- Category

- War in Ukraine

How One Unsanctioned Metal Keeps Russia’s Weapons Factories Running

While its missiles strike Ukraine, Russian titanium still powers its defense industry. A critical metal slips through sanctions, quietly fueling both Moscow’s war machine and Europe's aerospace industry.

Russia said that throughout 2025, it will quadruple the production of titanium tubes for its aviation, Andrey Andrianov, CEO of Rosatom MetalTech LLC announced in April 2025.

Russia holds 14.5% of the world’s titanium reserves, yet it imports 96% of its titanium raw materials—largely from the EU—due to the inefficiency of developing its deposits.

Titanium is critical to Russia’s military-industrial complex, playing a vital role across its aviation, space, chemical, and defense sectors.

China has the world's largest titanium deposits and has supplied Russia with critical titanium for missile components. China’s boost has resulted in Russia having an estimated stockpile of around 900 Iskander missiles, enough for at least two more years of strikes.

Russia’s new titanium hub is driving its air war

Titanium might be one of the Earth’s most abundant elements, but its value lies in what it can do, not how much of it exists. Strong, corrosion-resistant, and lightweight, it’s essential for making everything from fighter jets and rockets to paints and plastics.

While only 5–10% of global titanium reserves go toward aerospace and metal production, the rest powers industries most people don’t even associate with metal: paper, ceramics, plastics, and more. The global titanium market is set to hit nearly $52 billion by 2030.

Russia holds about 30 titanium deposits and sees the metal as strategically vital. Yet it still relies heavily on imports, mainly from Europe, where titanium shipments continue despite efforts to sanction Moscow’s war machine.

A new production facility for seven new types of aviation titanium tubes has been launched at Russia’s Chepetsk Mechanical Plant (ChMZ), a Rosatom enterprise. ChMZ is the world’s largest and Russia’s only producer of zirconium and its alloy.

Russia is significantly increasing the workforce in its metallurgy and engine production industries.

— Patricia Marins (@pati_marins64) August 5, 2023

During the last 15 months, both Barnaultransmash and Chepetsk Mechanical Plant have hired over 2,000 workers.

In particular, Barnaultransmash has announced an 80% increase in… pic.twitter.com/dhCgTP7jJR

Since Russia’s 2014 invasion of Ukraine, ChMZ has been supplying pipes and titanium alloys to the Russian military factories, including companies involved in constructing Russian warships and those producing gas turbine engines used in aviation, including military aircraft.

The plant has received multiple weapon-related licenses:

2015: License to produce and sell weapons and military equipment

2021: License to use nuclear materials for military purposes, including weapons

2023: License to design and manufacture equipment for nuclear facilities, radiation sources, radioactive substances, and more.

While the world is discussing sanctions and restrictions against the Russian military-industrial complex, one of the largest Russian factories producing zirconium and its alloy is still out of the West’s sight.

Statewatch think tank

ChMZ has a German front company Hermith GmbH, and a Turkish front company, Ti̇tan 2 Ic İçtaş İnşaat Anoni̇m Şi̇rketi̇, an investigation by Trap Aggressor revealed. Titan 2 exports critical raw materials to Western companies.

In 2017, a delegation from Germany, led by Bavarian Prime Minister Horst Seehofer, signed a long-term contract with ChMZ and Hermith GmbH to supply more than 1,000 tons of titanium products to Europe.

ChMZ and its CEO, Sergey Chineikin, are only sanctioned by one country—Ukraine.

Both companies operate under ownership structures designed to help Russia evade sanctions, retain access to Western markets, and funnel titanium into weapons production, ultimately sustaining its military aggression.

How Russia turns titanium into weapons of war

50% of Russia’s modern fighter jets are made with titanium, and two main players in the industry are state-owned corporations, Rosatom and Rostec. Trap Agressor investigated key titanium parts of some of Russia’s most brutal weapons used to strike Ukraine.

