- Category

- Latest news

This Russian Factory Shouldn’t Exist. But Western Tools Keep Plant No. 9 Alive

Despite mounting international sanctions, Russia continues to expand its domestic artillery production capacity, including critical infrastructure upgrades at a key weapons facility in Yekaterinburg.

According to a joint investigation by Frontelligence Insight and analytical group Dallas published on February 9, this progress heavily relies on precision industrial machinery originating from Western Europe and Taiwan.

We bring you stories from the ground. Your support keeps our team in the field.

Artillery still drives a significant share of casualties

While drone warfare has become the dominant feature of the battlefield, artillery remains a major cause of personnel losses.

Based on analysis of Russian and Ukrainian unit data, Frontelligence Insight estimates that between one quarter and one third of all battlefield casualties in 2025 were still caused by artillery and mortar fire.

The report emphasizes that despite shifts in tactics, artillery retains a central role in Russia’s offensive capabilities.

Ammunition production sees year-on-year growth

Citing a separate report, which references internal Russian documentation, the investigation notes that Russia delivered over 1.96 million 120 mm mortar rounds to its military in 2025—a 37.3% increase from the previous year.

-98d31b238962988a82662dd1f44a2cd4.jpg)

The supply of 152 mm artillery shells also rose by 10.2%, reaching 1.717 million units. This scale of output reflects an intensified effort to reduce dependency on imported ammunition from Iran and North Korea, which had previously been used to address supply shortfalls but suffered from quality and compatibility issues.

Ural-based Plant No. 9 undergoes expansion

At the center of this growth is Plant No. 9 in Yekaterinburg, a long-standing facility responsible for manufacturing artillery barrels for Koalitsiya and Msta howitzers, tank guns for T-90 and T-14 Armata platforms, and naval depth-charge launchers.

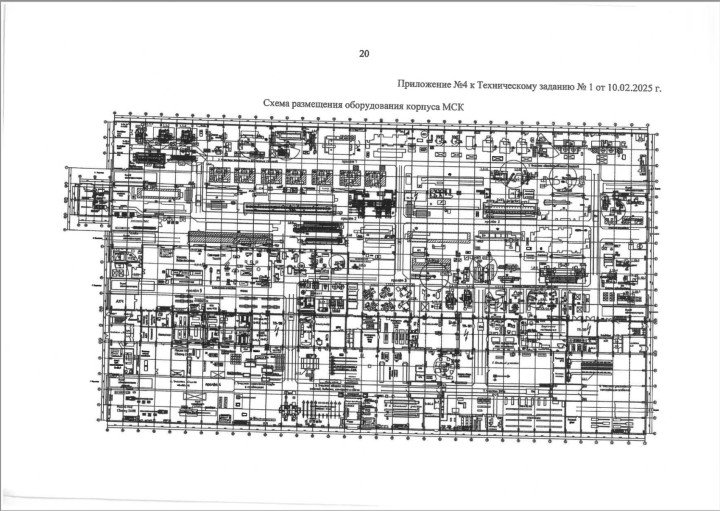

Satellite imagery and internal documents reviewed by investigators confirm that at least six workshops at the site are being modernized, including facilities used in the assembly and finishing of 152 mm gun systems.

Documentation reviewed by the research team highlights the role of “ZAO Zenit-Investprom” in delivering updated engineering plans and production blueprints to the facility in 2025.

One of the workshops, identified as MSK, has been equipped to manufacture the 2A88 artillery system for the 2S35 Koalitsiya platform, with designated areas for component machining, assembly, testing, and shipping.

Equipment traced to western manufacturers

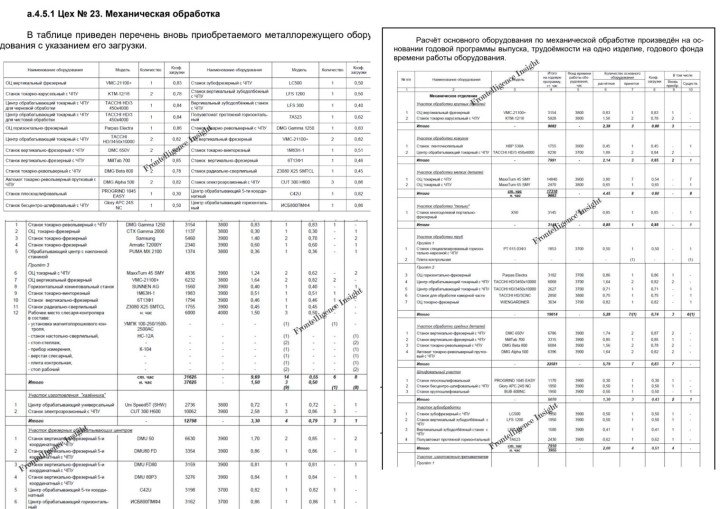

The report finds that at least 22 high-precision industrial machines have been slated for installation at Plant No. 9.

