- Category

- War in Ukraine

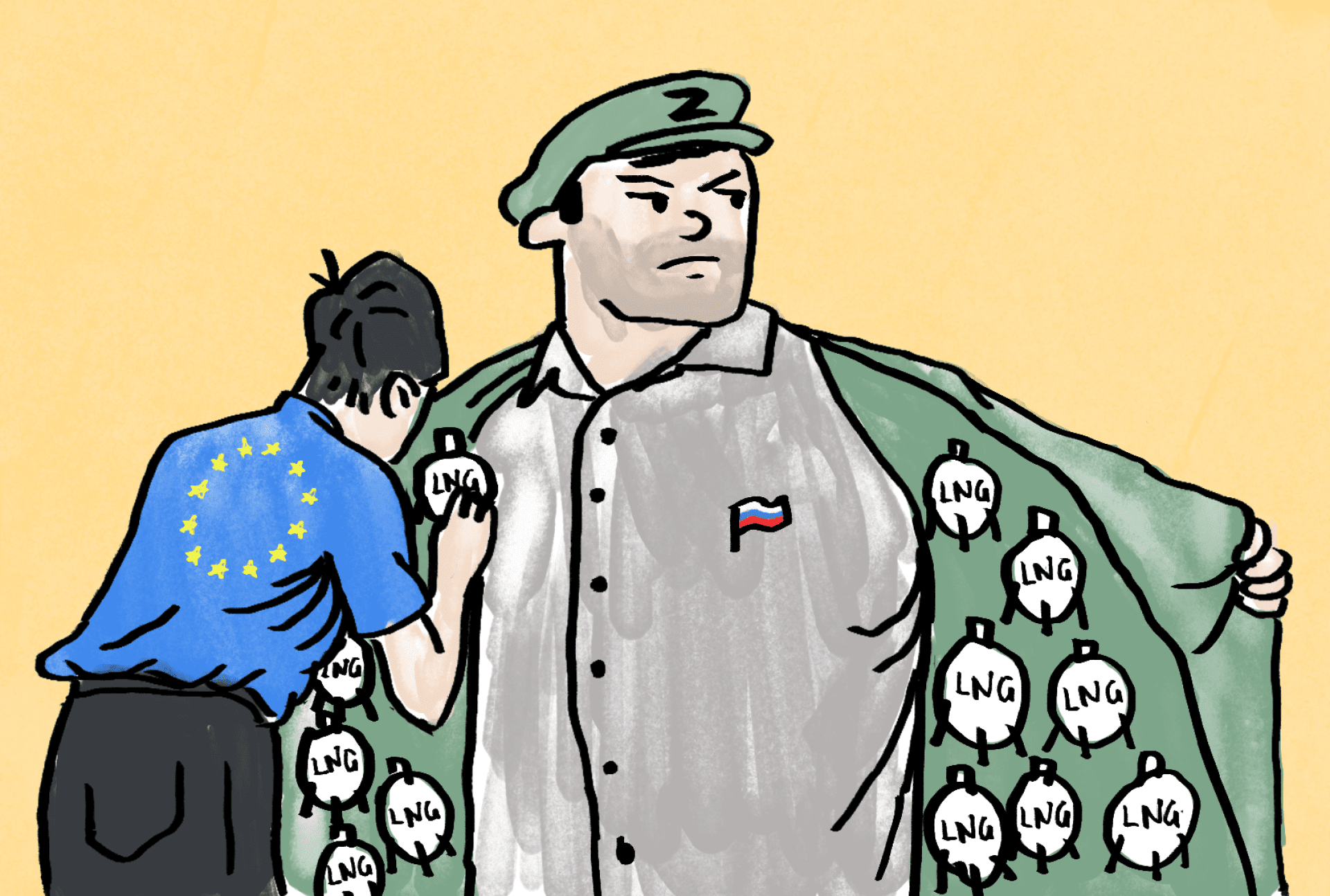

Russian LNG Imports Soar in Europe. Why Is Gas Still Flowing Freely?

Europe paid over €7 billion for Russian liquefied natural gas (LNG) in 2024. Despite efforts to cut ties, Europe remains hooked—Moscow is still its second-largest fuel supplier.

Before Russia’s full-scale invasion of Ukraine, nearly 40% of Europe’s gas came from Russian pipelines. That changed in February 2022: only a handful of countries continued purchasing pipeline gas, prompting Moscow to find an alternative route.

As Europe shut off the pipelines, it left the gates open for liquefied natural gas (LNG). Between 2023 and 2024, Russian LNG imports surged, reaching record levels. Analysts estimate volumes ranged from 15.5 million to over 17.8 million tons in 2024, compared to 15.18 million tons in 2023 and 13.7 million in 2022. Russian LNG is now Europe’s second-largest source of imports, trailing only the United States.

Why is Russian LNG so attractive?

Experts highlight two key factors:

1. Price advantage: Russian LNG is cheaper and not subject to sanctions, allowing European energy companies to profit. Amid skyrocketing energy prices driven by adverse weather conditions, this represents a lucrative opportunity.

2. Re-exports: European companies buy Russian LNG at low prices and resell it, leveraging existing infrastructure. Such re-exports may account for around 20% of total imports, equating to approximately 6 million tons, in addition to the 17.8 million tons purchased for domestic use.

Alternatives to Russian LNG are available from the United States, Middle Eastern nations, African countries, and Norway.

Russia’s revenue boom

In 2024, European countries spent €7.32 billion on Russian LNG alone, excluding costs for pipeline gas. For instance, in October 2024, Europe spent €701 million on LNG and an additional €603 million on pipeline gas, exceeding €1.3 billion in a single month.

For Russia, LNG exports are a critical alternative to maintain gas sales and exert energy leverage over its partners. The Kremlin continues to expand its influence.

In 2023, Russian Deputy Prime Minister Alexander Novak announced plans to increase the country’s global LNG market share from 8% to 20% within the next decade. Currently ranked fourth globally, Russia exported 33 million tons of LNG in 2024 and aims to triple that to 100 million tons by 2035.

The Yamal LNG terminal leads Russia’s exports to Europe, accounting for roughly 75% of shipments. Controlled by Russian company Novatek, Yamal LNG is thriving. In the first nine months of 2024, Novatek increased energy production and boosted LNG sales by 38%, reaching 8.3 million cubic meters.

The missing sanctions

Europe has yet to impose sanctions on Russian LNG. Initial plans suggested including such measures in the EU’s 16th sanctions package, expected in mid-February 2025. However, Bloomberg later reported that the proposal was dropped from the agenda.

Instead, European countries plan to develop a roadmap to reduce dependence on Russian energy by 2027. Only ten countries currently advocate for an immediate embargo. For now, restrictions remain piecemeal. For example, Belgium—one of Europe’s largest re-exporters of Russian LNG—pledged to halt sales from the Yamal LNG terminal to non-EU countries starting March 2025, though it will continue accepting Russian shipments until then.

As of now, ten EU nations continue importing Russian LNG, with Belgium, France, Spain, and the Netherlands leading due to their advanced port infrastructure. France topped the list in 2024, importing approximately 1.5 million tons worth €600 million.

Oil and gas revenues remain a cornerstone of Russia’s military budget, fueling its ongoing aggression.

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-74e27e09e312d1639f24e75f6233ccd5.png)

-24deccd511006ba79cfc4d798c6c2ef5.jpeg)

-9377b86f9f8cd8a2b08f20ffd5f043e0.jpg)

-5568db4fb3d8644b8f1bf8244594bec1.png)