- Category

- World

What Is the Strait of Hormuz and How Could It Spark a Global Energy Shock?

A chokepoint for nearly 20% of the world’s oil and a vital LNG lifeline, the Strait of Hormuz is once again at the heart of geopolitical tensions. Iran’s threat to block it can lead to rising oil prices and destabilize global trade.

Iran is reportedly prepared to obstruct the free passage of civilian cargo ships through the Strait of Hormuz. This comes in response to US strikes on the country’s nuclear facilities, as well as prior Israeli attacks on its military infrastructure. The consequences are already being felt: Bloomberg reports that the supertankers Coswisdom Lake and South Loyalty altered course, avoiding the risky passage through the strait.

The Strait of Hormuz is the second most important oil transit route in the world, handling about 20% of global oil shipments. Only the Strait of Malacca in the Indian Ocean surpasses it, with nearly 30%.

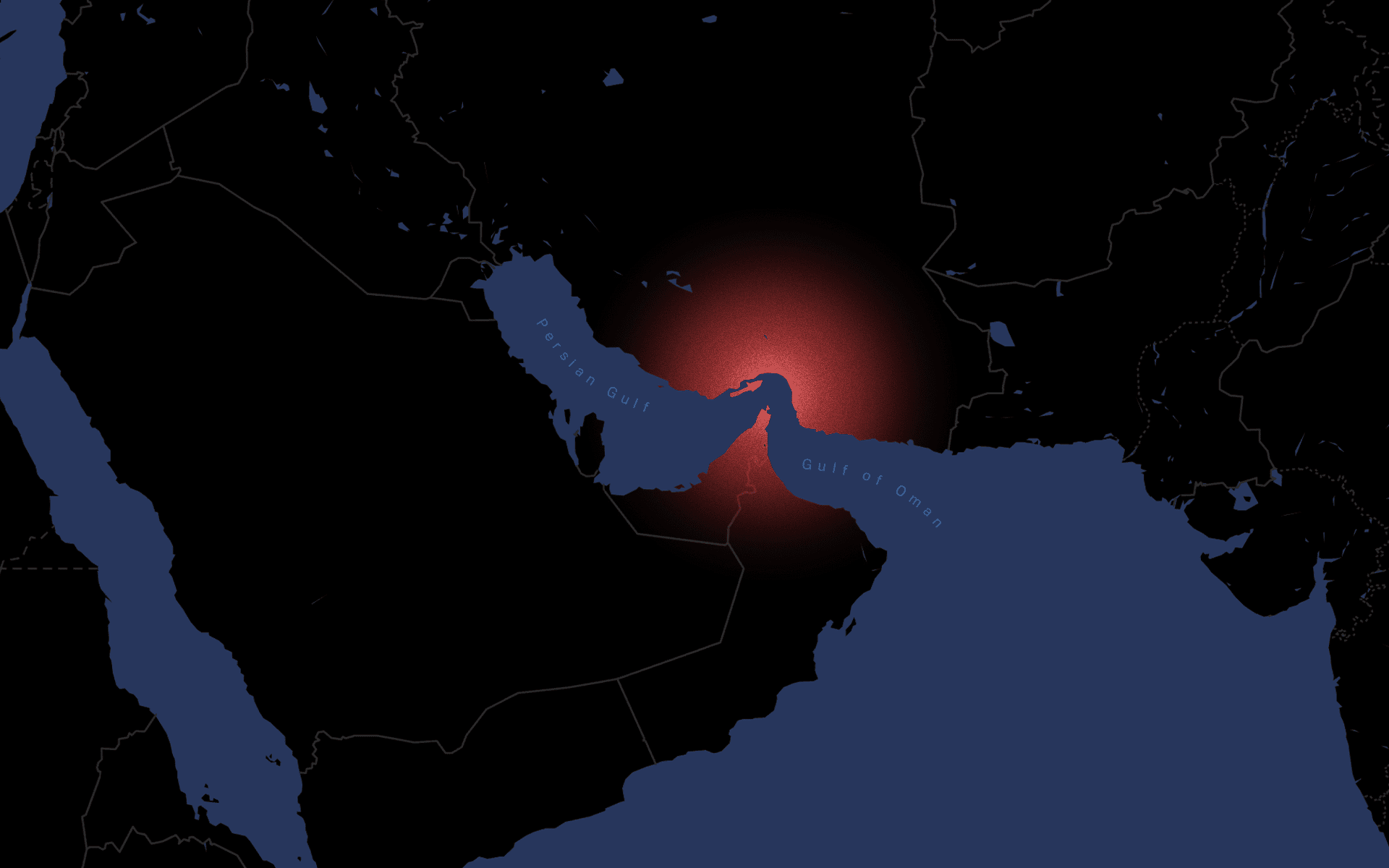

Each day, roughly one-fifth of the world’s oil—around 20 million barrels—passes through the Strait of Hormuz, which stretches 167 kilometers in length and narrows to just 33 kilometers at its tightest point.

The Strait’s importance lies in its role as the gateway to the Persian Gulf—a region from which vast quantities of oil are exported to the global market. Countries exporting oil through the Strait of Hormuz include Qatar, Bahrain, Saudi Arabia, Iraq, Kuwait, the United Arab Emirates, and even Iran itself.

The primary consumers of oil from this region are China, India, Japan, and South Korea, with Europe and the United States being less dependent but still affected.

What are the risks of military conflict in the Strait of Hormuz?

The most immediate and universal consequence—whether a country is a direct consumer or not—is a rise in oil prices. Since hostilities began between Israel and Iran, oil prices have already climbed, reaching $75 per barrel at the time of reporting. This impacts the global market, not just regional players.

LNG prices may also spike. The Persian Gulf and the Strait of Hormuz are the only export routes for Qatari LNG. Qatar—one of the world’s largest LNG exporters—ships most of its volumes through this passage and accounts for 25–30% of global LNG exports.

Any threat to tanker navigation in the area poses a risk to global energy stability.

Higher oil and LNG prices also benefit Russia. Moscow remains heavily dependent on revenues from oil and other natural resources, as its economy is almost entirely resource-based. Elevated prices help fund the war in Ukraine while allowing Russia to profit from oil and LNG sales, including exports to Europe. The higher the prices of oil and gas, the easier it becomes for the Kremlin to finance its budget deficit, which in turn supports military operations in Ukraine.

Interestingly, Iran’s aggressive posture in the Strait of Hormuz can be compared to Russia’s actions in the Arctic, where it seeks to expand its imperial ambitions and has been building up its military presence along key trade routes.

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-27ef304a0bfb28cb4215e5deede4a665.png)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-605be766de04ba3d21b67fb76a76786a.jpg)

-2c683d1619a06f3b17d6ca7dd11ad5a1.jpg)