development Bank, which funds joint projects. However, there are no institutions focused on creating a single currency, nor any interest in doing so—except for Russia.

The eurozone’s journey took nearly 40 years, with seven years of active work by specially created institutions. If BRICS ever does establish its currency, it will require considerable time, willingness, and collaborative effort.

So, what were the outcomes of the BRICS Summit in Kazan on this issue? No joint statements or discussions—just a photo of Vladimir Putin holding a mock currency.

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-0666d38c3abb51dc66be9ab82b971e20.jpg)

-35249c104385ca158fb62273fbd31476.jpg)

-554f0711f15a880af68b2550a739eee4.jpg)