- Category

- Business

Is Ukraine Becoming the Silicon Valley of Defense Tech?

Some experts would liken it to the next Costa Mesa. Either way, Ukraine is just getting started.

It is July 2025, and a conference room in Berlin is filled with donor governments and policy architects. Ukraine and the European Union launched BraveTech EU—a €100 million ($115 million) public‑private defense innovation alliance. It marks the first time the EU has funded a tech partnership of this scale with a nation at war.

Half the money will come from Ukraine, coordinated by the country’s homegrown defense incubator, Brave1. The rest will come from Brussels, through the European Defense Fund and the EU Defense Innovation Scheme, with oversight by the European Defense Innovation Office—now headquartered in Kyiv.

The mission is to discover, test, and scale the types of wartime technologies that can transform the battlefield. Hackathons begin this fall. Grant funding for deployment is expected to be available in 2026.

“Modern warfare is innovative, fast, and hybrid,” said Ukraine’s Digital Minister Mykhailo Fedorov. “Ukraine has a unique experience and is ready to share it.”

Behind that carefully chosen language is something more profound. Ukraine is becoming something more than just a testing ground. It’s becoming a co-architect of how Europe prepares for future war.

Giving Ukraine its flowers

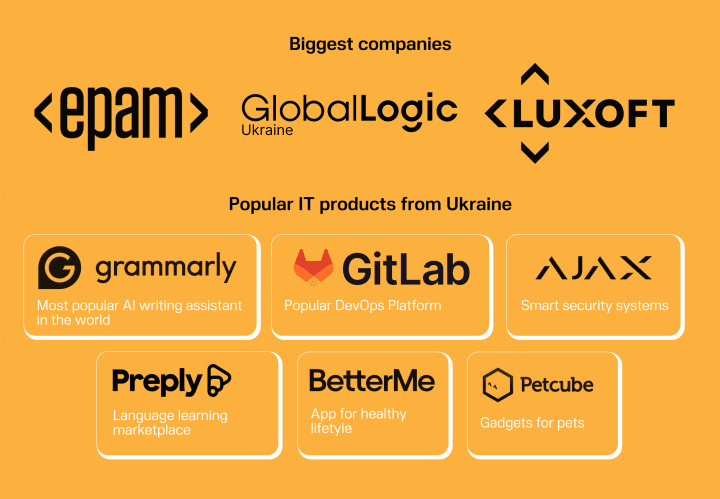

In the early 2000s, Ukraine emerged as one of Europe’s largest outsourcing hubs. Engineers fluent in math, English, and C++ sold their skills to the world’s top firms. Multinationals like EPAM, Luxoft, and GlobalLogic hired thousands, opening delivery centers from Kyiv to Kharkiv and Lviv. Ukrainian tech workers earned a reputation for Silicon Valley‑level skill at a competitive cost.

They weren’t just junior coders abroad. Ukraine produced its global brands—Grammarly, GitLab, Ajax Systems, Preply, BetterMe—conceived, built, and led at home. By 2021, the IT services sector was exporting over $6 billion annually to more than 100 countries, employing 300,000 people and delivering fast, scalable work without the drag of big‑company politics.

