- Category

- Latest news

How a Czech Company Reportedly Became a Backdoor Pipeline for Russian Missile Components

A Czech-based company led by Russian nationals has been funneling critical industrial equipment to Russia’s missile manufacturers, helping circumvent EU sanctions.

Leseft International s.r.o., headquartered in the Czech city of Ostrava, has reportedly supplied over $22 million worth of high-grade metallurgy and engineering products to Russia’s JSC Ruspolimet—a key supplier for multiple missile and aerospace enterprises—since the start of Russia’s full-scale invasion of Ukraine, according to a detailed investigation by analysts at Trap Aggressor published by Ekonomichna Pravda on June 30.

Customs data shows that several of these deliveries included goods restricted by EU export controls.

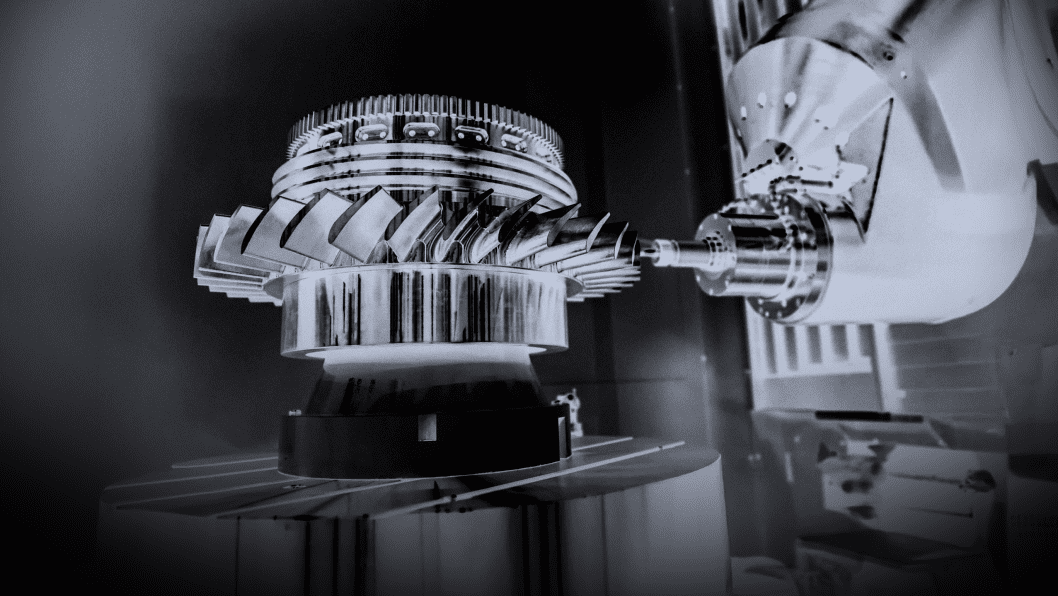

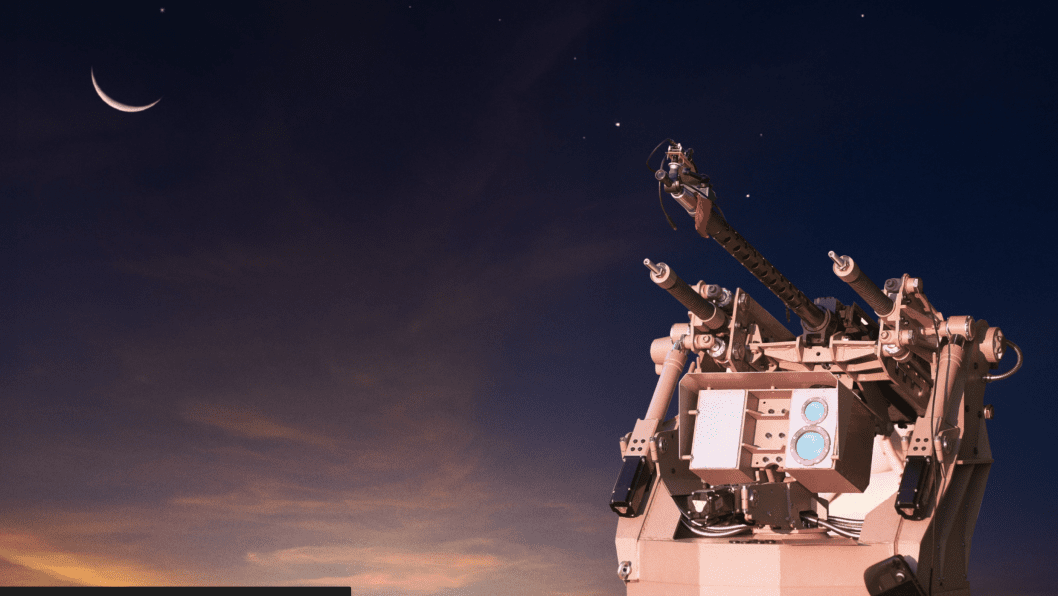

Ruspolimet is a strategic node in Russia’s defense-industrial base. Its materials—particularly high-temperature alloys—are essential for manufacturing turbojet engine components used in cruise and ballistic missiles such as the Kalibr, Iskander, Kh-101, and others.

-5947c77002279f1b732400e88fec4b3a.jpg)

Leseft’s CEO, Lev Seferyan, either currently holds or previously held Russian citizenship. The company’s Czech website lists services in Czech, English, and Russian, and a matching entity—OOO Leseft—operates in Russia under the same leadership.

