- Category

- Opinion

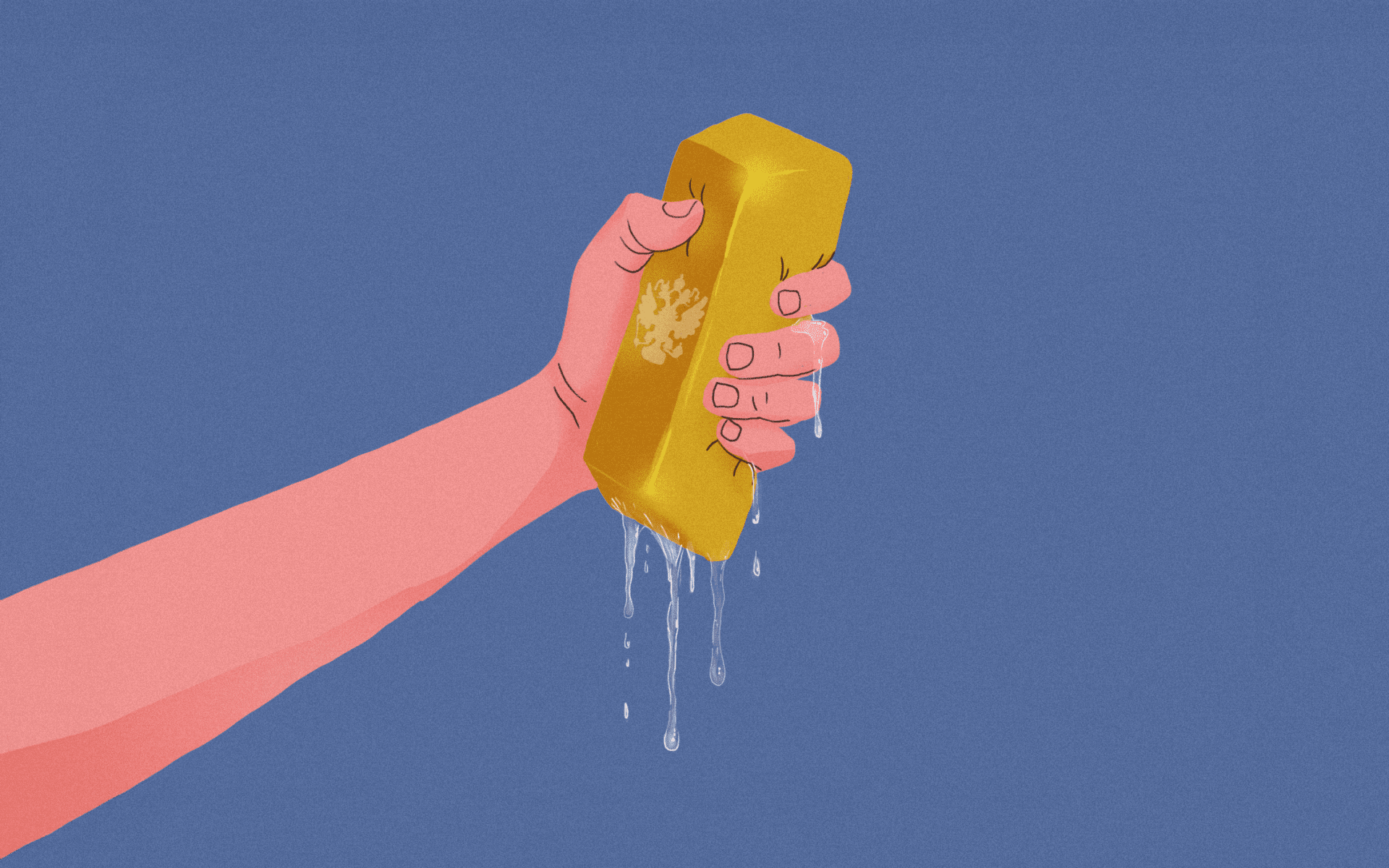

How Ukraine Could Win the War With Russia’s Own Money

Russia’s frozen assets could become the leverage Ukraine needs—not just to survive, but to compel Moscow to seek peace instead of betting on winning a war of attrition. Establishing an international “Reconstruction Bank” to manage these funds would send a clear signal: Ukraine has both the resources and international backing to endure and outlast Russia.