Pivot to defense tech

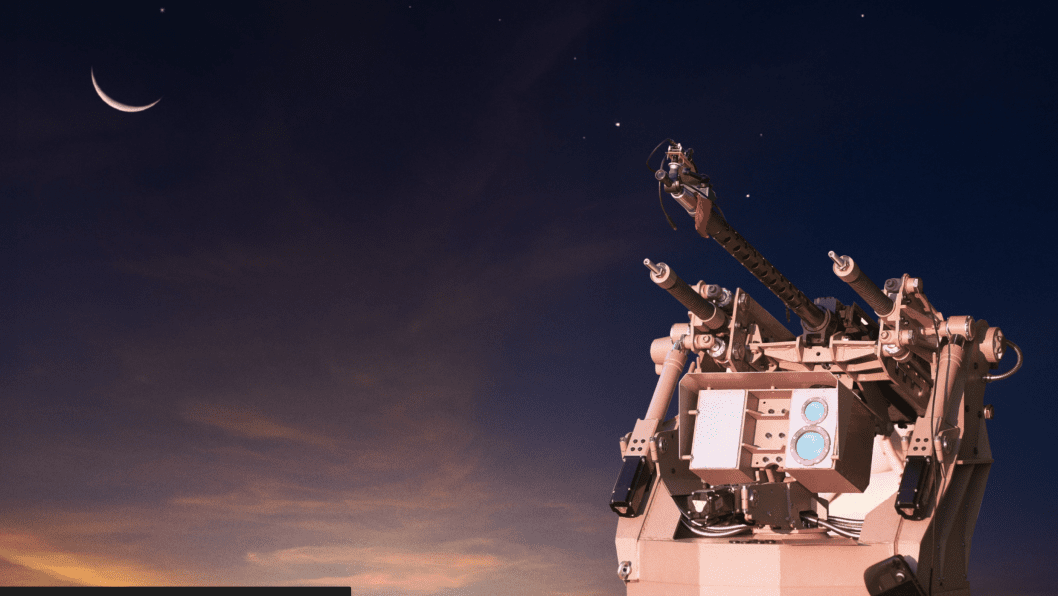

In the first weeks of the Russian full-scale invasion, Ukraine’s tech sector adapted. Teams worked from basements with limited access to electricity, turning Telegram bots into coordination tools, 3D-printed drones into weapons, and AI software into target acquisition systems.

“If we stop even for a day or a week, we risk falling behind Russia for good,” says Fedorov. “That’s why many companies are doing R&D, looking at what’s coming in a week, in two weeks, in six months. Everything changes in real time.”

That urgency drives not only speed but also creativity. “There simply cannot be a symmetrical response to Russian aggression,” says Artem Romaniukov, Deputy Minister at the Strategic Industries Ministry. “We always have to invent something asymmetrical to compensate for our lacks. Our people are the most valuable asset we have, and unmanned systems are the way to protect them—doing the job instead of humans.”

The government moved quickly to support this shift. In 2023, it launched Brave1, a functioning pipeline that connects developers with soldiers, funds prototypes, and pushes the best ideas straight to the battlefield. “We set technical tasks for the market, search for solutions, and then scale them—we provide grants and test them at proving grounds and on the battlefield,” Fedorov explains.

By 2024, over 500 defense startups had passed through Brave1. The feedback loop between the frontline and the factory was no longer measured in quarters—it was measured in days.

The EU signs on

In just a few years, Brave1 has evolved into a defense-tech pipeline producing drones (land, air, and sea), electronic warfare systems, and targeting software already in use on the front. More than 500 startups have entered the program, and while not all have gone beyond prototypes, enough have delivered combat-proven systems to draw serious interest from European and NATO militaries.

BraveTech EU will build on that model. Launching this fall, it will run joint hackathons pairing Ukrainian and European startups on live battlefield challenges. The best solutions will move to full production in 2026.

“European companies bring strengths in manufacturing and scaling; Ukrainian companies bring battlefield innovation and speed,” says Fedorov. “Together, we can deliver game-changing capabilities.”

For Kyiv, the program is a strategic breakthrough—a bridge between Ukraine’s frontline ingenuity and Europe’s defense procurement systems. Ukrainian tech will be integrated into the European market, co-developed, co-funded, and co-owned.

That cooperative spirit already defines Ukraine’s defense-tech sector. “There’s no competition here—only partnerships,” says Romaniukov. “In peacetime, many of these companies would be rivals. Today, they’re exchanging ideas, asking questions, and proposing solutions together.”

“Many Ukrainian startups are technologically ahead of their counterparts in the EU and US, but they remain significantly underfunded. They’re already combat-proven. Investors shouldn’t hesitate.”

Artem Moroz

Head of Investment at Brave1

Moroz sees BraveTech EU as “a unified market for defense startups”—one that merges Europe’s scale with Ukraine’s speed to “build a more resilient and competitive defense-tech sector together.”

