Decades before Russian missiles rained on Ukraine, Moscow had already pulled off a quieter heist: seizing tens of billions in Soviet assets that rightfully belonged to Kyiv.

The total damage to Ukraine’s infrastructure from Russia’s full-scale invasion has already surpassed $170 billion. Frozen Russian assets in Europe and the US could significantly help cover these losses, but debates over their use are still ongoing. Yet, there is another financial dimension that has been largely forgotten for more than three decades: Soviet money.

The “zero option”

After the collapse of the Soviet Union, the question arose of how to divide the state’s property and external debts among the newly independent nations. In 1991, Moscow signed the Treaty on Succession to the External Debt and Assets of the former Soviet Union. The document established each country’s share: the largest went to Russia (61%) and Ukraine (16%). This meant Kyiv was to assume 16% of the USSR’s debts but also receive 16% of its assets.

History provides tested precedents. After the fall of the Austro-Hungarian Empire, for example, its assets and debts were divided proportionally among successor states. In 2001, five states that emerged from the breakup of Yugoslavia reached a succession agreement. None of the new states inherited Yugoslavia’s full international legal personality or automatically assumed its memberships in multilateral institutions or treaties.

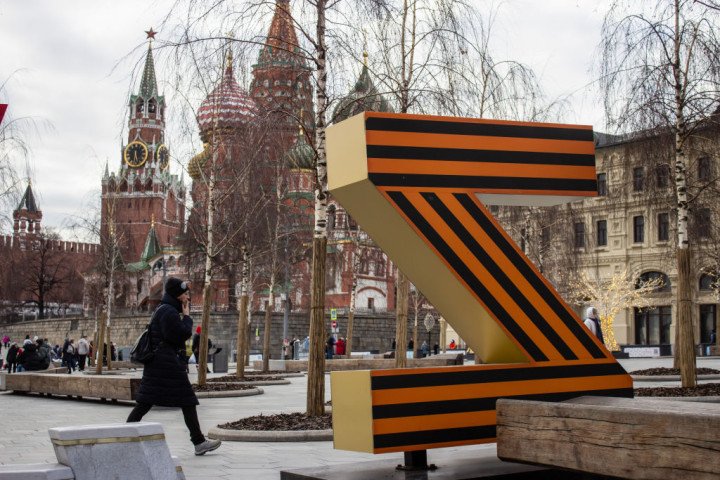

Russia, however, declared itself the sole successor of the USSR. When it came to dividing assets, Moscow pushed the so-called “zero option”: other states renounced Soviet property abroad in exchange for Russia covering all of the USSR’s debts. Moscow then used the debt issue as leverage to pressure the new independent states.

Ukraine never ratified the “zero option.” Instead, Kyiv consistently demanded that the Kremlin do the logical thing: provide a full inventory and valuation of the USSR’s foreign assets. Russia stubbornly refused, contradicting both the spirit and letter of the 1991 agreement, which guaranteed an equal distribution: 16% of both assets and liabilities. Ukraine insisted on legal and financial clarity consistent with international standards, while Russia preferred backroom deals.

How much was the USSR worth?

Moscow likely had strong reasons to conceal the real numbers. Diplomat and international affairs expert Yaroslav Voitko estimated that in 1991, the USSR’s diamond fund and gold reserves alone were worth about $100 billion. Beyond that, the Soviet Union held foreign currency funds and reserves, investments and stakes in foreign banks, real estate and movable property abroad, as well as receivables and other financial claims. Even by the most conservative estimates, this amounted to at least $300–400 billion. By contrast, the USSR’s external debt was only $81–96 billion.

Ukraine’s 16% share would have been roughly $50–64 billion — a colossal sum at the time, comparable to the country’s entire GDP in the early 1990s.

Yet Moscow never compromised, keeping most of the USSR’s assets for itself. Russia continues to use them today—including foreign real estate, diplomatic residences, and stakes in international companies. This remains part of the financial cushion that helps sustain Russia’s war machine.

All of this adds an important dimension to current legal debates: can Ukraine claim a portion of these assets, particularly those frozen in Europe since the start of the full-scale war?

Light freezes

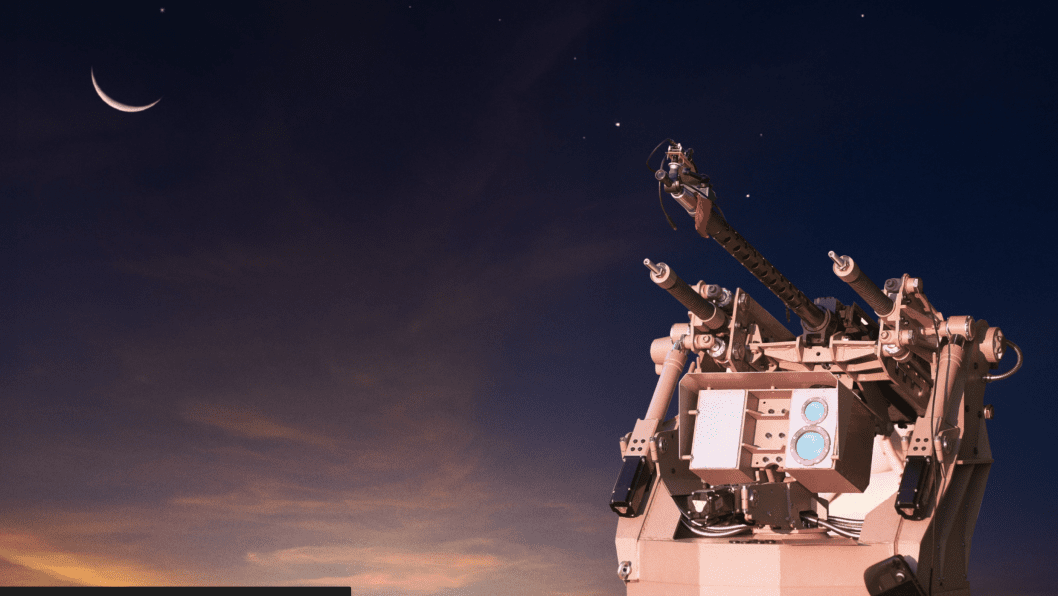

Shortly after Russia’s full-scale invasion of Ukraine, Western allies blocked Russian state funds. While exact figures were not disclosed, the most common estimates put the frozen assets at about $300 billion held in Western jurisdictions. The largest portion—over $200 billion—was in euros. About $67 billion was in US dollars, with the rest in British pounds, Japanese yen, Canadian, Australian, and Singapore dollars, as well as Swiss francs.

Financial punishment is not without precedent. US Presidents Ronald Reagan and George H.W. Bush outright confiscated Iran’s assets in 1981 and Iraq’s in 1992, respectively.

Many experts have similarly argued not just for freezing, but outright seizing Russia’s funds. Prominent economist and former US Treasury Secretary Lawrence Summers, along with former World Bank President Robert Zoellick, said confiscation was justified because “Russia has seriously violated international law.”

So far, however, Western allies have agreed only to use the profits generated from frozen Russian assets for Ukraine, not the assets themselves. Kyiv is receiving loans intended to be repaid with the interest accrued from Moscow’s blocked funds.

The debate continues. Russia’s handling of Soviet debt is not only a story of financial injustice. It illustrates a consistent Kremlin pattern: seizing what belongs to others, refusing transparency, manipulating treaties, and wielding economic tools for political coercion. Today, that same logic is on full display in Russia’s aggression against Ukraine.

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-4d7e1a09104a941b31a4d276db398e16.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-3db1bc74567c5c9e68bb9e41adba3ca6.png)