- Category

- Latest news

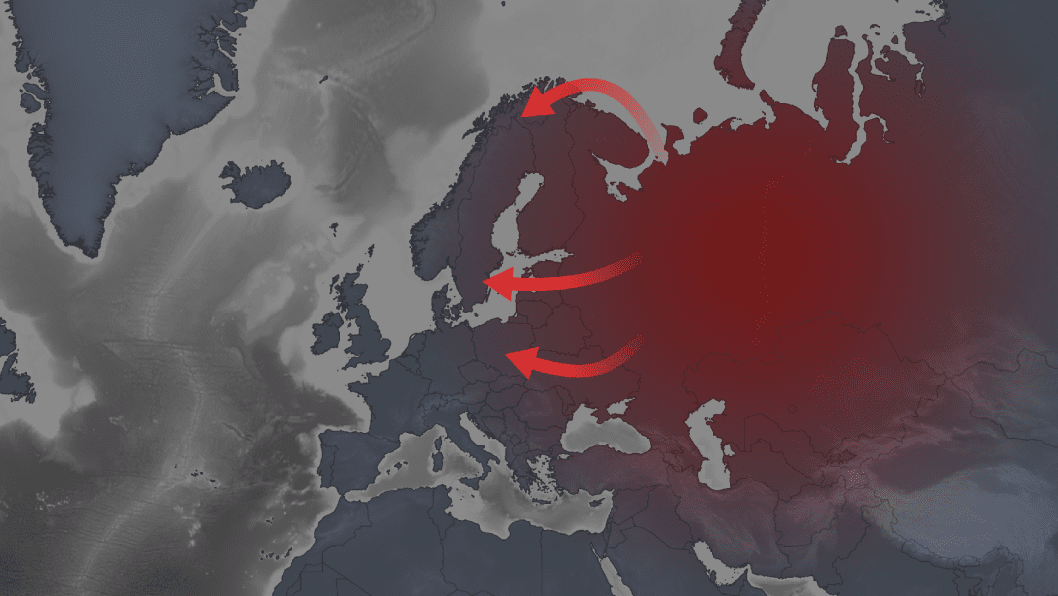

Europe’s Biggest Weapons Boom Since the Cold War—And Why It Could Change the Balance Against Russia

Europe’s defense sector is breaking records, with weapons factories expanding at a pace not seen in generations. Satellite data shows the arms industry building three times faster than during peacetime, adding more than 7 million square meters of new industrial space since Russia’s full-scale invasion of Ukraine.

Construction at European arms facilities has surged dramatically since 2022, the review of 150 sites tied to 37 defense companies shows that Europe’s long-promised military revival is now visible in steel and concrete, not just in political speeches and budget commitments, according to the Financial Times on August 12.

The expansion comes as EU leaders weigh how to keep supplying Ukraine while restocking their own arsenals, amid uncertainty about future US support.

🇩🇪🇺🇦 On the eve of Zelensky’s visit, Rheinmetall showed how it manufactures shells for Ukraine.

— MAKS 25 🇺🇦👀 (@Maks_NAFO_FELLA) May 28, 2025

Rheinmetall’s largest manufacturing facility, located in Unterluß, is the center of European defense production.

The plant, with a staff of 2,800 employees, produces a wide range of… pic.twitter.com/mm5Xg5f4Eh

Satellite data reveals rapid expansion

Using more than 1,000 radar satellite passes, the FT tracked changes at ammunition and missile production sites—two critical bottlenecks in Western aid to Kyiv.

Roughly one-third of the sites showed clear signs of expansion, ranging from excavation and road-building to entirely new factory complexes.

“This is a deep and structural change that will transform the defense industry in the medium to long term,” said William Alberque, a senior adjunct fellow at the Asia Pacific Forum and former NATO arms control director.

“Once you’re mass-producing shells, the metals and explosives start flowing, which drops the cost and complexity of missile production.”

From 790,000 to 2.8 million square meters in four years

Expansion at these sites has jumped from 790,000 square meters in 2020–2021 to 2.8 million in 2024–2025. One of the largest projects is a joint venture between Germany’s Rheinmetall and Hungary’s state-owned N7 Holding, which opened a major ammunition and explosives plant in Várpalota in July 2024.

The first facility there produces 30mm rounds for the KF41 Lynx infantry fighting vehicle, with future production to include 155mm artillery shells and tank ammunition.

The EU’s Act in Support of Ammunition Production (ASAP) program—worth about $580 million—has targeted key production bottlenecks, especially in ammunition and missiles.

The FT found that 20 ASAP-backed sites showed large-scale construction, while 14 had smaller upgrades such as parking or access roads.

EU defense commissioner Andrius Kubilius told the FT that Europe’s annual ammunition production capacity has grown from 300,000 rounds pre-war to an expected 2 million by the end of this year. Rheinmetall alone plans to boost its 155mm shell output from 70,000 in 2022 to 1.1 million in 2027.

Missile production ramps up

Major missile makers are also expanding. MBDA’s German headquarters in Schrobenhausen has received about $11.6 million from ASAP, along with a $5.6 billion NATO order for Patriot missiles.

Norwegian manufacturer Kongsberg opened a missile factory in June 2024, backed by roughly $74 million in funding, including $11.6 million from ASAP.

UK-based BAE Systems has invested over $174 million in munitions plants since 2022.

Latvian Foreign Minister Baiba Braže called the surge in construction “a very positive and much needed development” but stressed the need for NATO to “deliver effectively” on its defense commitments.

Future challenges and limitations

Experts caution that Europe still lacks sufficient long-range strike capabilities. Fabian Hoffmann of the University of Oslo told the FT that “missiles are the precondition for NATO’s theory of victory” against Russia, but production of miniature jet engines for cruise missiles remains a major bottleneck, alongside explosive filler shortages.

Future EU defense programs may follow the ASAP model to expand missile, artillery, and drone production — part of a wider shift from peacetime efficiency to wartime capacity.

Earlier, Germany launched a wartime-style overhaul of its Armed Forces, ordering 600 Leopard tanks and 1,000 Boxer APCs.

-c439b7bd9030ecf9d5a4287dc361ba31.jpg)

-72b63a4e0c8c475ad81fe3eed3f63729.jpeg)