A new analysis by maritime intelligence firm Dryad Global reveals that Russia’s so-called “shadow tanker fleet” has more than tripled in size since the start of 2022, as Moscow turns to older vessels to bypass Western sanctions, according to the report published on July 2 by Safety4sea.

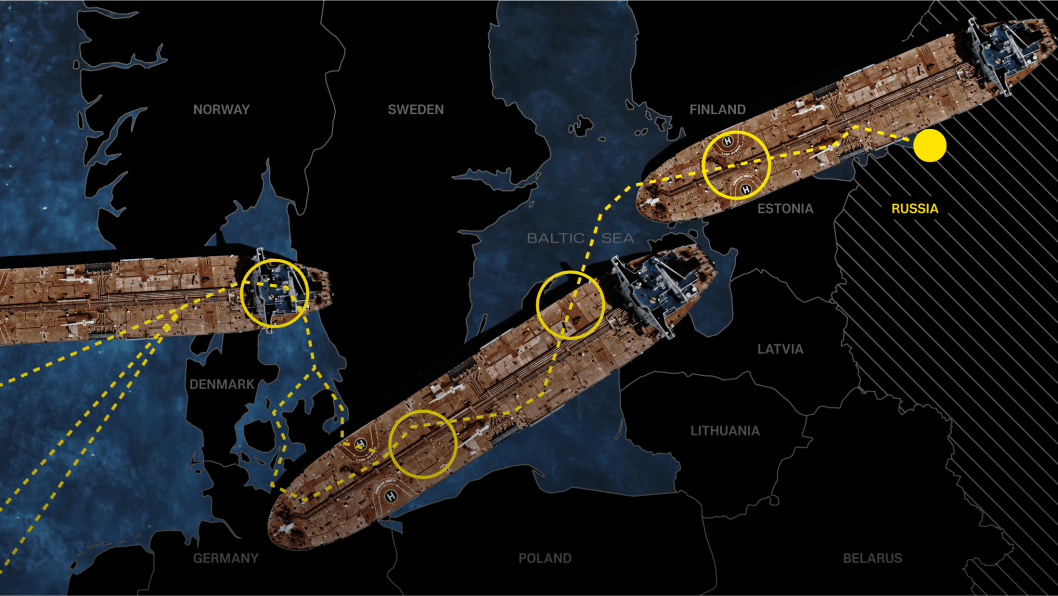

The main tactics of the shadow fleet include disabling Automatic Identification Systems, frequently changing flags, concealing ownership structures, and operating under minimal insurance coverage to transport sanctioned cargo.

According to Dryad Global, this network has swelled from fewer than 100 tankers at the outset of Russia’s full-scale invasion to an estimated 300–600 vessels by early 2025, depending on the tracking methodology.

Many vessels in this fleet are 20–25 years old—well above the 13-year industry average—and refresh paperwork by repainting identifiers, hopping flags and executing rapid name changes to mask build years and maintenance records, all reflected digitally without deeper vetting.

This growth has prompted coordinated sanctions: between January and May 2025, the US Treasury blacklisted 183 tankers on January 10, the EU added 74 in February and 189 in May, and the U.K. sanctioned 29 in March—together removing nearly 25 million deadweight tonnes from mainstream trade.

Germany announced on July 1 that authorities will question tankers transiting its waters about their oil pollution damage insurance. “This measure will help pressure Russia’s covert maritime operations and protect the Baltic Sea environment,” said German Foreign Minister Johann Wadephul.

Sanctions have driven freight rates sharply higher: US action removed about 4 percent of global Aframax capacity, doubling spot rates from Russia’s Kozmino terminal to North China within days, and by Q1 2025 average Aframax rates were about 30 percent above year-earlier levels, as charterers reroute via the Cape of Good Hope to avoid European enforcement zones.

Beyond economics, the fleet’s advanced age and stealth operations pose environmental and safety risks: older tankers burn high-sulphur fuel, raising emissions, while at-sea ship-to-ship transfers and falsified cargo documents increase the likelihood of oil spills—prompting regulators and investors to turn to satellite imagery and emissions-monitoring platforms to flag high-risk tonnage.

Earlier, the European Union blacklisted 189 vessels in Russia’s so-called shadow fleet as part of its 17th sanctions package, targeting tankers that breached the $60 price cap, banning them from European ports and applying liability provisions for unsafe or uninsured vessels.

-111f0e5095e02c02446ffed57bfb0ab1.jpeg)