- Category

- World

Russia Sets Three Oil Export Records Via Baltic Ports in January 2026—Here’s What We Know

Despite a sharp decline in Russian energy export revenues due to sanctions pressure, Moscow is still maintaining and increasing its seaborne crude oil exports.

In an effort to offset the growing discount on its oil, Russia is boosting the physical volume of shipments to foreign markets, actively relying on the so-called “shadow fleet” of tankers.

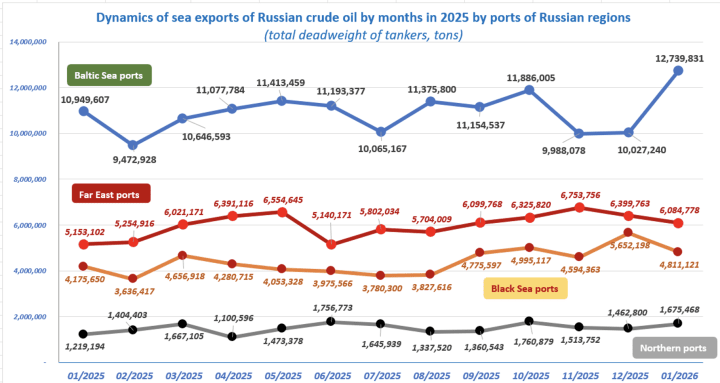

January 2026 saw a new all-time record for seaborne exports of Russian crude oil from Baltic ports—12.7 million tons in a single month, the Monitoring Group of the Institute for Black Sea Strategic Studies reported. The previous high, recorded in October 2025, stood at 11.8 million tons.

“Some may believe that the fight against Russia’s so-called ‘shadow fleet’ is finally yielding results,” the report authors say. “That is not the case. It is a complete illusion.”

Sanctioned tankers become the new normal

In addition to the overall export volume, January 2026 saw several other record-breaking indicators.

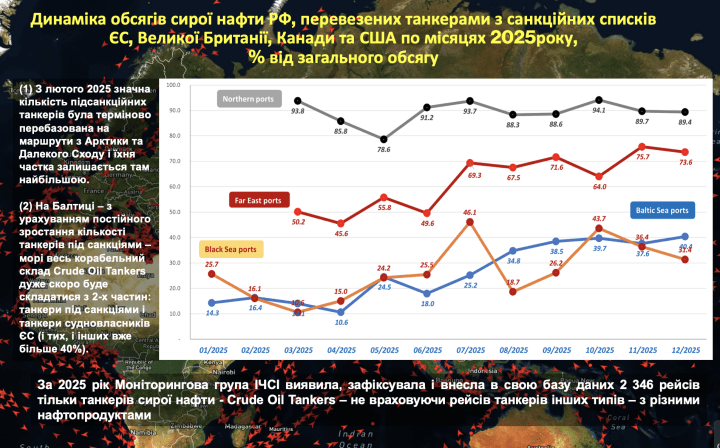

Notably, nearly half of the total volume—47.7%—was transported by tankers under sanctions imposed by the European Union, the United States, the United Kingdom, or Canada.

A record was also set for the number of tankers involved in transporting crude oil. In January 2026, 106 vessels were engaged in shipments—the highest monthly figure for the entire observation period.

In other words, a significant share of Russian oil exports is now carried out by vessels that, formally, should not have access to global maritime logistics.

Sanctions triggered only short-term panic

Seaborne exports of crude oil from Russian ports continue to grow steadily. In January 2026, total volumes reached 25.3 million tons—nearly 4 million tons more than in January 2025 (21.5 million tons).

As the study notes, “Sanctions against Rosneft and Lukoil caused short-term panic… Within a month, buyers and carriers learned how to circumvent them.”

Growth throughout 2025 occurred across all of Russia’s maritime basins, with the largest contributions coming from the Baltic Sea and Far Eastern ports.

