- Category

- War in Ukraine

How Ukraine’s 2025 Drone Strikes Are Crippling Russia’s Wartime Oil Revenues

As 2025 began, Ukraine significantly ramped up its strikes on Russian oil refineries. This comes at a particularly inconvenient time for Russia, which has been increasing its oil refining output to circumvent sanctions on its crude oil exports.

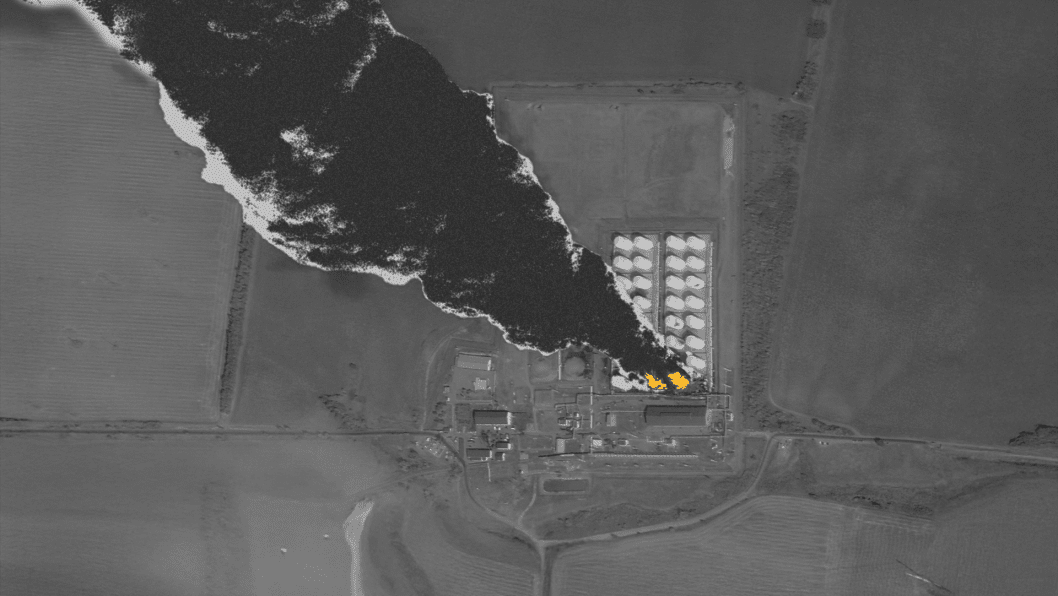

Ukrainian forces struck the Albashneft oil depot in Krasnodar Krai on February 5. This "mini" refinery, located near the Ukrainian-Russian border was an important cog in Russia’s military supply chain, processing 2.7 million barrels of crude oil annually, most of which would become fuel for Russia’s war efforts

News like this about drones hitting oil infrastructure became routine in Russian news at the beginning of the year. Starting in January 2025, Ukraine has carried out at least thirteen successful strikes on Russian oil and gas infrastructure, according to open-source data.

The increase in the frequency of attacks is Ukraine's response to Russia's efforts to ramp up oil refining for export, as crude oil exports have been hindered by sanctions targeting the "shadow fleet" used to circumvent those restrictions.

Oil and gas revenues had historically accounted for 30% of Russia's budget, which also funded a significant portion of its military spending. However, with Ukraine not renewing its gas transit contract after January 1 and the US imposing sanctions on Russia's shadow fleet—responsible for most of Russia’s oil and gas exports—the stability of this revenue stream is now up in the air. Experts predict these measures may cut 10-20% of Russia's foreign currency earnings from oil exports, totaling $10-20 billion annually.

The reduction in Russia's crude oil exports predicted to decline by 8% in February 2025, highlights the combined impact of international sanctions and Ukraine’s targeted strikes. This is only worsening Russia's already dire financial situation.

Russia's problem is that its oil and gas revenues are no longer enough to cover its wartime expenses. The country ended 2024 with a record budget deficit of 3.5 trillion rubles ($35 billion), further underscoring the financial strain.

Ukraine’s deep-strike campaign

Ukrainian drones have struck the majority of Russia’s 20 biggest oil refineries.

— UNITED24 Media (@United24media) February 5, 2025

We’ve compiled them into a convenient list—check it out. https://t.co/sBAsOyFKbn

In just over a month, these drone attacks have impacted approximately 17% of Russia’s oil refining capacity and 20% of its seaborne crude oil exports. This means that roughly one out of every five barrels of refined oil and one-fifth of Russia's crude oil exported by sea has been affected.

January 14th, 2025: Ukrainian drones attacked the Kristal oil depot in Engels, the Saratov Oblast, which supplies fuel to the Engels-2 air base and Russian strategic bombers. Approximately 800,000 tons of jet fuel were destroyed by fire.

January 16th, 2025: Drones targeted the Liskinskaya oil depot in the Voronezh region, causing significant damage.

January 17th, 2025 Ukrainian Strike drones targeted the Lyudinovo oil depot, operated by oil and fuel distributor Kaluganefteprodukt, in the city of Lyudinovo, the Kaluga region.