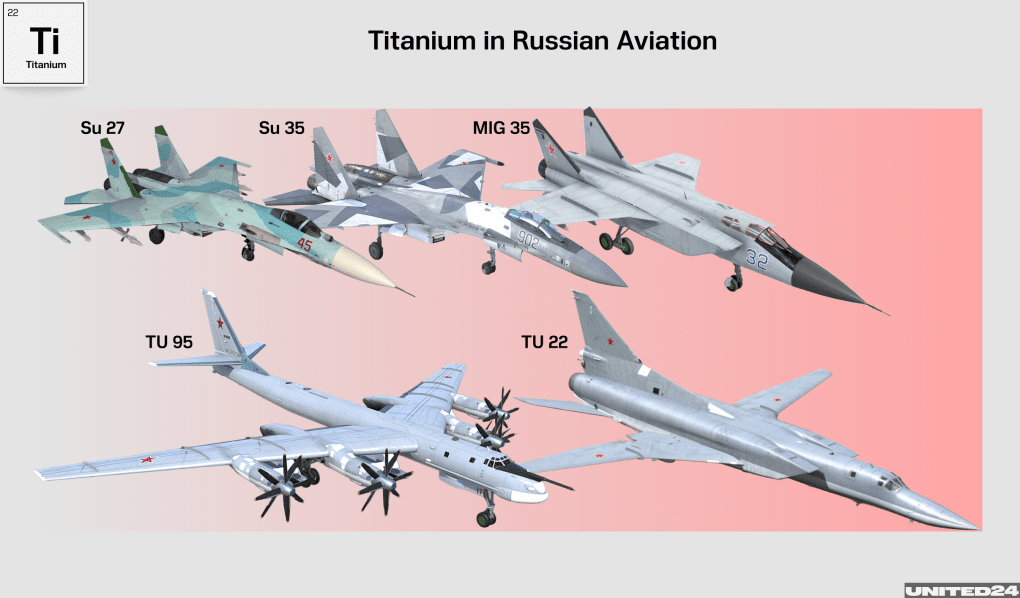

Aviation

Modern aircraft such as the Su-35 use about 50% of titanium products. Jet components are also made exclusively of titanium, such as parts for the Su-27, Su-35, Tu-95, and Tu-223 fighter jet engines, along with MiG-31 aircraft engines.

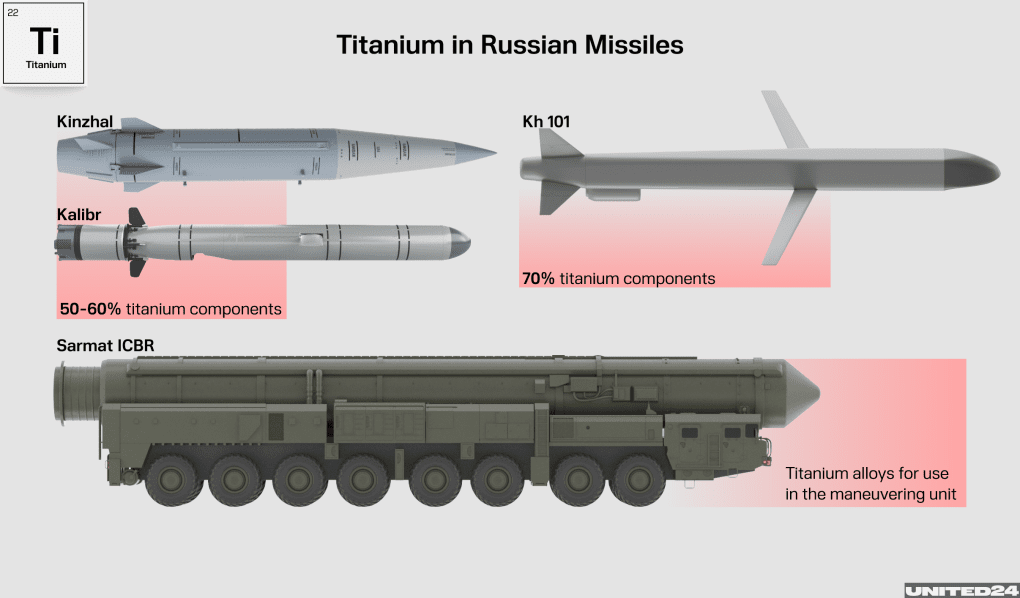

Missiles and missile systems

All Russian missiles contain titanium parts and warheads of missiles are made of titanium alloy ingots.

