- Category

- War in Ukraine

Russia Defies Sanctions, Continues to Secure Critical Bearings, Including from EU Manufacturers

Bearings—small but indispensable components—are the lifeblood of heavy machinery, from tanks to drones. Despite international sanctions banning their export to Russia, the Kremlin continues to secure these critical parts, often involving third-country intermediaries and re-export schemes, including from manufacturers in the EU and Japan.

Why bearings are critical for Russia

To manufacture tanks, armored personnel carriers, missiles, or strike drones, bearings are indispensable and must be of high quality. Bearings reduce friction, enhancing efficiency and reducing wear and tear on parts.

Poor-quality bearings lead to wheel issues, suspension damage, transmission failures, brake malfunctions, and engine overheating.

The importance of these components is well understood in the defense industry. Bearings have been included in the Common High Priority Items List—goods banned for export to Russia. It contains several bearing types categorized under the following codes:

8482.10 (ball bearings)

8482.20 (tapered roller bearings, including cone and roller assemblies)

8482.30 (spherical roller bearings)

8482.50 (other cylindrical roller bearings, including cage and roller assemblies).

«these items pose a heightened risk of being diverted illegally to Russia because of their importance to Russia’s war efforts. The list may be updated periodically as new information becomes available» - the explanation emphasizes. Nevertheless, such products are supplied to the Russian Federation in circumvention of the sanctions.

Who supplies bearings to Russia?

Despite some domestic production, Russia imported bearings worth over $400 million annually even before its full-scale invasion of Ukraine. Following the invasion, several manufacturers exited the Russian market, further increasing the need for imports. However, their products continue to reach Russia.

Customs data obtained by UNITED24 Media shows that tens of millions of dollars worth of bearings—specifically those on the Common High Priority Items List—were shipped to Russia in the first half of 2024, also underscoring the continued presence of Japanese technology in Russia despite sanctions.

Top 10 suppliers in the first half of 2024:

Manufacturer | Country of origin | Supply value (USD) |

Zeolite MANSFORD | Malaysia | 4888266 |

Centrina | Malaysia | 4403711 |

SKF | Branches in the EU, China, and USA | 3520042 |

SPZ BEARINGS | Uzbekistan | 3072032 |

FERSA | Spain | 2996999 |

PHO YEN MECHANICAL | Vietnam | 2952861 |

FARTON MITEX | Malaysia | 2135102 |

KUGEL UND ROLLENIAGEWERK | Germany | 2128072 |

NSK | Japan | 2127274 |

NSK | Branches in the EU, China | 1555151 |

SKF | Sweden | 1121783 |

ZKL | Czechia | 1047200 |

Some companies, like NSK and SKF, appear twice due to products sourced from multiple branches. However, they should still be held accountable for export control practices.

Top suppliers and their practices

The world’s largest bearing manufacturer, Sweden’s SKF, announced in April 2022 that it had ceased all operations in Russia. Yet, it remains one of the top suppliers.

In 2023, media reports indicated that the Swedish government had stated it was in contact with several companies suspected by the European Commission of exporting products to Russia in violation of sanctions. SKF was among the companies named. These companies «could have evaded sanctions through third countries or through subsidiaries, subcontractors or other entities» - according to the European Commission.

Despite these accusations, data from 2024 reveals that shipments to Russia continued. SKF did not respond to UNITED24 Media’s inquiry about measures to prevent exports to Russia or enhance export controls.

The Czech company ZKL is among the top 10 suppliers, and its case is particularly illustrative of the broader issue. In the summer of 2024, Czech journalists uncovered that the company had knowingly supplied its products to the Russian market through a Chinese intermediary.

A ZKL manager admitted to a journalist that while direct sales to Russia were banned, the company sold bearings through China. Almost all these transactions followed a re-export scheme through the Chinese subsidiary Tianjin Xishanfusheng International Trading Co. Ltd.

The company that supplied ZKL bearings to Russia acknowledged that the exported bearings were intended for military use. Specifically, these bearings are essential components in KAMAZ trucks, which play a crucial role in the logistics of the Russian military. Despite multiple inquiries from United24 Media, the company declined to comment on its involvement in these shipments.

Malaysian companies Zeolite MANSFORD and Centrina led in exports during the first half of 2024. In late October 2024, the United States sanctioned these companies and four other Malaysian bearing manufacturers for supplying bearings to Russia. These sanctions grouped them with 10 Russian and Chinese companies facilitating such imports. UNITED24 Media reached out to the Malaysian firms, but no responses were received.

At the same time, certain bearing categories—specifically those under codes (8482.91: balls, needles, and rollers for ball or roller bearings; 8482.99: parts for ball or roller bearings; 8482.40: needle roller bearings; 8482.80: ball or roller bearings, including combined ball/roller bearings)—were excluded from the sanctions list. This loophole has been exploited by suppliers, providing significant benefits to Russia. United24 Media calculated that the imports of these goods amounted to $15 million in the first half of 2024.

Are sanctions effective?

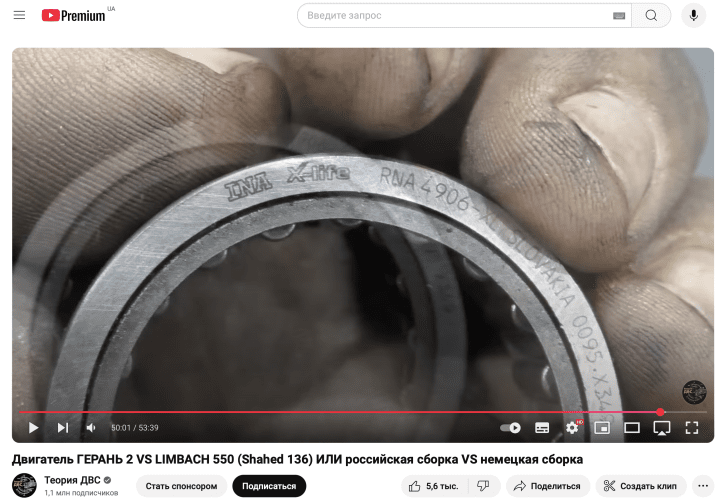

Despite sanctions, bearings from EU countries are still found in most Russian weaponry. For instance, an analysis of the Shahed kamikadze drone, manufactured in Russia, revealed bearings sourced from the EU.

Sanctions have nonetheless caused disruptions. Russian Railways (RZhD), one of the largest bearing consumers and a key player in military logistics, faced near-collapse in late summer 2024 due to bearing shortages, even as sanctioned goods continued to arrive.

Bearings, like many dual-use items, can be purchased on the open market. However, the volume of shipments to Russia suggests that companies are often deliberately circumventing sanctions, as evidenced by investigations like the one into ZKL.

The Czech Economy Ministry eventually imposed partial export restrictions to China in response to ZKL’s activities. Still, other third countries facilitate deliveries to Russia.

Western companies must recognize that profits from Russian trade cannot justify their complicity in aiding a nation that kills civilians, threatens global security, and openly espouses xenophobic policies.

Asian companies involved in such activities have already faced sanctions. European firms should expect regulators, governments, and law enforcement to investigate their actions objectively and, if necessary, impose stricter restrictions on exports to jurisdictions linked to Russian supply chains.

-206008aed5f329e86c52788e3e423f23.jpg)

-347244f3d277553dbd8929da636a6354.jpg)

-f88628fa403b11af0b72ec7b062ce954.jpeg)

-554f0711f15a880af68b2550a739eee4.jpg)