These include advanced gear-shaping, milling, and turret lathe systems. The majority originate from companies based in Germany, Italy, the United Kingdom, and Taiwan:

Germany: DMG MORI (DMC 650V and MillTap 700 CNC machines), Liebherr (LC500 hobbing and LFS series shaping machines), and Hermle (C42U 5-axis machining center);

![German-built Liebherr LC500 gear hobbing machine, used for shaping artillery drivetrain components. (Source: liebherr.com) German-built Liebherr LC500 gear hobbing machine, used for shaping artillery drivetrain components. (Source: liebherr.com)]()

German-built Liebherr LC500 gear hobbing machine, used for shaping artillery drivetrain components. (Source: liebherr.com) Italy: TACCHI (HD/3 multifunctional turning centers) and PARPAS (OMV Electra horizontal milling system);

![Italian-made TACCHI HD/3 CNC turning lathe, used for rough machining of large artillery components. (Source: electron-services.co.uk) Italian-made TACCHI HD/3 CNC turning lathe, used for rough machining of large artillery components. (Source: electron-services.co.uk)]()

Italian-made TACCHI HD/3 CNC turning lathe, used for rough machining of large artillery components. (Source: electron-services.co.uk) Taiwan: KAFO (VMC-21100+ vertical milling center) and Glory (APC 24S NC centerless grinder);

![KAFO VMC-21100 vertical milling machine from Taiwan, one of the high-precision tools procured for artillery production at Plant No. 9. (Source: machinestation.us) KAFO VMC-21100 vertical milling machine from Taiwan, one of the high-precision tools procured for artillery production at Plant No. 9. (Source: machinestation.us)]()

KAFO VMC-21100 vertical milling machine from Taiwan, one of the high-precision tools procured for artillery production at Plant No. 9. (Source: machinestation.us) UK: Jones & Shipman (PROGRIND 1045 EASY surface grinding machine).

![UK-manufactured PROGRIND 1045 EASY surface grinding machine, slated for installation at the Yekaterinburg facility. (Source: machinetools.com) UK-manufactured PROGRIND 1045 EASY surface grinding machine, slated for installation at the Yekaterinburg facility. (Source: machinetools.com)]()

UK-manufactured PROGRIND 1045 EASY surface grinding machine, slated for installation at the Yekaterinburg facility. (Source: machinetools.com)

The findings highlight that the machinery in question is not composed of hard-to-trace microcomponents, but rather large-scale industrial tools, which are subject to export controls and easier to monitor.

Long-term sanctions circumvention

Internal correspondence obtained from 2014 shows that executives at Plant No. 9 were already seeking foreign machinery under special exemptions. The requests included equipment from Taiwan and Germany and were justified on the basis that no domestic equivalent was available.

According to Frontelligence Insight, Russia’s long-standing import-substitution efforts have failed to eliminate reliance on foreign industrial systems. The company concludes that despite sanctions, “nearly all critical stages of manufacturing at Plant No. 9… still rely on high-precision industrial equipment from Europe and East Asia.”

The investigation raises concerns about enforcement gaps in current sanctions regimes. While restrictions may have delayed procurement, the report notes that internal documents showed “no significant concerns or a lack of confidence” among Russian planners regarding their ability to source the required equipment.

Earlier, Bloomberg reported that Russia is preparing for a possible breach of its 2026 budget deficit target as rising war-related spending collides with falling oil and gas revenues, forcing the Kremlin to rely more heavily on costly domestic borrowing.

-7f54d6f9a1e9b10de9b3e7ee663a18d9.png)

-111f0e5095e02c02446ffed57bfb0ab1.jpeg)

-72b63a4e0c8c475ad81fe3eed3f63729.jpeg)

-c439b7bd9030ecf9d5a4287dc361ba31.jpg)