- Category

- Business

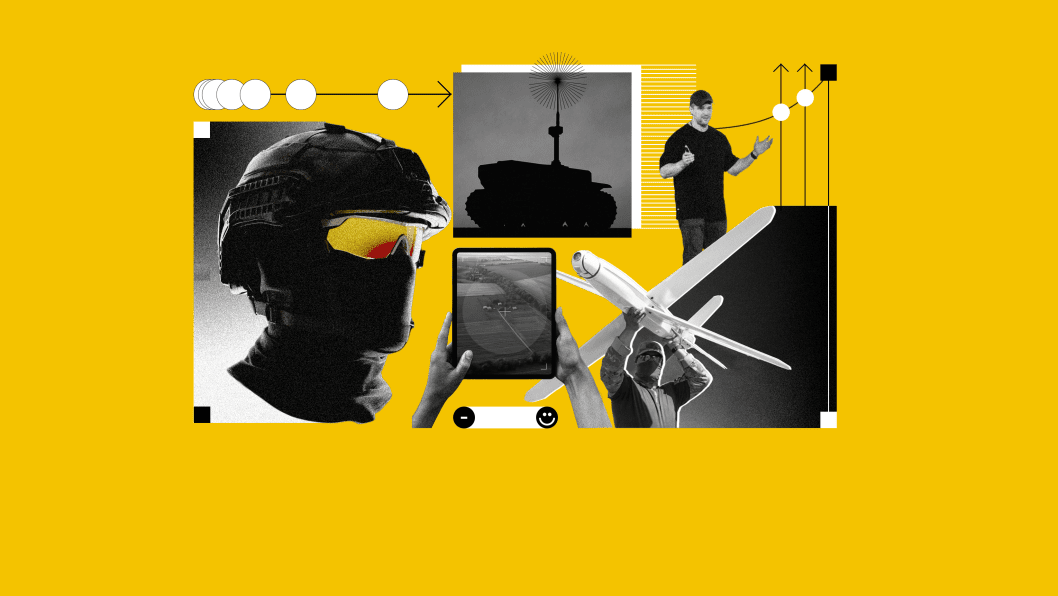

Why Global Investors Are Pouring Millions Into Ukraine’s Combat-Tested Defense Tech

Nearly four years into the war, investment in Ukraine’s defense-tech ecosystem continues to rise, making it one of the few industries in the country experiencing growth. This raises a simple question for investors: why park your money in Ukraine?

Data from Brave1, Ukraine’s government-run defense cluster, presents a clear line graph showing that roughly $5 million was invested in 2023, $59 million in 2024, and $105 million in 2025.

Early-stage investment in Ukrainian defense technology is growing rapidly and now approaches the volume raised across Europe at similar stages. The Brave1 report also states that 50 Ukrainian startups secured the entirety of 2025’s investments. Citing Dealroom.co data, the same report shows that all European defense startups raised a combined $200 million in Pre-seed, Seed, and Series A rounds that year, meaning Ukraine now represents the lion's share of these investments.

Meanwhile, foreign participation in Ukraine’s defense tech industry is increasing. Germany’s Quantum Systems opened an office in Ukraine and acquired a stake in Frontline, a promising local drone startup, while Boeing expanded its foothold in Ukraine.

New foreign investment funds focused on Ukraine have also emerged, including US firms MITS Capital and Green Flag Ventures, which have opened their offices in Ukraine. Firms like NUNC in the Netherlands and Verne Capital in Germany have already invested tens of millions of euros in the industry.

Seeding rounds have grown accordingly. Startups that once raised $200,000–$400,000 are now closing $2.5–$5 million rounds. Recent examples include $15 million for Swarmer, $3.74 million for Tencore, $2.75 million for Dropla, and $1–$1.5 million for Teletactica, M-fly, and Norda Dynamics.

Reducing investor risk

Ukrainian defense-tech companies have moved out of the garage and into large production facilities. As Artem Moroz, head of investments at Brave1, explains, “The technologies have matured enough to actually perform well on the frontline. They are no longer in the R&D stage—they are real products, with revenues and traction.”

Products are now fully deployed on the frontline, being sold in large quantities, and demonstrating their value in real-time. As Ukraine’s military doctrine is quickly shifting to one intrinsically tied to drones, there is less ambiguity about any given technology's effectiveness, as there are ubiquitous opportunities to test it out and receive feedback from the soldiers using it.

“We start to see companies that already sell test units to the US Army, to NATO armies. This kind of traction makes it more attractive.”

Artem Moroz

Head of Investments at Brave1

Ukrainian defense companies, typically barred from export, are now securing limited permissions to sell specific systems abroad and are beginning early-stage engagements with NATO and US military entities. Their market share in the West remains small, but the distinction is clear: while many Western defense startups raise capital on concepts that may take years to validate, Ukrainian technologies have already proven themselves outside of a controlled test.

Western defense firms are now coming to Ukraine for real-world R&D, with many adopting the “tested in Ukraine” label to signal frontline validation. Some partner directly with Ukrainian companies or military units because no other environment allows systems to be tested against Russian EW and air defenses. Anduril, one of the hottest US defense tech startups, has already trialed UAVs in Ukraine and reported failures in Russian EW zones; meanwhile, Ukrainian drones operate through those conditions daily, giving local developers a technical advantage that is hard to replicate elsewhere.