In recent weeks, it has become unmistakably clear—Russia has no intention of ending the war. While many world leaders, as well as Ukrainians themselves, had hoped at minimum for a ceasefire along the front lines, Moscow instead demanded that Ukraine withdraw its troops from Ukrainian territory still inhabited by millions of its citizens.

Other demands—such as the so-called “protection of Russian-speaking populations”—are not even worth debating. The only country in the world where Russian speakers truly lack rights, press freedom, or religious liberty is Russia itself.

At least on paper, the G7 and other Ukrainian partners have concluded that the aggressor must be held accountable for its actions, and that Russian assets will not be returned without resolving the consequences of the war.

“We reaffirm that, consistent with our respective legal systems, Russia’s sovereign assets in our jurisdictions will remain immobilized until Russia ends its aggression and pays for the damage it has caused to Ukraine,” reads the May 2025 Communiqué of the G7 Finance Ministers and Central Bank Governors.

Why Russia's frozen assets are Ukraine’s strongest leverage

Ukraine is already receiving financial support in the form of loans backed by these frozen Russian assets. However, the scale of these loans is limited, while Ukraine still faces a shortfall of up to $30 billion to fully activate the capacity of its domestic defense industry. Given the situation on the battlefield, decisive steps are needed now.

These assets have been frozen for more than three years, yet there is still no transparent, public accounting of their exact value or the jurisdictions in which they are held. Their “immobilized” status does not mean they aren’t generating dividends or profits. In this case, it is not Ukraine but often private commercial entities that have earned windfall profits from these assets.

Today, the most commonly cited figure, sourced from generally reliable estimates, is $300 billion, roughly equivalent to Russia’s annual defense budget times two. Of this, it’s well-documented that approximately $195 billion is held within the Euroclear system.

Comprehensive data is lacking on the income derived from the remaining portion of these assets. There is an ongoing debate globally about the potential risks of transferring these assets to Ukraine, arguments often centering on currency volatility and the stability of financial markets.

Yet it’s evident that these markets are already heavily regulated. Solutions exist, and they do not appear overly complex. The real question is whether there is the political will to find and implement them.

The case for a "Reconstruction Bank"

Rather than keeping these assets idle in various institutions, the G7 countries could establish a modern entity to take custody of and manage the frozen Russian assets until Russia halts its war and compensates Ukraine for the damage inflicted.

Creating such an institution—a “Reconstruction Bank,” in essence, could address several key challenges:

This hypothetical “Reconstruction Bank” could serve as a guarantor for the loans extended to Ukraine by its allies, which are backed by expected future revenues.

It could begin issuing secure, asset-backed bonds to attract capital at low interest rates, offering “ethical investment” opportunities for Ukraine’s supporters. These funds could be channeled directly into Ukraine’s defense industry, without requiring new governmental allocations.

The proceeds from bond redemptions could be rolled over into reinvestments in debt securities of Ukraine’s allies, such as US and EU government bonds.

After the end of hostilities, the institution could shift its focus to addressing the consequences of the war and become a guarantor of social protection for millions of people affected by it: veterans, people with disabilities, internally displaced persons, orphans, and children whose parents were killed by Russia. These social programs could be financed by interest generated from investments in allied bonds.

When time stops working for Russia

It’s clear that Ukraine would struggle to sustain a war of attrition on its own against a much larger economy. Yet Ukraine’s partners surely now recognize the risk that Russia could gain significant ground, indoctrinate Ukrainian children, and further militarize its society with hatred toward “Western values.”

The facts show Russia’s financial reserves are dwindling. But with support from other authoritarian regimes, Russian leader Vladimir Putin remains confident that time is on his side, especially as anti-Ukraine rhetoric grows louder within the political spheres of partner nations, often fueled by Russian propaganda.

Many people around the world no longer realize that the largest war in Europe since World War II is still ongoing. Those who follow the news and see the frontlines barely shifting may wrongly conclude that little of consequence is happening.

But within Ukraine, the reality is starkly different: hundreds of people die every day, leaving thousands of families shattered. Even the most powerful leaders have so far failed to stop it through diplomacy.

This is why bold action on frozen Russian assets is needed now. It must signal to Russia that time is no longer on its side and that Ukraine will have the means to fight back.

-206008aed5f329e86c52788e3e423f23.jpg)

-7e242083f5785997129e0d20886add10.jpg)

-657d7bbeba9a445585e9a1f4bccfb076.jpg)

-c48eebd28583d39a724921453048d33f.jpg)

-56360f669cb982418f455a4b71d34e4e.jpeg)