- Category

- World

Global Military Spending Hits Record $679B, with Russia Driving the Surge. Here’s Where It All Went

Global military spending has hit a historic high. Europe is rapidly rearming, Russia is increasing production for domestic use, and two major wars—in Ukraine and Gaza—are the key drivers behind this trend.

Stockholm International Peace Research Institute (SIPRI) has released its annual report on the world’s 100 largest arms manufacturers, revealing that global military spending in 2024 reached $679 billion—the highest figure since SIPRI began tracking these metrics. This marks a 5.9% increase over the previous year. Over the past five years, global arms revenues have grown by $150 billion, nearly doubling over the past decade. The most significant jump came after Russia launched its full-scale invasion of Ukraine, as the world recognized the scale of the threat.

Russia’s war—now nearing its fourth year—has forced the United States and European countries to reinvest in defense and modernize their military capabilities. Delays in arms deliveries from allies and rising geopolitical tensions have further compelled governments to expand domestic production and spending.

Newcomers from the Middle East

For the first time, nine companies from the Middle East entered SIPRI’s Top 100 list:

Three Israeli firms reported a 16% increase, reaching $16.2 billion in revenue.

Five Turkish companies earned $10.1 billion, an 11% year-over-year growth.

UAE’s EDGE Group reported $4.7 billion in arms revenues.

Combined, these companies generated $31 billion, representing a 14% increase from the previous year. SIPRI analysts directly cite the war in Gaza and Israel’s broader regional operations as one of two major global catalysts behind the surge in defense spending.

Europe rearms

The second catalyst is, unsurprisingly, Russia’s war in Ukraine.

Previously, Ukraine’s presence in SIPRI’s rankings was minimal—about $1 billion annually. In 2024, the figure tripled to $3 billion, all of which was for domestic consumption. Ukraine’s internal arms production capacity this year is estimated at $6–10 billion and is expected to grow to $20 billion by 2025. The main bottleneck: lack of funding.

We bring you stories from the ground. Your support keeps our team in the field.

Dozens of foreign companies are also supplying Ukraine. One standout is the Czech Czechoslovak Group, which posted 193% growth, reaching $3.6 billion, largely due to its role in the Czech ammunition initiative for Ukraine.

Among 26 European companies (excluding Russia), 23 saw revenue increases, with a collective growth of 13%, totaling $151 billion. This is driven both by a desire to support Ukraine and fear of Russian aggression. While SIPRI doesn’t note this directly, shares of European defense firms have soared—Rheinmetall’s stock tripled compared to early 2022.

Germany saw particularly strong growth: Four German firms increased their arms revenues by 36%, totaling $14.9 billion, spurred by demand for air defense systems, ammunition, and armored vehicles amid heightened threat perceptions.

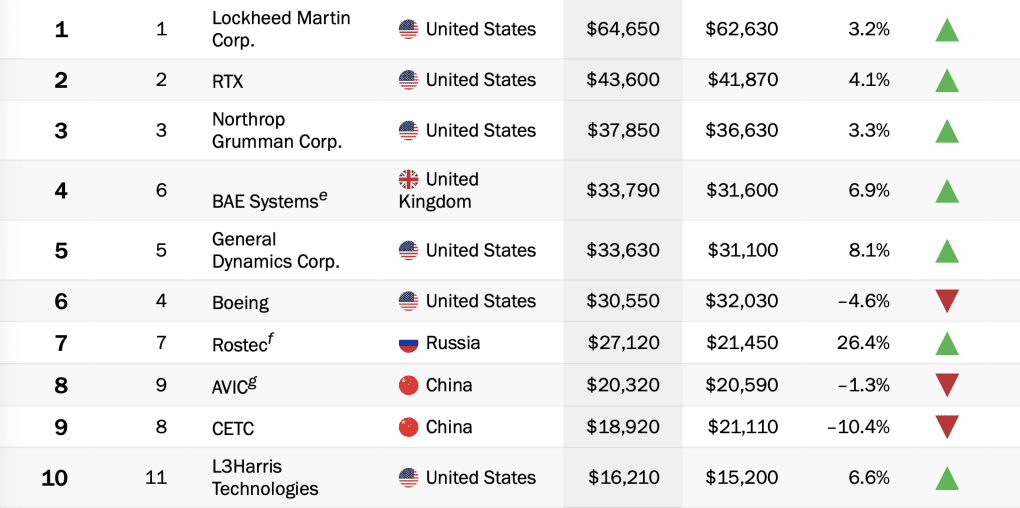

The UK’s BAE Systems remains among the top five global arms producers, with $33.7 billion in revenue and 6.9% annual growth.

The US: still the world’s defense leader

The US continues to dominate the global arms market. In 2024, 39 American companies in the Top 100 saw revenues rise by 3.8%, reaching $334 billion. Leading firms like Lockheed Martin, RTX, Northrop Grumman, and General Dynamics remain at the top.

The US not only supplies partners worldwide but also invests heavily in domestic defense. Through the PURL initiative, European allies have purchased billions in US-made arms for delivery to Ukraine.

Notably, SpaceX made its debut on SIPRI’s list this year, recording $1.8 billion in military-related revenue.

Russia doubles down on war economy

Russia’s presence in the 2024 SIPRI report is telling.

Two Russian firms made the list:

Rostec — $27 billion, up 26%.

United Shipbuilding Corporation — $4.1 billion, up 6.5%.

Together, Russian arms firms reported $31.2 billion in revenue—23% more than the previous year. With most foreign clients gone, this production is almost entirely directed at the domestic war effort in Ukraine.

To compare:

2022: $20 billion

2023: $25 billion

2024: $31.2 billion

Russia’s military spending continues to rise, and SIPRI notes that Moscow is undeterred by sanctions or a growing shortage of skilled labor—another major internal challenge.

The 50% growth in Russia’s arms spending over three years underscores that Moscow has no intention of seeking peace. SIPRI concludes that Europe’s rearmament is a justified and necessary response to deter further Russian military expansion.

Asia and Oceania: Mixed picture

Additional highlights from SIPRI 2024:

For the first time, Indonesia’s DEFEND ID entered the Top 100 with $1.1 billion in arms revenue, a 39% increase.

India’s three listed companies saw combined revenues rise 8.2% to $7.5 billion, driven by domestic orders.

Asia and Oceania were the only regions where arms revenues among the top 100 firms declined in 2024, falling to $130 billion (down 1.2% from 2023), due to a 10% drop among eight Chinese firms.

In contrast, Japanese and South Korean companies reported strong growth, fueled by both European and domestic demand:

Five Japanese firms saw a 40% rise, totaling $13.3 billion.

Four South Korean firms grew by 31%, reaching $14.1 billion.

South Korea’s Hanwha Group, its largest defense contractor, posted a 42% increase, with more than half from exports.

-457ad7ae19a951ebdca94e9b6bf6309d.png)

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-605be766de04ba3d21b67fb76a76786a.jpg)

-88e4c6bad925fd1dbc2b8b99dc30fe6d.jpg)

-206008aed5f329e86c52788e3e423f23.jpg)

-7ef8f82a1a797a37e68403f974215353.jpg)

-554f0711f15a880af68b2550a739eee4.jpg)