The Kalibr and Kinzhal missiles contain 50-60% titanium

Kh-101 contains about 70% titanium components

Titanium is used in its Avangard missile system

Titanium alloys for use in the maneuvering unit of the new Sarmat intercontinental missiles

Zircon hypersonic anti-ship missile

![Image showing different types of Russian missiles which uses titanium to wage its war in Ukraine. Image showing different types of Russian missiles which uses titanium to wage its war in Ukraine.]()

Image showing different types of Russian missiles which uses titanium to wage its war in Ukraine.

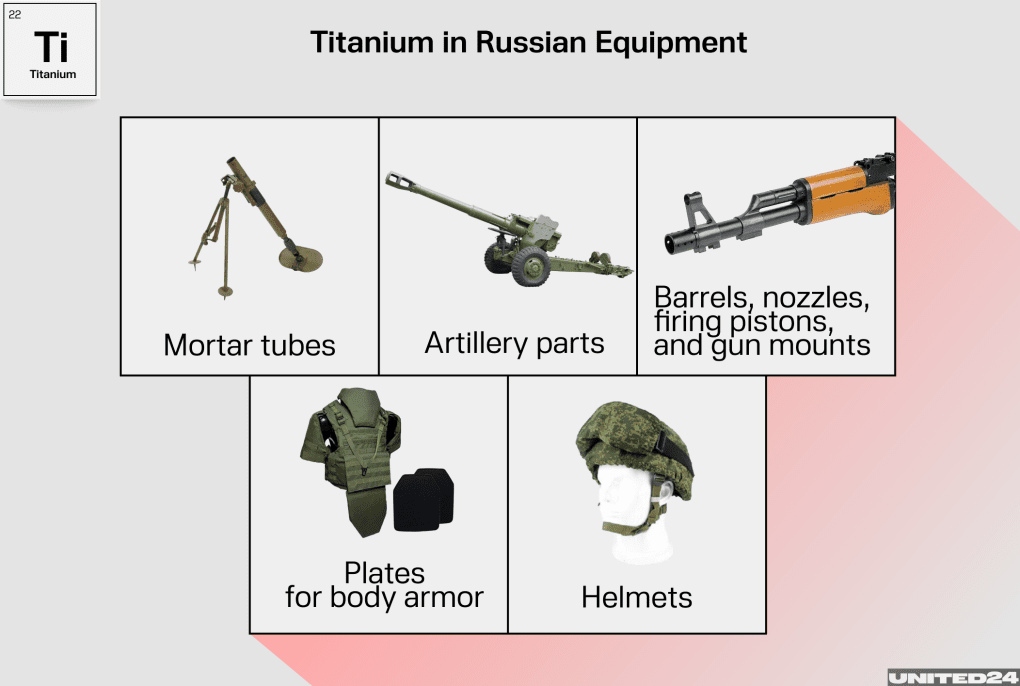

Other military-related equipment

Much of Russia’s military equipment needs titanium.

Mortar tubes

Parts for artillery systems

Barrels, nozzles, firing pistons, and gun mounts

Plates for body armor, protective clothing, and helmets.

Titanium chloride plays a key role in creating battlefield smoke screens—delivered via grenades, mines, shells, bombs, and specialized smoke-generating gear.

Who is still selling Russia titanium?

Countries worldwide, including several from Europe, continue to supply Russia with titanium. In 2022, the West imported $365 million worth of Russian titanium, most of it for aircraft manufacturers, Airbus and Boeing, according to reports. From January to July 2024 alone, the following amount of titanium was imported into Russia;

Country | $ amount imported | % total imports |

|---|---|---|

China | $65,344,615.37 | 51.95% |

India | $10,595,882.45 | 8.42% |

Vietnam | $8,979,675.90 | 7.14% |

EU | $5,609,529.32 | 4.46% |

Türkiye | $3,706,195.34 | 2.95% |

Denmark | $3,673,696.38 | 2.92% |

Germany | $3,581,322.79 | 2.85% |

Spain | $3,355,239.94 | 2.67% |

Sweden | $2,693,051.37 | 2.14% |

US | $2,586,106.53 | 2.06% |

Russia’s titanium imports have seen a slight decline. In 2023, Russia imported titanium products worth $436,556,195, compared to $522,154,239 in 2022, Trap Agressor reported. They suggest that the decline could be due to Russia’s domestic extraction increase, foreign suppliers seeking to avoid potential sanctions and reputational risks, or even gray exports.