Another factor to consider is that valuations for Ukrainian companies remain far below Western equivalents. “Ukrainian companies are costing less to invest in for the stage where they are, with the revenues and technological readiness, you could expect the same company in the US to cost at least 10x more compared to what it costs in Ukraine, and at least 3x in Europe,” said Moroz.

A more supportive legal environment

One of the main obstacles for Ukrainian defense-tech startups in 2022–2023 was the lack of standard investment tools that Western investors are used to, such as simple early-stage contracts that let them invest quickly (known in the US as SAFEs or convertible notes). Because Ukraine did not offer these mechanisms, many founders had to register their companies abroad.

HULESS CEO Taras Semenuk, who raised about $500,000 in investment and received $250,000 in grants, still had to use a UK company structure.

Investors from abroad don’t understand Ukrainian law. They understand ASA, they understand SAFE. But in Ukraine, we don’t have such instruments.

Taras Semenuk

CEO of HULESS

New legislation planned for 2025–2026 will introduce these investor-friendly tools into Ukrainian law. Together with programs like Diia.City and Brave1, this should make it easier for Ukrainian startups to raise money inside the country rather than abroad. Event materials also point to more mergers and acquisitions, more deals happening under Ukrainian jurisdiction, and the potential for Ukraine’s first $50+ million funding round once its export rules match European standards. “I am very happy that now, from 2025 to 2026, it will be in the Ukrainian entity,” says Semenuk. “It’s very necessary.”

Ukraine’s procurement system—the way the government buys military technology—also works differently from places like the United States. Instead of relying on a few large defense corporations, Ukraine uses a decentralized model that allows small startups to win contracts for testing or small-batch delivery. This structure encourages competition and helps new companies grow faster. Platforms such as the Brave1 Marketplace and DOD Chain give early-stage teams a way to sell directly to the military without needing political connections or massive production capacity.

Getting in on the ground floor

Ukraine has historically been a relatively minor destination for foreign investment. The country has strong sectors in natural resources, agriculture, metallurgy, and IT, but capital flows have remained limited and inconsistent. Risk-averse investors generally stayed away due to concerns over governance, regulatory instability, and geopolitical exposure.

This is the first time in 30 years that large, targeted capital is entering Ukraine specifically for military technology rather than general emerging-market exposure, says Roman Sulzhyk, founder of the VC fund Resist.ua, and former JP Morgan/Deutsche Bank trader. The current investment wave is sector-specific, based on the expectation that Ukraine will become one of the leading producers of drone-era warfare systems.

“People realize that the world is changing,” said Sulzhyk. “It’s like the invention of the tank and airplane rolled into one, and the warfare of five years from now is going to be completely different and unimaginable to a person today. It’s very likely that when you think about what the top five countries in the world are going to be producing the best technologies of this drone-era warfare, suddenly Ukraine is going to be one of those five.” He explained.

Sulzhyk estimates the defense-tech sector is currently valued at roughly $1–2 billion. If, after the war, Ukraine can export even $2–5 billion in systems annually—primarily to Europe during its rearmament cycle—the total industry value could rise to $5–10 billion.

While the growth suggests “a tide that lifts all boats,” Sulzhyk emphasizes that selecting the right teams still matters. His focus, he says, is on founders who operate with Western standards of governance and transparency. In his view, the long-term success of the sector depends on backing teams who will not misuse capital or replicate past corruption patterns, ensuring that the companies gaining scale are those capable of building a modern industry rather than undermining it.

Expanding the market's potential

Geopolitical shifts and Europe’s emerging rearmament cycle are reshaping global military procurement and, in parallel, investor behavior. With the United States signaling a long-term strategic pullback from Europe and security concerns rising across the continent, more foreign investors are examining Ukraine’s defense sector.

This shift has been noticeable, says Deborah Fairlamb, founding partner of the US-based fund Green Flag Ventures: “High-net-worth individuals and smaller institutional funds are looking seriously at Ukraine’s defense sector.”

Early fundraising for Ukraine-focused defense tech was slow, says Fairlamb, but sentiment changed substantially over the summer as more investors recognized the relevance of Ukraine’s battlefield-tested technology. “There is interest. There is actually even more interest,” she says.

People started recognizing that there needed to be more money in the ecosystem, both within Europe but also specifically within Ukraine.

Family offices capable of writing $5–10 million checks are now actively exploring the market, she says, noting “There is a pipeline of money that is extremely interested in [Ukraine’s defense tech] going forward,” even as Ukraine and Europe continue building the capacity to absorb larger investment volumes.

Ukrainian defense-tech companies are not limited to Western buyers. Fairlamb notes growing demand in Southeast Asia, Latin America, Africa, and the Middle East, where governments are seeking affordable systems that have already been proven in combat. “What is happening in Ukraine does absolutely have pertinence for anybody out there,” she says, pointing to the global relevance of technologies shaped under high-intensity warfare.

Fairlamb also highlights the growing importance of dual-use systems—autonomous monitoring tools, UGV kits, critical-infrastructure protection platforms, and tethered aerial surveillance—that can be applied to border control, disaster response, and commercial security. To her, and many investors like herself, Ukraine’s defense-tech sector will remain competitive well after the war as its products move into a broader set of international markets.

New foreign-backed funds in Scandinavia, fresh US and EU capital, and accelerators like Defense Builder, Darkstar, and MITS point to an ecosystem preparing for scale rather than surviving the moment. By 2026, investors expect Ukrainian companies to compete directly in global procurement cycles—not as a wartime aberration, but as major players in the global defense-tech market.

-ee9506acb4a74005a41b4b58a1fc4910.webp)

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)