- Category

- Latest news

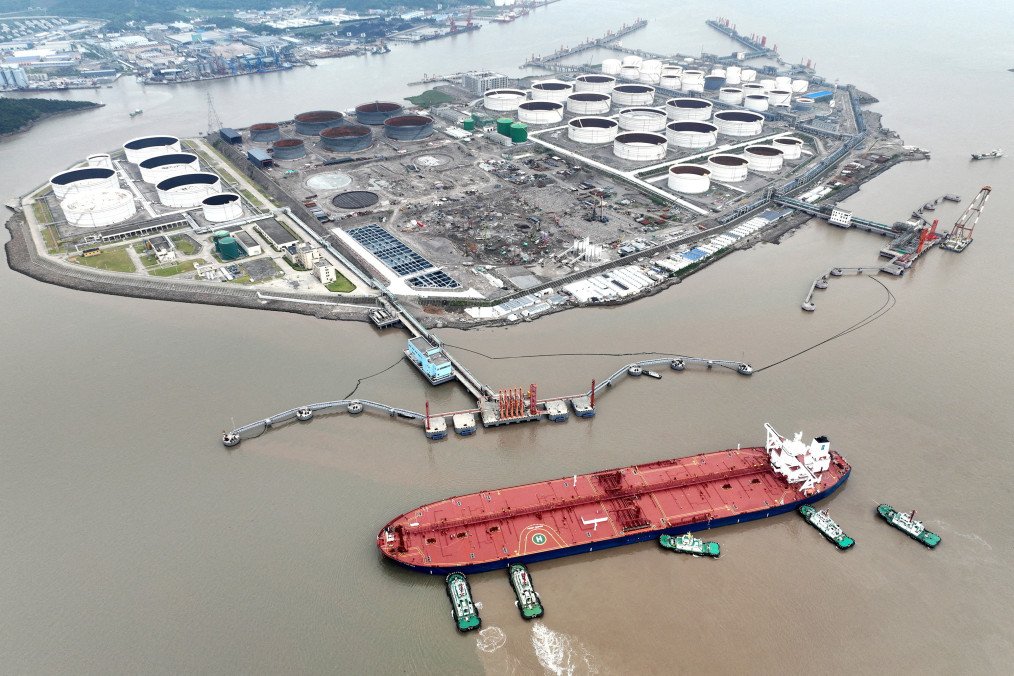

Sanctions Choke Off Russia’s Oil Flow to China—Crude Imports Nosedive 66%

Tightening US sanctions targeting Chinese oil infrastructure and Russian energy giants are rattling the global crude market, sharply reducing flows of Russian and Iranian oil into China—the world’s largest oil importer, according to Bloomberg on November 18.

But experts warn the slowdown may be temporary, as traders begin to exploit alternative channels and enforcement gaps.

According to Bloomberg and analysts at Rystad Energy, Chinese seaborne imports of Russian crude could drop by as much as 800,000 barrels per day in November—a two-thirds decline from typical levels. Iranian flows may fall by up to 400,000 barrels per day, or 30%.

-ed051fb1853bcb98ed81f53fa31bd834.png)

The shift comes after Washington imposed sanctions on Russia’s top oil producers, Rosneft and Lukoil, and blacklisted the major Chinese port of Rizhao, which previously handled about 10% of China’s crude imports. Both moves have had knock-on effects for Iranian shipments, which frequently passed through Rizhao.

“US sanctions on Rosneft and Lukoil could be a little bit of a game-changer,” said Vandana Hari, head of Singapore-based Vanda Insights.

China’s state-owned refining giants have suspended purchases of Russia’s ESPO crude, a key grade shipped from Russia’s Far East, while smaller, privately-owned “teapot” refineries are also backing away—despite traditionally being more risk-tolerant, Bloomberg noted.

Much of their caution stems from recent EU and UK blacklisting of Shandong Yulong Petrochemical Co., a major buyer of Russian oil. The move sent a ripple of anxiety across China’s private refining sector, particularly in Shandong province, a refining hub.

“There’s now an overhang of ESPO crude being offered at a $4 discount per barrel to benchmark prices,” traders told Bloomberg. That’s a steep increase from just $0.50 in late October.

China’s appetite for Iranian crude has also cooled. The US sanctioned Rizhao in October over its ties to Iranian exports, forcing tankers to idle offshore.

Stockpiles of Iranian oil held at sea have surged to nearly 48 million barrels—levels not seen since mid-2023. About 40% of that oil now floats in the Singapore Strait, with another 40% in the Yellow and South China Seas.

Meanwhile, high inventories in Shandong and the approaching end of China’s annual import quota cycle are making private refiners reluctant to commit to new barrels.

“Even if new quotas are granted, refiners may wait and see how sanctions enforcement plays out before resuming Russian crude purchases,” said Jianan Sun of Energy Aspects.

Bloomberg notes that despite the official slowdown, some ports and traders are finding ways around the restrictions. Dongjiakou port in Shandong, sanctioned by the US in August, is once again moving large volumes of Iranian oil—suggesting that for some, profit still outweighs the risk of penalty.

-176bc9926add85b3bef920e5c1ac3892.jpg)

There’s also renewed activity involving “dark fleet” practices: ship-to-ship transfers and transponder shutdowns to mask cargo origins, particularly for cut-rate ESPO cargoes.

“There’s a growing glut of sensitive oil that’s struggling to find a home,” said Emma Li, China market analyst at Vortexa. “Sellers are desperate to offload barrels, which is pushing prices down.”

Earlier, Russia’s flagship Urals crude has fallen to its lowest price in more than two and a half years, just days before sweeping US sanctions on Rosneft and Lukoil—the country’s two largest oil producers—come into force.

Urals from Novorossiysk dropped to $36.61 a barrel on November 13, the weakest level since March 2023. Similar declines were recorded at Baltic Sea ports.

-7f54d6f9a1e9b10de9b3e7ee663a18d9.png)

-c439b7bd9030ecf9d5a4287dc361ba31.jpg)

-72b63a4e0c8c475ad81fe3eed3f63729.jpeg)