January 18th, 2025: Ukrainian drones struck the 8 Marta oil depot, which is managed by Rosrezerv and located near the town of Uzlova. The depot contains 58 storage tanks for petroleum products.

January 21st, 2025: The Liskinskaya oil depot was struck again by Ukrainian drones.

January 24th, 2025: Ukrainian drones struck the Ryazan Oil Refinery, one of Russia's largest, located approximately 500 kilometers from the frontlines. The refinery processes over 250,000 barrels of oil per day, representing 5% of Russia’s total refining capacity. The attack caused the refinery to shut down.

January 26th, 2025: The Ryazan Oil Refinery was targeted a second time by Ukrainian drones, resulting in a fire and further damage to the facility.

January 29th, 2025: The Kstovo Oil Refinery in the Nizhny Novgorod region was struck. The refinery processes 17 million tons of oil annually, accounting for 5.8% of Russia’s total refining output. The attack caused a massive fire, shutting down the entire facility.

January 30th, 2025: Drones struck the Novozbykov oil pumping station, a key part of the Druzhba pipeline, and the Andreapol pumping station on the Baltic Pipeline System-2, which supplies the Ust-Luga sea port. The volume of seaborne oil exports has dropped to zero, according to Bloomberg. The port is responsible for 20% of Russia's total seaborne exports.

January 30th, 2025 (continued): The Novoshakhtinsk oil refinery in Russia’s Rostov region has halted operations following Ukrainian drone strikes. The refinery is capable of processing 7.5 million tons of oil but has only produced approximately 3 million due to previous strikes hindering production capabilities.

January 31st, 2025: Drones struck the Volgograd Oil Refinery, Russia’s sixth-largest plant. It processes 14.8 million tons of crude oil annually, or 6% of Russia's total output.

February 3, 2025: A coordinated strike using multiple Ukrainian drones targeted critical Russian energy infrastructure across Russia, including the Lukoil oil refinery in Volgograd, which was hit a second time, and the Astrakhan gas processing plant, the largest plant of the Russian state-owned energy corporation Gazprom.

February 5, 2025: The Albashneft oil depot in Krasnodar Krai was struck. The "mini" refinery, located near the Ukrainian-Russian border, processes 2.7 million barrels of crude oil annually.

Sanctions hit Russia’s oil revenues

We continue working on sanctions against Russia, targeting those who help finance its war against Ukraine. Today, I discussed this with the UK Foreign Secretary during his visit to Ukraine.

— Volodymyr Zelenskyy / Володимир Зеленський (@ZelenskyyUa) February 5, 2025

It is crucial to keep pressuring Putin’s shadow tanker fleet, which moves oil around the… pic.twitter.com/hLr2AMPTqx

On January 10th, in the lead-up to Donald Trump’s inauguration, the outgoing Democratic administration imposed a massive sanctions package targeting 182 individual ships belonging to Russia’s "shadow fleet," which was used to transport crude oil and circumvent Western restrictions.

“The United States is taking sweeping action against Russia’s key source of revenue for funding its brutal and illegal war against Ukraine,” said former Secretary of the Treasury Janet Yellen.

Experts predict these measures may cut 10-20% of Russia's foreign currency earnings from oil exports, totaling $10-20 billion annually.

Reuters reports that, as a result, Russia has shifted its focus towards refining more oil domestically and has increased exports of petroleum products to offset the loss of crude oil sales.

At the same time, Russia's two largest crude oil buyers, India and China, have suspended their trade in Russian oil as US sanctions have triggered a sharp increase in tanker freight rates, according to Reuters.

In 2023, Russian crude imports accounted for 36% of India’s oil imports, while nearly 20% of the total went to China.

Declining oil exports and economic strain

President Trump is demanding Saudi Arabia and OPEC to drop the oil price in order to stop the war in Ukraine.

— (((Tendar))) (@Tendar) January 23, 2025

This demand - drying up Russian revenues - is reminiscent with the 1980s, where Saudi Arabia significantly increased oil production, eventually driving down the oil… pic.twitter.com/vrGGUHua3O

Experts warn that Russia’s over-reliance on oil has become a serious vulnerability, particularly as the country grapples with rising production costs and increasing military expenses. This economic pressure has made Russia’s energy infrastructure an ideal target for Ukraine's deep-strike campaign.

While some feared that escalating drone strikes could push global oil prices higher, the opposite has occurred, said the Brookings Insitute.

As noted by the US-based think tank, Institute for the Study of War (ISW), Ukraine's strikes are a key component of its strategy to destabilize Russia’s economic foundation, making it increasingly difficult for the Kremlin to continue its war effort.

The ongoing disruption to Russia's oil infrastructure is pushing the country closer to a budget deficit in 2025, which could further cripple its ability to fund military operations.

While further Western sanctions and tariffs are being discussed, Ukraine is actively reshaping Russia’s economic and military foundations, making it harder for the Kremlin to sustain both its war effort and its domestic economy.

-347244f3d277553dbd8929da636a6354.jpg)

-f88628fa403b11af0b72ec7b062ce954.jpeg)

-554f0711f15a880af68b2550a739eee4.jpg)