- Category

- Business

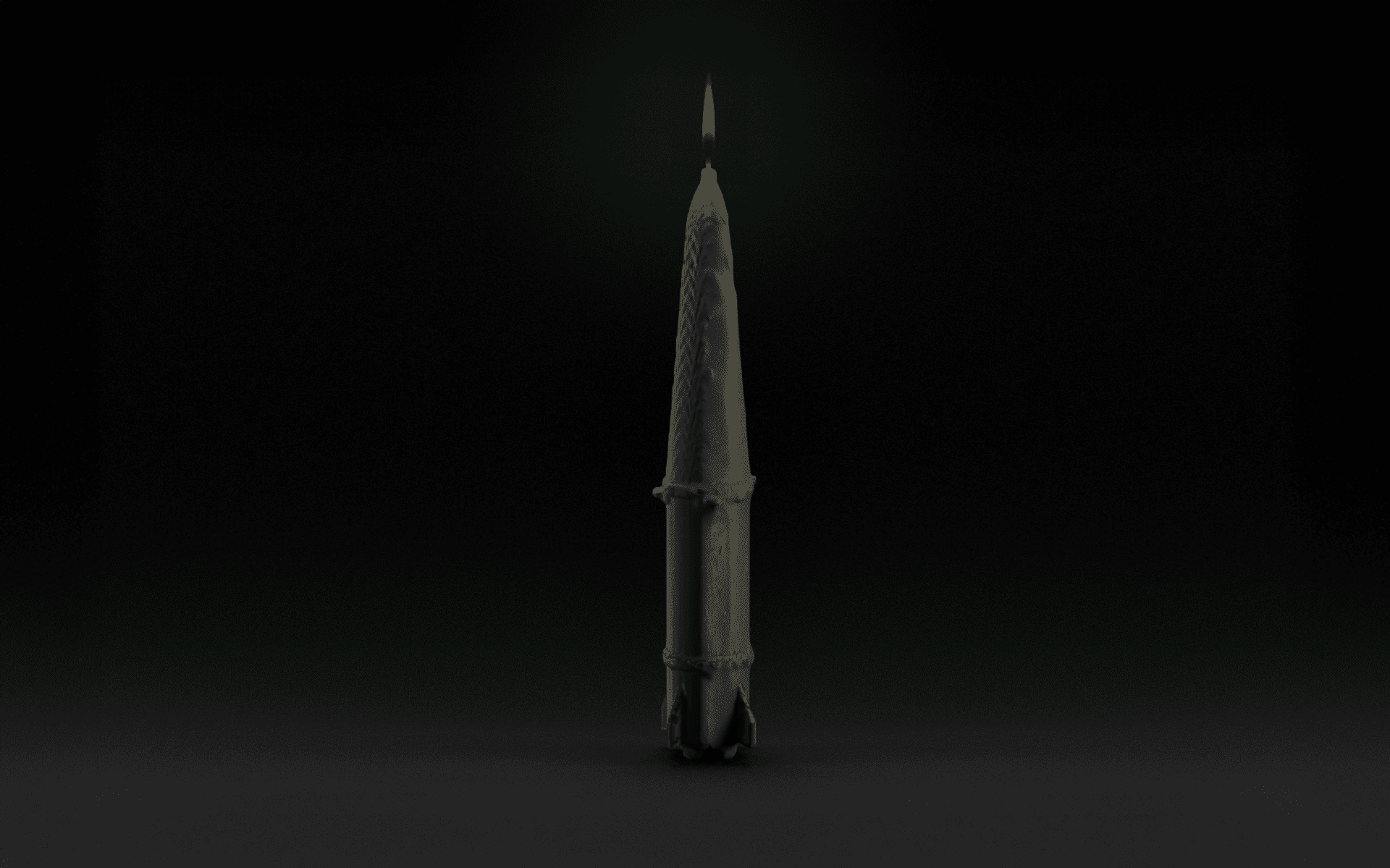

How Cutting Just One Chemical Supply Could Severely Cripple Russia’s Deadly Iskander-M Missile Production

One of Russia’s most destructive weapons—the Iskander-M ballistic missile—relies not just on imported parts but also on foreign raw materials used in its fuel. Targeted sanctions on sodium perchlorate (a component of ammonium perchlorate) could cripple the production of the Russian missile that kills civilians and threatens Europe’s security.

Chemical compounds like ammonium perchlorate rarely make headlines—until they explode. That happened recently in Iran, where its component, sodium perchlorate, triggered a blast at a port that killed around 30 people and injured many more.