Sanctioned components, Western suppliers

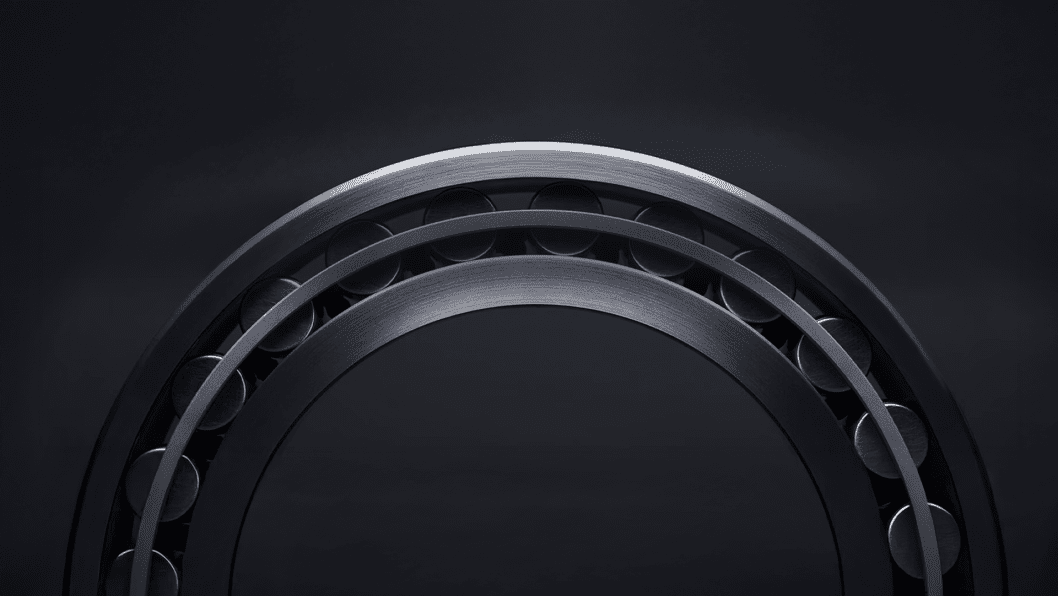

Much of the restricted equipment was routed through Turkey. One Turkish firm, HPS Muhendislik Makina Sanayi Ve Ticaret, supplied hydraulic motors, heat exchangers, pressure valves, and other components—classified under EU-controlled HS codes—to Leseft, which then funneled them to Ruspolimet.

According to Trap Aggressor, 99% of HPS’s deliveries ultimately went to Russia.

Other suppliers include Swiss industrial firm ENCE GmbH, German metallurgy giant SMS Group GmbH (which still operates in Russia despite claims of market exit), and Chinese and European partners.

Notably, SMS Group responded to inquiries stating its last shipment to Russia occurred before the full-scale invasion, and that while its operations in the country have been scaled down, they have not been terminated.

Ukrainian connection: metal supplies via Ostrava

Leseft’s industrial footprint includes Kronatech Impex s.r.o., a Czech firm established in 2013 whose directors are Ukrainian nationals Oleg and Oksana Yarovyi, Ekonomichna Pravda wrote.

The Yarovyis also run Ukraine-based Aratta Invest, a producer of forged metal components. While Aratta denies any direct relationship with Ruspolimet, its products have been exported to Kronatech and Leseft during the war.

In a statement to Trap Aggressor, Oleg Yarovyi confirmed cooperation with the Czech company but claimed no knowledge of downstream Russian defense contracts.

He added that Aratta operates “exclusively within the legal framework” and would cut ties with any partner found to be working with the Russian defense industry.

Trap Aggressor, however, highlighted that these companies’ long-standing links to Seferyan and his Russia-based family business raise serious questions. Despite widespread scrutiny of supply chains, neither Aratta nor its Czech affiliates have flagged concerns about their end-users.

Enabling Russia’s missile arsenal

Ruspolimet’s clients include top-tier Russian weapons manufacturers:

Khrunichev State Research and Production Space Center – under sanctions for missile and space tech.

Votkinsk Machine Building Plant – builder of Iskander-M, Topol-M, and Yars ballistic missiles.

UEC-Saturn and UEC-UMPO – developers of engines for Kalibr cruise missiles and Su-35 fighter jets.

-bc762b8983e20ee63a97f76b0a5b1f09.png)

Leseft has also reportedly supplied goods through Kazakhstan-based entities, some of which appear to be shell companies controlled by Seferyan’s associates. These subsidiaries have financial accounts in Kazakh banks, allowing further obfuscation of supply routes.

Earlier, reports emerged that Czech-made metalworking machines continue to enter Russia despite sanctions, with some reportedly used by the Russian military-industrial complex.

According to an investigation by The Insider, at least 12 Czech manufacturers have supplied such equipment to Russia since 2023, often via indirect routes through countries such as Estonia, Serbia, Turkey, and Latvia.

The majority of these exports are dual-use technologies — machinery applicable to both civilian and military manufacturing. Three companies—Šmeral Brno, Varnsdorf, and TAJMAC-ZPS—account for the largest share of exports, valued at approximately $8 million in 2024 alone.

Customs data show that in 2023, Russia imported Czech metalworking machines worth $18 million; in 2024, the value dropped to $12 million.

-c439b7bd9030ecf9d5a4287dc361ba31.jpg)

-72b63a4e0c8c475ad81fe3eed3f63729.jpeg)