- Category

- Business

Russian Oil Tug-of-War: EU Tightens Sanctions as Iran-Israel Conflict Drives Prices Higher

The European Union’s plan to ban refined products made from Russian oil comes at the same time the war between Israel and Iran threatens to send global crude prices soaring—and nowhere do these two storylines intersect more dangerously than in Moscow’s budget.

Russia’s economy runs on barrels, and every rise in oil prices buys the Kremlin more shells, missiles, and contract soldiers to keep its war in Ukraine grinding on. However, in this pivotal moment, Moscow’s path to riches is complicated by Brussels's 18th push to hammer Russia’s banking and energy sector with a new package of sanctions, even as resistance from Slovakia and Hungary threatens to stall progress.

“The main thing we have to understand is that there is a linear connection between oil prices and how easy and free Russia’s budget is,” Yuliia Pavytska, manager of the sanctions programme at the KSE Institute, said in an interview with UNITED24 Media. “When prices rise, Russia feels less pressure because it can finance the war more easily.”

It’s a dynamic as old as this war: Russia sells its oil—mostly at a discount—and pays for tanks, artillery shells, drones, and social programs to keep its domestic population quiet. And Europe, America, and their allies race to cap, ban, or reduce that flow. But a series of isolated bombing incidents in the Middle East and their potential consequences have put Ukraine, Europe, and the United States in a predicament.

Israel-Iran war and oil price volatility

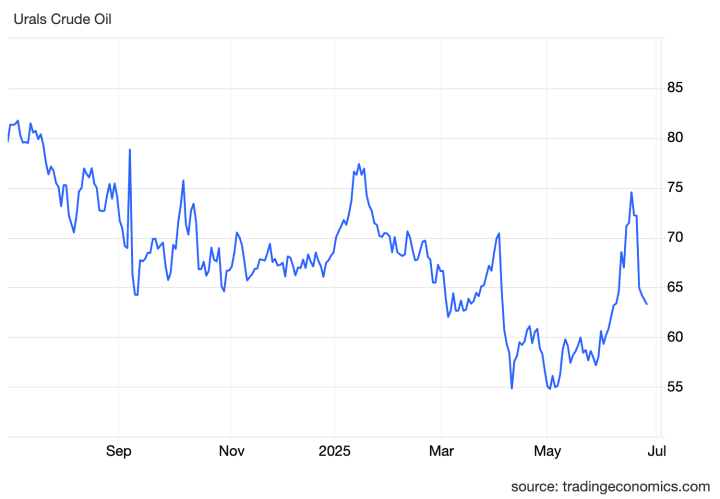

The outbreak of open hostilities between Israel and Iran sent Brent crude futures above $81 per barrel earlier this month. Moscow’s Urals blend, the flagship Russian crude that drives Kremlin revenues, jumped nearly 15% in three days, from 4,400 rubles ($57.20) to 5,000 rubles ($65) per barrel.

Analysts warned that if Iran carried through on its threat to close the Strait of Hormuz—the narrow maritime chokepoint that handles about 20% of the world’s seaborne oil—prices could spike well into the triple digits. Such a closure would be a geopolitical wildcard, potentially sending oil markets into chaos and adding tens of billions of dollars to Russia’s war chest if high prices persist.

This volatility comes at a precarious moment for Russia. The country’s oil and gas revenues fell by 34% year-on-year in May, hitting their lowest level since January 2023. The Russian finance ministry has already slashed its 2025 energy revenues forecast by 24%, and Russia’s budget deficit has already reached 3.4 trillion rubles in the first five months of the year, nearly five times higher than the same period in 2024, with the finance ministry projecting a full-year deficit of 1.7% of GDP—more than triple the original estimate.

But a sustained spike in oil prices could turn that situation around almost overnight. Russia exports roughly 4.7 million barrels of crude daily; a $20-per-barrel increase would add an extra $2.8 billion per month to Moscow’s revenues, based on calculations using current export volumes.

Conversely, if tensions ease and the US lifts Iranian oil sanctions, as it is currently floating in meetings between US envoy Steve Witkoff and Iranian officials, more supply could flood the market, driving prices down and worsening Russia’s fiscal crisis.

Pavytska sees a delicate balance: “If we return to the loose oil market where there is more supply rather than demand, this is the first time when we can afford to start cutting Russian oil from the market because there is spare capacity to substitute it.”

How EU sanctions reshape Russian oil exports

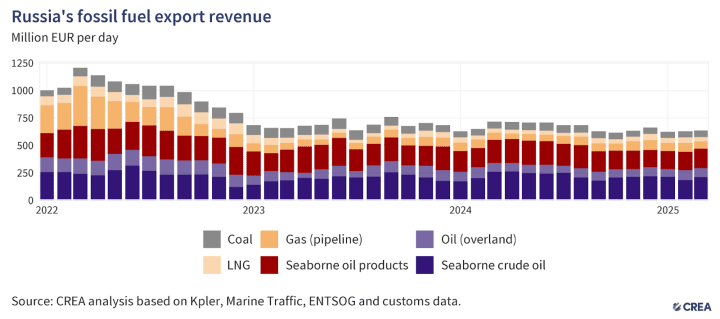

While price cap enforcement remains shaky, the EU’s 18th sanctions package lays out aggressive new measures aimed at cutting Russian oil revenues. Central to the plan is a ban on imports of refined products made from Russian crude, no matter where those fuels are processed. This measure is designed to block Russian oil from slipping back into Europe through third countries.