Baltic ports remain key

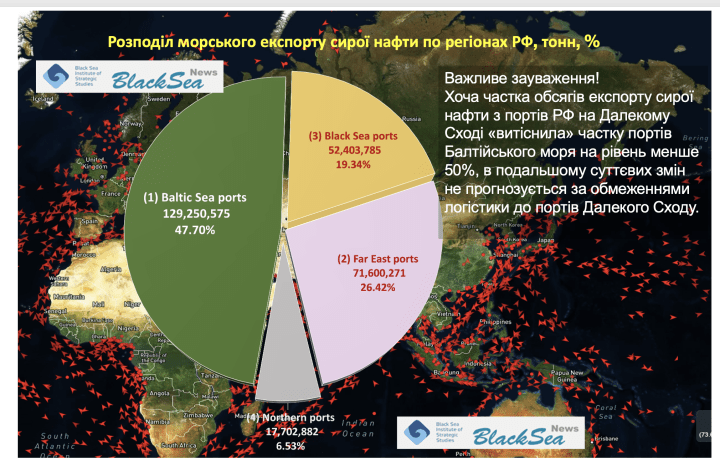

By the end of 2025, seaborne crude oil exports from Russian ports were distributed as follows:

Baltic Sea—129.2 million tons (47.70%), 1,111 voyages

Far East—71.6 million tons (26.42%), 651 voyages

Black Sea—52.4 million tons (19.34%), 434 voyages

Arctic region—17.7 million tons (6.53%), 150 voyages

In total, the Monitoring Group recorded 2,346 crude oil tanker voyages in 2025.

Russia has adapted to sanctions

One of the key tools for circumventing sanctions has been the use of electronic warfare systems to suppress AIS signals of tankers near Russia’s main export ports.

“Maritime tracking services record routes ‘from India to India,’ because the tanker’s actual port call for loading in Ust-Luga or Novorossiysk drops out of the movement track,” the study says.

As a result, Russian tankers effectively disappear from global maritime monitoring systems, complicating efforts to track their involvement in transporting sanctioned oil.

What could actually limit Russia’s seaborne exports

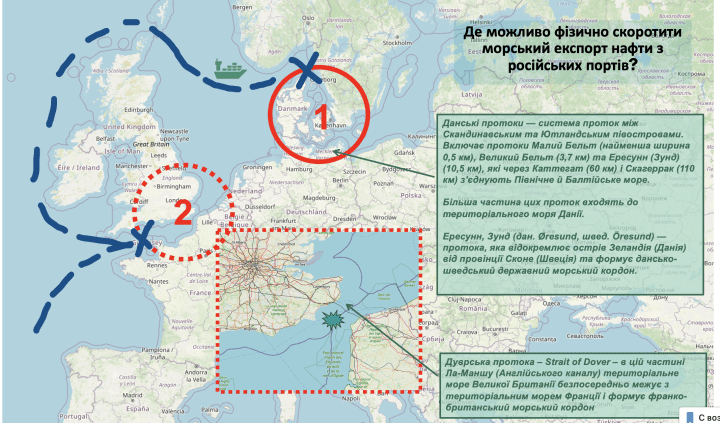

According to experts, an effective reduction of Russia’s seaborne oil exports would only be possible through physically restricting sanctioned vessels’ access to key maritime routes, particularly in the Baltic direction.

The Danish Straits — a system of straits between the Scandinavian and Jutland peninsulas.

Includes the Little Belt (minimum width 0.5 km), the Great Belt (3.7 km), and the Øresund (the Sound) (10.5 km), which connect the North Sea and the Baltic Sea via the Kattegat (60 km) and the Skagerrak (110 km).

Most of these straits lie within Denmark’s territorial waters.

Øresund (Danish: Øresund, Swedish: Öresund) is the strait that separates the island of Zealand (Denmark) from the province of Skåne (Sweden) and forms the Danish–Swedish maritime border.

The Strait of Dover — in this part of the English Channel, the territorial waters of the United Kingdom directly border those of France, forming the Franco-British maritime boundary.

Proposed measures include:

banning entry into the territorial waters of the EU and G7 countries for tankers on sanctions lists;

denying access to the Baltic Sea for vessels sailing under false or unknown flags;

prohibiting passage for tankers included on the Paris MoU and Tokyo MoU “blacklists”;

banning the transport of Russian oil by tankers owned by companies from the EU and G7 countries.

Experts recommend paying particular attention to strategic maritime chokepoints, such as the Danish Straits and the Dover Strait, whose control could significantly complicate Russia’s sanctioned logistics.

-206008aed5f329e86c52788e3e423f23.jpg)

-605be766de04ba3d21b67fb76a76786a.jpg)

-27ef304a0bfb28cb4215e5deede4a665.png)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-2c683d1619a06f3b17d6ca7dd11ad5a1.jpg)