In the case of Ukraine, sodium perchlorate (a component of ammonium perchlorate) has been killing civilians since the beginning of Russia’s full-scale invasion, as it is a key ingredient in missile propellant, especially for Russia’s Iskander-M ballistic missiles. This dependency was confirmed in research by Economic Security Council of Ukraine (ESCU).

Sodium chlorate is a component of ammonium perchlorate. Based on an analysis of residual combustion products, experts suggest that the Iskander-M system uses a variant of Opal solid fuel, with ammonium perchlorate making up between 45% and 52.55% of the mix.

“Out of all oxidizing agents in rocket fuels, ammonium perchlorate stands out for its combination of high energy density, stability, and relative ease of production, making it the preferred choice for most missile systems,” ESCU reported. “Alternatives are generally limited to experimental projects due to their specific drawbacks, such as cost, complexity, or safety concerns.”

Domestic production of ammonium perchlorate in Russia and export to Iran

Russia has only one producer of ammonium perchlorate—Federal State Enterprise ANOSIT, formerly known as “Kuybyshev Chemical Plant.” ANOSIT produces ammonium perchlorate and electrochemical hydrogen peroxide primarily for Russia’s military industry.

The company ensures a stable supply of strategically important raw materials to its allied enterprises. Over the past decade, the Perm Powder Plant, a large explosive producer, has been its primary customer, with five contracts totalling RUB 850 million. Other government customers include GosNIIMash (one of the Iskander producers, in charge of cluster warheads), GosNII «Kristall» (a fellow enterprise to the state military company Sverdlov plant, producing octogen and hexogen—compounds essential for military-grade munitions), and Cheboksary Production Association named after V.I. Chapaev (ChPO), which manufactures anti-hail rockets and pyrotechnic components with potential dual-use applications.

ANOSIT announced a threefold increase in ammonium perchlorate production in 2024, including plans to export perchlorate to Iran for manufacturing solid fuel for Iranian Zolfagar missiles.

Weaknesses in Russia’s solid rocket fuel production

Ammonium perchlorate cannot be produced without sodium chlorate. Russia lost the ability to produce sodium chlorate domestically after the collapse of the USSR and remains dependent on imports, especially from China and Uzbekistan.

Before its full-scale invasion of Ukraine, Russia relied heavily on the EU as the main supplier of sodium chlorate, ESCU reported. Since 2022, shipments from the EU have ceased, and Russia has reoriented towards China and Uzbekistan.

China was the key producer and exporter of sodium chlorate to Russia in 2024. In the first 6 months of 2024, the PRC was the key producer and exporter of sodium chlorate for the Russian Federation (70% of all supplies). Uzbekistan also contributed a significant share of exports – 29%.

Russian importers of sodium chlorate supply it to numerous military enterprises, including manufacturers of Iskander-M missiles. Moreover, once Russia converts the substance into ammonium perchlorate, it can export it to Iran. Despite this, sodium perchlorate is not completely banned in the EU for export, re-export or transit through EU countries.

Russia is aware of its dependence on sodium chlorate imports and is therefore attempting to establish domestic production by opening new plants and investing in new projects.

In April 2022, Khimprom PJSC announced the design of a new sodium chlorate plant with a capacity of 50 thousand tonnes per year, which is scheduled to be launched in 2025. In June 2022, Russian Orgsintez Group confirmed investments in this project of RUB 5.7 billion with full capacity by 2027.

Russia’s EuroChem company also signed an agreement in 2023 to establish a new facility for producing sodium chlorate and hydrogen peroxide at the Novomoskovsk Chlorine chemical plant in the Tula region.

“These companies are actively developing domestic sodium chlorate production capacity,” ESCU reported. “However, this does not reduce Russia's dependence on sodium chlorate imports in the coming years, as most production facilities are scheduled to start up in 2025-2027. This vulnerability and Russia's dependence on external supplies of aforementioned raw materials creates a unique opportunity for partners to influence.”

ESCU outlines several recommendations for strengthening export and customs controls in its report. Among the key actions Ukraine’s allies should consider:

Stricter monitoring of the movement of dual-use and sensitive goods

Tougher sanctions on individuals involved in sanctions evasion and illicit trade schemes with Russia

Enhanced customs enforcement at critical logistical choke points across supply routes

These measures—if implemented collectively—could severely limit Russia’s ability to manufacture missiles, a growing threat to regional and continental security.

-206008aed5f329e86c52788e3e423f23.jpg)

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-4390b3efd5ecfe59eeed3643ea284dd2.png)