- Category

- Business

Why Only a Full Oil Embargo Can Cripple Russia’s War Economy

A new US bill threatens steep tariffs if Russia won’t pursue peace, but experts say only a full oil embargo backed by secondary sanctions can cut deep enough.

US Senators Lindsey Graham and Richard Blumenthal introduced a bipartisan bill on April 1 to impose sweeping sanctions on Russia — and a 500% tariff on imports from countries that continue buying Russian oil, gas, or uranium — if Moscow fails to pursue lasting peace in Ukraine. The move has reignited debate over whether stricter sanctions are enough, or if only a complete embargo can truly cripple Russia’s war economy.

“These sanctions would be imposed if Russia refuses to engage in good faith negotiations for a lasting peace with Ukraine or initiates another effort, including military invasion, that undermines the sovereignty of Ukraine after peace is negotiated,” the press release stated. “The legislation also imposes a 500 percent tariff on imported goods from countries that buy Russian oil, gas, uranium and other products.”

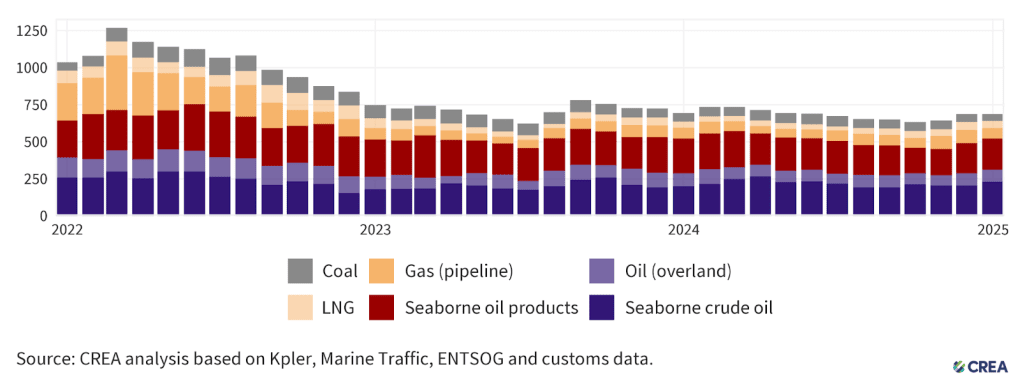

Since Russia launched its full-scale invasion in 2022, the country has weathered a barrage of sanctions from G7 nations — most targeting its energy sector, which remains the financial engine of its war effort. But over two years in, the Kremlin is still funding and sustaining its military operations in Ukraine.

How effective have sanctions been?

To Borys Dodonov, Head of the Center for Energy and Climate Studies at the Kyiv School of Economics, the problem is clear: enforcement of sanctions has lagged, and the existing price cap strategy is full of holes. “The price cap has lost its credibility as a policy,” Dodonov told UNITED24 Media. “An embargo would be much more effective.”