The numbers behind the boom

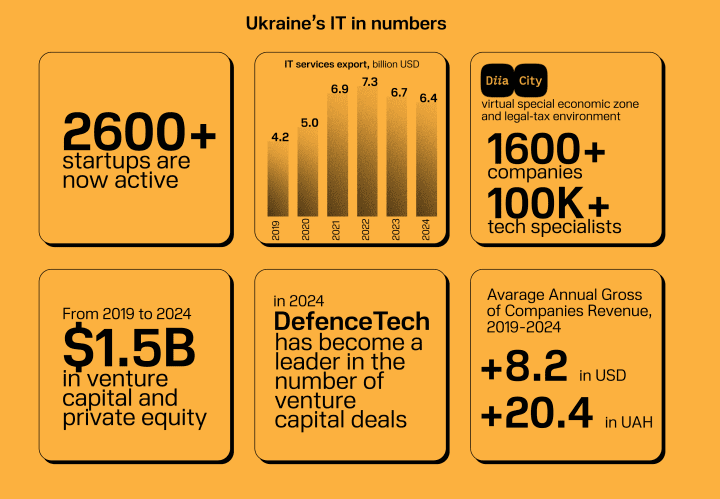

The Digital Tiger 2024 report shows that Ukraine’s tech sector didn’t shrink during the war. It accelerated.

2,600+ startups are now active, nearly triple the 2020 figure.

The IT industry exported $6.4 billion in services in 2024, reaching 147 countries.

The US alone accounts for 37.2% of Ukrainian IT exports.

Diia.City now includes 1,600+ companies, employing over 100,000 tech specialists.

From 2019 to 2024, Ukraine raised $1.5 billion in venture capital and private equity.

In 2024, DefenseTech led all verticals in VC activity, overtaking fintech, deeptech, and SaaS.

Average annual growth: 8.2% in USD, 20%+ in hryvnia.

Moroz adds his own tally: since its launch, Brave1 has facilitated approximately $145 million in combined public and private investment, about $85 million private and $60 million in public grants.

“Broadly speaking, it’s safe to say hundreds of millions of dollars have flowed into Ukraine’s defense tech sector since the start of Russia’s full-scale invasion,” he says.

A different clock

“Ukraine is definitely the new Silicon Valley for defense tech,” says Romaniukov. “We have a truly unique experience, and it would be a crime not to use this advantage and develop it.”

That advantage is speed. In NATO procurement, new weapons can take years from concept to deployment; in Ukraine, the cycle can be weeks, sometimes days. “It’s a constant race,” says Fedorov. “If we stop even for a day or a week, we risk falling behind Russia for good… Everything changes in real time.”

That pace is driven by battlefield urgency, but it comes with constraints. Moroz is blunt: funding remains the biggest bottleneck. “They are already combat-proven,” he says of Ukraine’s startups. “They don’t just exist in theory—they’re being used successfully on the battlefield. Investors shouldn’t hesitate.”

Fedorov points to the focus trade-offs; Ukraine can’t lead in every category at once. This year’s priority was interceptors for Shahed drones, a program that “got results,” but fiber‑optic drones and countering guided aerial bombs remain gaps. Infrastructure is still vulnerable, export controls slow dual‑use tech transfers, and the sector lives with a constant drain of talent and energy.

Scaling the edge

BraveTech EU is meant to do more than fund ideas; it’s designed to turn Ukraine’s defense‑tech ecosystem into a fully integrated part of Europe’s industrial base. The goal is to link Ukrainian innovation with European manufacturing, while giving European firms access to battlefield testing they can’t get anywhere else. For investors, it offers a rare combination of proven technology and growth potential.

That potential depends on scaling quickly. Ukraine’s next phase is about moving from small, agile teams to larger entities capable of delivering complete systems, not just individual tools. NATO members and other partners are already signaling interest, with some preparing to commit funds.

Romaniukov calls it the shift “from prototypes to mass production,” and stresses that unmanned systems will remain Ukraine’s core advantage. Fedorov, looking ahead, sees autonomy and AI as the next leap—drones operated from anywhere in the country, eventually working in coordinated swarms—but warns that getting there will demand sustained investment in R&D, engineering talent, and infrastructure.

The scale of Ukraine’s 1,200‑kilometer front means every breakthrough forces Russia to adapt, and every adjustment by Moscow drives fresh innovation in return. With contracts at home and abroad, combat‑proven systems, global attention, a highly motivated technical workforce, and a legacy of heavy industry to build on, Ukraine already has the conditions in which entire industries take root.

Whether Ukraine becomes the “next Silicon Valley” for defence technology is still an open question, but the pieces are falling into place. The war has forged an ecosystem where necessity drives invention, investors are engaged, and the output is tested in the most demanding environment on Earth. Given the trajectory, it may be less a question of if than when.

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-4390b3efd5ecfe59eeed3643ea284dd2.png)