- Category

- Business

Europe’s Defense Booms as Military Spending Hits Record Highs and Stocks Soar

Double-digit growth rates in European defense stocks have caught many by surprise, as shares of companies poised to secure government contracts and new deals continue to climb.

In early March, European nations announced plans to invest over €800 billion ($842 billion) in defense, marking the highest military expenditures in the European Union’s decades-long history. Individual countries have also significantly boosted their defense budgets:

• Germany — $86 billion

• United Kingdom — $81.1 billion

• France — $64 billion

• Italy — $36 billion

• Poland — $28 billion

Just two years ago, these figures were, in many cases, half as large. Many European nations have already met NATO’s requirement of allocating 2% of GDP to defense spending, while some are preparing to raise the target to 3% or even 5%.

Europe is home to a vast defense industry, producing fighter jets, tanks, artillery, infantry fighting vehicles, and advanced weaponry such as drones and even laser weapons. The continent is eager to support its own manufacturers, as investments in defense not only bolster security but also create jobs, fund research and development, and expand production capacity. The latter remains a key challenge—demand for weapons is high, yet production timelines often stretch over years. Long-term contracts are now seen as a way to accelerate procurement.

Supporting domestic manufacturers also ensures that arms supplies will not be subject to foreign restrictions or sanctions. Europe is determined to defend itself—and is investing accordingly.

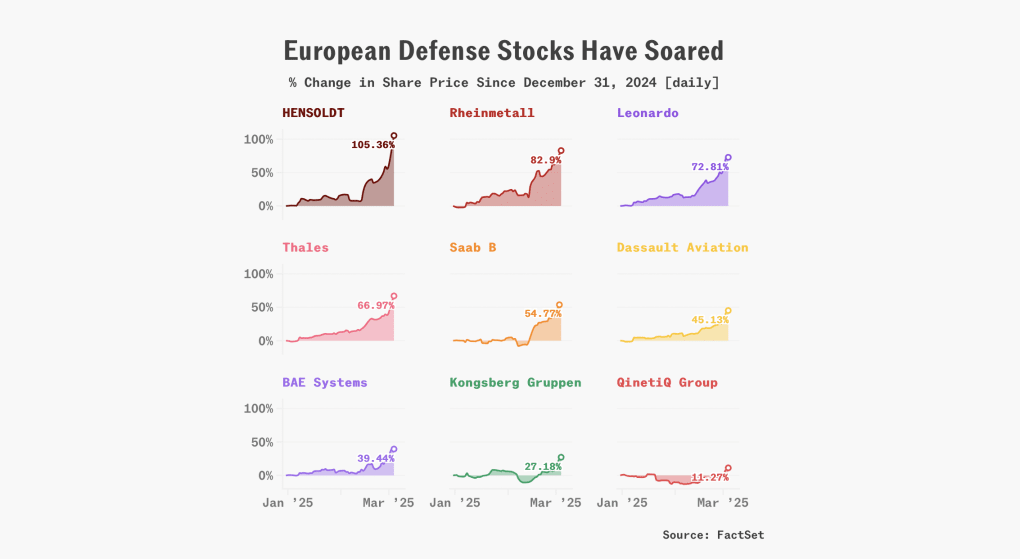

Defense stocks on the rise

Nearly all European defense stocks have surged. Companies including HENSOLDT, Rheinmetall, Leonardo, Thales, Saab B, Dassault Aviation, BAE Systems, Kongsberg Gruppen, and QinetiQ Group have seen double-digit growth, with some stocks even doubling in value. Crucially, this trend spans multiple countries, signaling the expansion of the broader European defense market rather than the success of a single player.

One striking example is Eutelsat, the Franco-British satellite communications company that competes with Starlink. Following speculation about potential new contracts both within Europe and for supplying Ukraine, its stock price has skyrocketed sevenfold in the past month.

Another standout is Rheinmetall. Since November 2024, its stock price has jumped from €480 to over €1,100 as the company ramps up factory investments, boosts production, and secures new contracts.

The European defense market is on the rise. Nations are rearming in response to the threat posed by Russia and its expansionist policies. While full-scale war is currently limited to Ukraine, Europe is already facing Russian aggression—sabotage operations across the continent, hybrid warfare in the Baltic Sea, and military preparations in the Arctic.

Europe is determined to ensure its security—and is investing accordingly.

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-4390b3efd5ecfe59eeed3643ea284dd2.png)