The package also proposes lowering the oil price cap from $60 to $45 per barrel to match current market conditions and restore its intended impact. To strengthen enforcement, the EU will add 77 more vessels from Russia’s shadow fleet to its sanctions list, tightening control over the ships Moscow uses to sidestep restrictions. Together, these steps are intended to squeeze Russia’s energy income, which still provides about a third of the Kremlin’s budget.

For context, countries like India and Türkiye have become major buyers of discounted Urals crude, refining it and selling fuels on global markets, including back into Europe.

“This sanction will impact the demand from main crude oil buyers like India, Türkiye, who are refining and selling back oil products,” Pavytska said. But she warned that enforcement is key: “We need to see how this measure is written in the sanctions package itself and how it will be enforced.”

Meanwhile, the two main European importers of Russian energy exports, Slovakia and Hungary, are holding up the package. Slovak Prime Minister Robert Fico demanded a delay, warning that new sanctions could spark supply shortages, price spikes, and up to 20 billion euros in arbitration losses for breaching long-term gas deals with Gazprom.

European diplomats still expect the package to pass, but it may not happen until the next EU summit. Poland’s European Affairs Minister Adam Szłapka said: "I hope that it will be possible to close it by the end of the (EU) Polish presidency, and as we know, there are four days left."

While Europe moves forward with new sanctions, the US stance under President Trump has shifted after earlier hesitation. Senator Lindsey Graham said Trump now backs his bill to impose 500% tariffs on countries buying Russian oil while refusing to help Ukraine, after discussing it with him personally. Graham stressed that India and China, which buy 70% of Russia’s oil, are key targets. The bill, with 84 co-sponsors, is expected to advance after Congress returns from recess, though earlier consideration was delayed by the Israel-Iran conflict.

Price cap policy and market reactions

The price cap on Russian oil, introduced by the G7 and EU in late 2022, was meant to keep Russian barrels flowing to avoid a global “supply shock” while limiting Moscow’s earnings. The idea was simple: if buyers paid more than $60 per barrel, they’d lose access to Western shipping and insurance.

But in practice, the price cap has been undermined by opaque contracts, shadow tankers, and weak verification.

“There are very legitimate questions about whether there is any proper compliance with the price cap,” Pavytska said. “Because the pricing information comes from Russian-linked companies, and they can write anything.”

She points out that about 75% to 80% of Russian crude oil now travels via a so-called shadow fleet of tankers operating outside the Western shipping insurance system, making it virtually impossible for G7 governments to track real sale prices.

While the remaining “white fleet,” which is insured by the International Group of P&I Clubs—the consortium of maritime insurers covering most legitimate global shipping—is supposed to comply with the G7 price cap, it relies entirely on paperwork submitted by Russian-linked oil traders. Insurers and shippers generally have no mechanism to verify whether these prices match what buyers paid.

As Pavytska put it: “Because nobody understands whether and how the pricing information is provided, and that Russians can easily manipulate the prices in the contracts, then I have huge doubts whether there is any leverage left in the price cap regime.”

This loophole allows Russia to effectively set its price narrative and continue selling russian oil above the cap without significant risk of exposure or punishment, undermining the cap’s intended effect.

Russia’s shifting oil trade strategy

Russia’s oil industry also faces a structural problem: storage. While Moscow can temporarily stockpile refined products, it lacks large-scale storage for crude itself. Pavytska explained that many older Russian oilfields can’t be paused without permanently damaging them.

“They cannot slow down production on older drilling sites,” she said. “They either drill or shut down, and shutting down means irreversible losses requiring massive reinvestment.”

This leaves Russia desperate to keep exports moving, even at deep discounts, to avoid shutting down wells.

Meanwhile, shadow tankers are the Kremlin’s escape valve. Only 43 tankers overlap the US, UK, and EU sanctions lists, highlighting the urgent need for more coordinated tracking. Without better enforcement, Russian crude moves freely outside price cap restrictions, providing the Kremlin with hard currency for war spending.

An urgent need for tougher enforcement

Western countries could do much more to squeeze Russia’s oil revenues if they choose, Pavytska says. She suggests they could expand sanctions so that all of Russia’s major oil companies are blocked, not just some of them.

She also recommends changing how the oil price cap is calculated: instead of measuring the price at Russian ports, it should be measured at the ports where the oil is delivered, which would make it harder for Russia to hide higher prices.

Finally, she proposes imposing secondary sanctions on banks in countries like China or Türkiye that help Russia buy weapons or military equipment, which would discourage those banks from doing business with Moscow and disrupt significantly supply chains fueling the Russian military industrial complex..

“There is no magic pill,” she said. “But we can cut Russian oil piece by piece. This will be painful for them and get us closer to forcing them to the negotiating table.”

She remains skeptical, however, about Europe’s resolve: “The EU still has aspirations to do more, but they honestly lack the political will to take bold steps that will generate consequences for Russia in the short term.”

The weeks ahead will show whether Europe can overcome internal divisions to pass the 18th sanctions package, whether Trump’s White House shifts to tighter measures, and whether Russia can keep its budget afloat as its war rages on.

For now, as Iran and Israel exchange strikes, global oil markets remain on edge, and every dollar added to Russia’s energy revenues risks prolonging the war in Ukraine.

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-4390b3efd5ecfe59eeed3643ea284dd2.png)