- Category

- World

Russian Assets Worldwide Face Seizure After Final $65 Billion Court Defeat in the Case Against Yukos Shareholders

The Supreme Court of the Netherlands rejected Russia’s final appeal in the $65 billion Yukos case, opening the way for the forced collection of this sum from the Russian Federation’s assets around the world. Joint ventures with Russian state companies now face serious risks, as all assets linked to the Russian state—including stakes in joint enterprises, real estate, and even transport—are exposed to potential seizure. The company representing the former shareholders has already announced plans to begin enforcement proceedings.

Last week, the Supreme Court of the Netherlands dismissed the Russian Federation’s final legal attempt to overturn lower court rulings from more than a decade ago that ordered compensation to former majority shareholders of Yukos, once one of Russia’s largest private oil producers, whose assets were brutally transferred to the state-owned corporation Rosneft.

“With this ruling, the Supreme Court definitively ends the Russian Federation’s proceedings to annul the arbitration awards,” read their press release.

The company’s former main shareholder, prominent oligarch Mikhail Khodorkovsky, was among the first major businessmen to fall out of favor with Vladimir Putin early in his presidency. Khodorkovsky was imprisoned, and his business empire was dismantled by Russian authorities.

After serving more than ten years in prison, Khodorkovsky was released at the end of 2013. He did not participate in the legal proceedings himself, as he ceased to be a Yukos shareholder in 2004. Overall, the legal battle has lasted 20 years. Commenting on the decision, Khodorkovsky called it “the most powerful legal blow yet to Putin’s regime.”

He wrote: “For me, this decision also carries deep meaning. An independent, respected court—recognized by Russia, which chose to participate and thus acknowledged its jurisdiction—has officially confirmed: Yukos operated legally.”

The company GML, representing the interests of the former shareholders, also welcomed the ruling. In its press release, GML stated that since there are no remaining legal avenues for appeal, the largest arbitration award in history—now exceeding $65 billion including interest—is final, irrevocable, and enforceable against Russian state assets worldwide.

“Today’s final and historic ruling by the Dutch Supreme Court is not only a victory for the shareholders, but also an affirmation of a fundamental principle of justice: no state, not even one like Russia, stands above the law,” said GML CEO Tim Osborne.

So far, Russian officials have not commented on the court’s decision. However, back in 2020, the Russian Constitutional Court issued a ruling effectively allowing the country to ignore international arbitration decisions in The Hague. Despite Russia’s participation in the proceedings, it is highly unlikely that Moscow will voluntarily pay the largest arbitration award in history—especially given the nature of the case and the scale of compensation.

Meanwhile, GML has announced plans to move forward with enforcement. “True justice only comes through enforcement. We will now focus all our efforts on the forced recovery of the Russian Federation’s assets worldwide until every cent of the more than $65 billion awarded has been paid,” Osborne said.

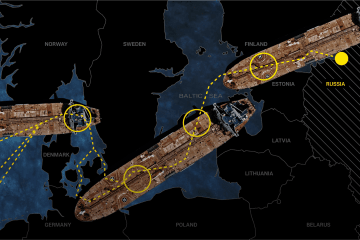

The company explained that this process involves locating Russian state assets abroad—such as commercial property, bank accounts, or shareholdings—and petitioning local courts to recognize the arbitration rulings and authorize asset seizures.

If successful, these assets could be frozen and sold, with the proceeds used to cover the awarded compensation, now exceeding $65 billion with interest.

“Real justice lies in enforcement—it shows that contempt for the law carries real consequences,” Osborne emphasized.

Given that many Russian state corporations operate internationally through joint ventures, shareholdings, and financial institutions, the Dutch Supreme Court’s ruling gives former Yukos shareholders a realistic path to recover damages, while significantly complicating Russia’s investment projects abroad, many of which serve as tools of political influence. From now on, any Russian state business in developed jurisdictions faces extreme risks of asset loss.

In a comment, Heorhii Tykhyi, Spokesperson for the Ministry of Foreign Affairs of Ukraine, called on governments and responsible businesses around the world “to not work with Russians, neither in Russia nor anywhere else.” He stated that: “This is not only because any profits earned by Russia ultimately fund Russian war crimes in Ukraine, but also because cooperation with the Russian government or Russian companies carries both reputational and purely commercial risks.”

Commenting on the Yukos case, he highlighted that, “These risks existed even before the Yukos ruling. For instance, the Ukrainian company Naftogaz has already won two international arbitration cases against Russia and Gazprom, totaling around $7 billion. Naftogaz is already working to enforce these awards by seizing Russian assets in foreign jurisdictions. Following the Yukos decision, they too are searching for Russian assets. For the global business community, this means only one thing—essentially, any business involving Russian money is now in a high-risk zone. We urge everyone to diversify risks wisely and refuse cooperation with Russians.”

-206008aed5f329e86c52788e3e423f23.jpg)

-605be766de04ba3d21b67fb76a76786a.jpg)

-27ef304a0bfb28cb4215e5deede4a665.png)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)