- Category

- Opinion

Why Smart Capital Is Backing Ukraine’s Defense Tech to Win the War

Unlocking investment in Ukraine’s defense tech could open the next major frontier, forged in war and fueled by ingenuity.

Bringing capital to win the war—and the peace

Ukraine’s defense ecosystem has achieved remarkable things under impossible conditions. But to sustain that pace—and to build an enduring defense industrial base that integrates into European and NATO supply chains—it needs capital. Not charity, not one-time grants, but investment capital that treats Ukraine’s defense tech as what it is: one of the most dynamic innovation environments on the planet.

That capital, however, is not flowing at the scale it should. The reasons are not ideological; they are practical. Ukraine presents four core challenges that make foreign venture capital hesitant: access, war risk, customer concentration, and export bottlenecks. Each is solvable. Each needs to be addressed deliberately and quickly if Ukraine is to move from wartime improvisation to long-term industrial strength.

The four hurdles

Access and due diligence – It is physically difficult to get to Ukraine. That may sound trivial, but it is not. People underestimate how much the border complicates capital flow. Investors need to see what they are funding, meet management teams, and inspect production lines. Air travel restrictions, unpredictable ground logistics, and the absence of normal cross-border banking mechanisms make this process slow and expensive. Investment decisions die in delay.

War risk – Ukraine is a war zone. Facilities can be hit by Russian Shahed drones. Personnel can be drafted. Insurance is prohibitively expensive, and legal contracts contain clauses about force majeure and interruption risk. Those are real deterrents for institutional investors whose business model is to price risk. Mitigations should include a mix of government guarantees, multilateral backstops, and facility-level insurance pools.

Customer concentration – At the moment, Ukraine’s Ministry of Defense is the only significant customer for most domestic defense-tech firms. That’s logical in wartime, but it creates a paradox: success in defeating Russia will sharply reduce domestic demand for defense hardware and software just when the industry most needs throughput to survive. Solving the single-buyer problem requires opening new markets abroad through exports and joint ventures. Without diversification, the industry risks withering the day peace arrives.

Exports and policy bottlenecks – Exports are the linchpin. Licensing remains slow, inconsistent, and opaque. If a company can’t export, it can’t scale—and if it can’t scale, it can’t attract capital. The result is predictable: innovators move to Poland or Czechia, draining talent and breaking the feedback loop between engineer, factory, and warfighter. Only in Ukraine does that loop exist, where prototypes move from design to combat in days. It’s an advantage no Western defense bureaucracy can replicate, and losing it to bureaucracy would be a strategic error.

A market ripe for investment

Despite these obstacles, Ukraine remains one of the most compelling investment opportunities anywhere. Valuations for early-stage defense technology companies are roughly a fifth of what comparable firms would command in the US or Western Europe. That’s not because the technology is weaker; it’s because the perceived risk is higher. Investors who understand how to underwrite that risk—or who can help reduce it through structure—will see extraordinary returns as the market normalizes.

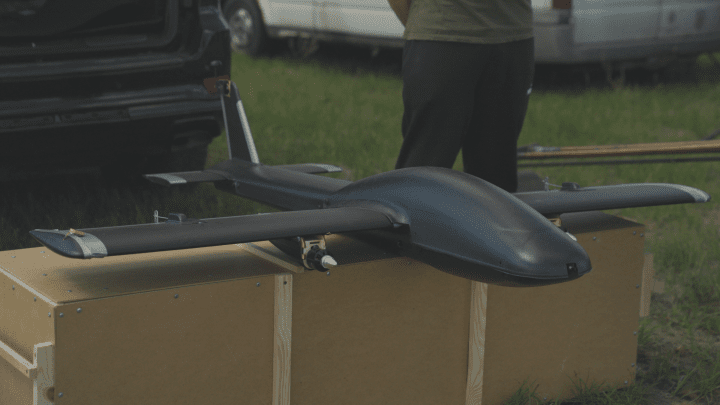

Ukraine’s engineers and entrepreneurs are building world-class systems: AI-enabled drones, counter-drone EW suites, and battlefield logistics software that operates in real combat conditions. Their prototypes evolve through live feedback from the front lines. Ideas move from whiteboard to deployment in weeks, not years. It is the most aggressive R&D cycle in modern military technology.

The missing piece is scale. Ukraine doesn’t need a hundred more drone startups; it needs the best twenty to become fully industrialized manufacturers with standardized quality control, certification, and NATO-grade documentation. That’s what transforms wartime innovation into a postwar industry.

To accelerate that transition, MITS Capital created MITS Industries—a Danish-Ukrainian joint venture designed to consolidate and scale the sector. We began by merging three Ukrainian defense firms—Unwave, Infozahyst, and Tencore—into one platform that centralizes production, quality assurance, and capital allocation. Ukraine brings the industrial base and engineering talent, while Denmark offers capital access, export credibility, technology, and a NATO/EU gateway.

As a dual-headquartered firm based in Copenhagen and Kyiv, MITS Industries can tap European markets and procurement systems while keeping most of the manufacturing and R&D in Ukraine. This hybrid structure is not cosmetic; it is the financial and legal plumbing that allows Ukrainian innovation to flow into NATO pipelines without losing its speed or effectiveness.

A defense industry can exist, but not without reform

If Ukraine wants to sustain and expand its defense-tech edge, it must address the policy architecture that governs capital and exports. The solutions are not theoretical:

Simplify access. Establish investor corridors and logistical programs to make due diligence practical. Time kills deals; predictability revives them.

Structure risk. Develop a war-risk insurance mechanism—either sovereign or multilateral—to make industrial sites insurable and bankable.

Promote exports. Publish a clear, narrow list of restricted technologies and a transparent, time-bound licensing process with defined service levels.

Consolidate and scale. Incentivize mergers and industrial partnerships that push the best Ukrainian startups to production-grade scale rather than proliferating redundant micro-firms.

If these reforms are implemented, Ukraine’s defense industry can follow the trajectory of Israel’s—a sector born in existential war, sustained by exports, and professionalized by standards. If not, the current explosion of ingenuity risks collapsing under its own weight once battlefield demand tapers off.

The most attractive thing about investing in Ukraine remains the same: the people. The entrepreneurship, the skill level, the professionalism—they are unmatched and consistently underestimated in both Europe and the United States. Ukraine has already proven it can innovate under fire. The next step is to show it can scale under stability.

The roadmap is clear. Make access possible, make risk insurable, make exports predictable, and make scaling the national priority. Do that, and capital will not trickle—it will compete to enter.

-d3de513386ff7ece206c471b0bada51c.jpg)

-2c683d1619a06f3b17d6ca7dd11ad5a1.jpg)

-da3d9b88efb4b978fa15568884ef067f.jpg)

-73e9c0fd8873a094288a7552f3ac2ab4.jpg)

-f3bede69822b36ac993a6cd5b65014f9.png)