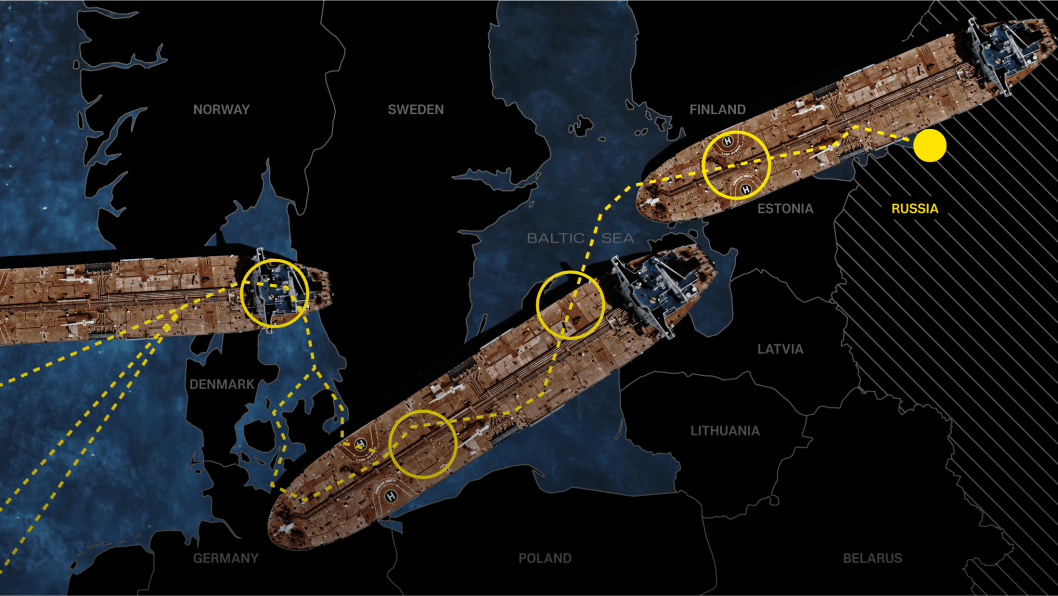

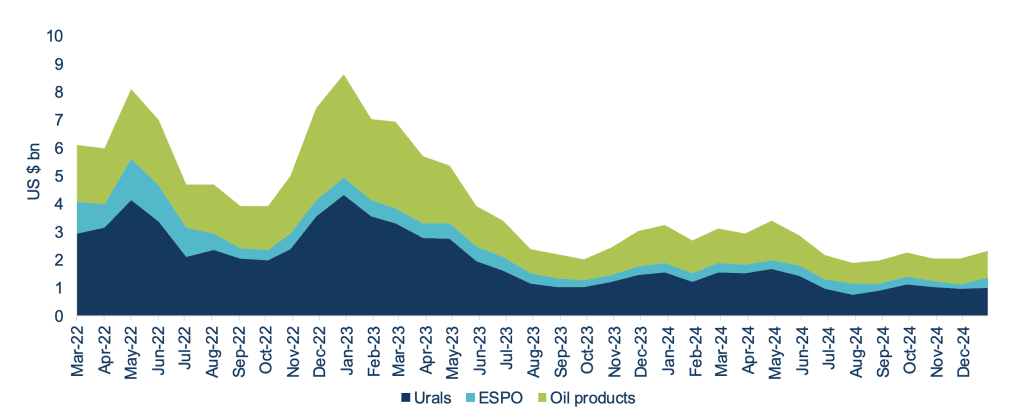

The $60-per-barrel cap on Russian crude — set in December 2022 — aimed to reduce the country’s revenues while maintaining the global oil supply. But from the start, the cap was poorly monitored, and Russia found ways to export oil by sea above the threshold using a combination of “shadow fleet tankers” and even vessels owned or insured by companies in G7 countries. It was also approved at a very high level, insufficient to deprive Russia of oil export revenues to wage its war in Ukraine.

“The first reports of these violations were published by the Kyiv School of Economics months after the cap was introduced,” Dodonov said. “But there were no proper actions until October 2023 — and even then, only a few vessels were designated.”

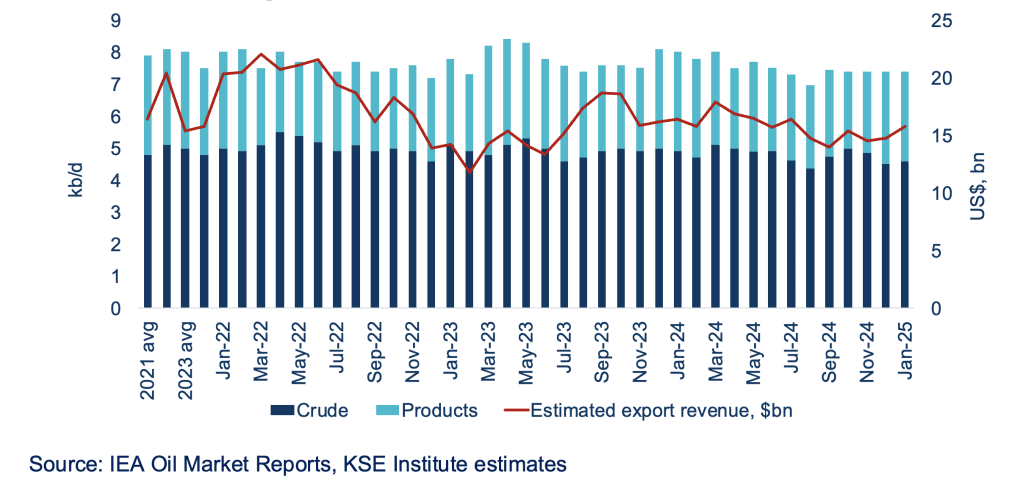

As of March 2025, the cracks in the cap are still evident. Russia’s weekly revenue from seaborne oil exports dropped to $1.27 billion per week in the third week of March — down 13% from the week before — even as export volumes hit a five-month high of roughly 3.45 million barrels per day, Bloomberg reported.

Analysts, including Dodonov, point to two forces behind this paradox: declining oil prices and the resumption of Ukrainian deep strikes on Russian energy infrastructure. “Ukrainian strikes on Russian oil refineries were quite successful,” Dodonov said. “The exports of Russian oil products from Black Sea ports contracted by 9% or .”

After Ukraine resumed attacks in January 2025, gasoil and fuel oil exports — one of Russia’s largest refined products — fell by around 100,000 and 90,000 barrels per day, respectively.

“Total Russian oil export revenues dropped by about $2.4 billion in February,” Dodonov said, “falling from $15.7 billion to $13.3 billion — driven by both lower crude and product prices and lower export volumes.”

These strikes also highlight a structural vulnerability: Russia’s oil industry has virtually no storage.

“If you target refineries, they’re forced to export more crude,” he explained. “If they can’t, they have to shut down oil fields — and that’s where the real damage starts. Shutting down fields can cause permanent production losses.”

Despite the disruption, global oil prices have remained stable, undermining earlier fears that aggressive actions against Russian supply would lead to price shocks. “There’s been no major effect on world oil supply as higher supply of Russian crude was refined into products in other countries,” he said. “The market absorbed it.”

How much money is Russia still making from oil and gas?

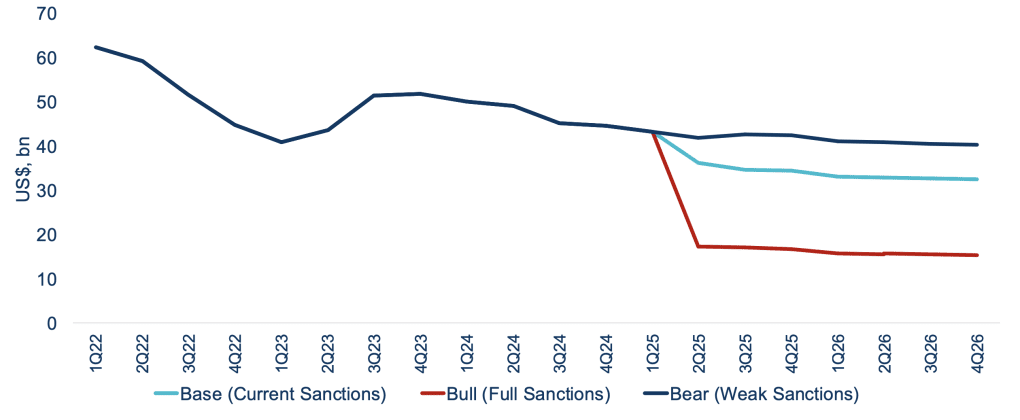

Despite sanctions, Russia’s energy revenues remain substantial. As of early 2025, Dodonov estimates oil and gas revenues still hover around $230 billion annually. That’s well above the $150 billion threshold he identifies as historically significant—the point at which Russian recessions begin to take hold.

“Every $1 drop in oil price costs Russia about $2.5 billion per year in export revenue,” Dodonov said. “If we want to weaken their ability to wage war, we have to cut volumes and force deeper discounts.”

Russia's ability to maintain this level of revenue is due in large part to its steady export volumes and access to willing buyers of crude oil, particularly in India and China. “Russia also obtained the possibility to export oil products at market prices,” Dodonov said, pointing to a higher price cap for premium products (diesel, gasoil, gasoline, VGO) than current world prices for these products..

Meanwhile, Russia’s “shadow fleet” — tankers operating under obscure ownership and flags of convenience — continues to move Russian oil despite restrictions, helping the Kremlin sustain its cash flow. As long as this workaround remains, Russia can sell high volumes of oil near global market prices, even under formal sanctions.

Have Biden’s sanctions made a difference?

While the Biden administration initially championed the oil price cap strategy, enforcement remained a weak spot for much of his presidency. Dodonov points out that the most serious sanctions targeting Russia’s circumvention tactics, particularly the shadow fleet, only came at the end of Biden’s term. “If the US had imposed those sanctions back in 2023, the price cap might have worked,” he said. “But the delay gave Russia time to adapt.”

In late 2024 and early 2025, the US finally moved to blacklist dozens of vessels and companies suspected of helping Russia sell oil above the $60 cap. The move was seen as a shift in tone but came after months of warnings from watchdog groups and economists like Dodonov, who had flagged widespread noncompliance and limited action from Western governments.

Design flaws further weakened the cap’s impact. While crude oil was capped at $60 per barrel, refined products like diesel and gasoline were initially set at $100 — well above market prices through much of 2024. “Russia obtained the possibility to export oil products at market prices,” Dodonov said. “There was no shortage in supply.”

The result, he argues, was a sanctions regime that failed to put real financial pressure on the Kremlin and left Russia’s oil revenue largely intact.

Could Trump’s proposed secondary sanctions finally force a change?

With Donald Trump back in the White House, pressure is mounting for a tougher response. In late March, Trump threatened to impose secondary tariffs on countries that continue purchasing Russian oil if Moscow doesn’t agree to a ceasefire. Days later, a bipartisan Senate bill followed, proposing sweeping new sanctions and a 500% tariff on imports from nations that trade in Russian oil, gas, or uranium.

For Dodonov, it’s not just rhetoric — it’s a necessary escalation. “Only the US can effectively enforce this full embargo on Russian oil,” he said. “That includes secondary sanctions — not just on shipping companies, but on final buyers.”

The mechanism would mirror those used in sanctions against Iran. If an Indian or Chinese refinery buys oil from a blacklisted vessel, it risks losing access to the US dollar system. “Oil is traded in US dollars,” Dodonov explained. “If these buyers lose access to the dollar system, they won’t be able to buy any oil — not just Russian oil.”

The tools to cripple Russia’s war economy are already on the table — from tighter sanctions enforcement to a full embargo backed by secondary sanctions. But without credible threats and consistent follow-through, they remain symbolic. As Dodonov notes, Russia doesn’t believe the West is serious. Changing that will require more than policy tweaks — it will require political will.

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-4390b3efd5ecfe59eeed3643ea284dd2.png)