However, even though it seems to be in decline, exports and imports continue, as does Russia’s war in Ukraine.

Could Uzbekistan supply Russia’s titanium next?

Large reserves of minerals, including titanium, estimated to be worth $3 trillion, were found in Uzbekistan, President Shavkat Mirziyoyev announced in June.

Uzbekistan already supplies Russia with cotton pulp, a key ingredient to its missiles that continue to strike civilian infrastructure in Ukraine.

Titanium is also the key to keeping Russia’s war machine running. While it's not yet reported that Russia will be importing titanium from the country, considering its current cooperation on cotton pulp, cooperation in this field is likely.

The Russian titanium giant that the West still won’t sanction

There is no comprehensive sanctions regime targeting titanium and its related products in trade with Russia, aside from a few restrictions on specific companies, allowing Russia to expand its military complex and nuclear sector.

Russian company, VSMPO-Avisma, is the world’s largest titanium producer with a significant presence in the aviation industry. It’s the only company in the world that carries out a full production cycle from raw material processing to manufacture.

The European Union blocked a proposal to sanction VSMPO in 2022 at the last minute, citing Airbus ’, reliance on the Russian supplier. Airbus is partly owned by France, Germany, and Spain.

The same year, Boeing Co., one of the world's largest aviation companies, suspended its contract with VSMPO, while Airbus continued its own.

Why are critical raw materials not banned? Because they are critical, right. Let’s be honest.

The EU’s special envoy for sanctions

VSMPO is thought to have supplied up to a third of the global aviation sector before Russia’s full-scale invasion of Ukraine in 2022, Reuters reported.

VSMPO is also the largest supplier for Russia’s military-industrial complex. Trap Aggressor says it supplies to the following companies;

PJSC Strela - manufactures components and assemblies for Yak-130 trainer aircraft, MiG-29, Su-30, Su-35 fighters, Su-34 bombers, latest generation T-50 fighters, Sukhoi Superjet & UAVs

JSC Tupolev - a subsidiary of the Russian Defence Industry Corporation, designer and manufacturer of strategic bombers and long-range aircraft

PJSC Amur Shipyard - a state-owned enterprise that designs and builds most of Russia's warships

FSUE ‘Russian Federal Nuclear Centre’ - a state-owned research and production enterprise maintaining the reliability and safety of Russia's nuclear weapons.

Ukraine is the only country to fully sanction VSMPO. Canada sanctioned the supplier, but France’s aerospace giant, Safran, used to source about half of its titanium needs from VSMPO, and lobbied for the waivers. French President Macron convinced Canadian Prime Minister Justin Trudeau to allow a waiver for Airbus and Safran to keep buying from Russia.

The US has some export controls, and the UK has no ban on VSMPO but includes it in wider metals sanctions.

The UK and the US prohibited in 2024 the exchange of other metals produced by Russia, such as aluminum, copper, and nickel. The US also encouraged its G7 allies to consider imposing sanctions on Russian palladium and titanium, but as of early July 2025, the sanctions have yet to be imposed.

We’ve had enough time to react. The annexation of Crimea dates back to 2014, the invasion of Georgia even dates back to 2008 15 years ago! And what have we done? We’ve increased our dependence on Russia. It was an absolute and serious mistake.

Transparency International

Titanium is vital for the European and US markets, especially in the aviation industry, and restricting its supply could drive up prices globally. After the UK and the US sanctioned Russian aluminium, nickel, and copper in April 2024, prices surged, but dropped slightly not long after.

These metals are more easily substituted with a variety of materials, such as plastic, steel, and carbon fibre. Substituting titanium is difficult, but not impossible. Due to strict aerospace quality controls, new materials must be audited and tested, which could take years to reach certification for use.

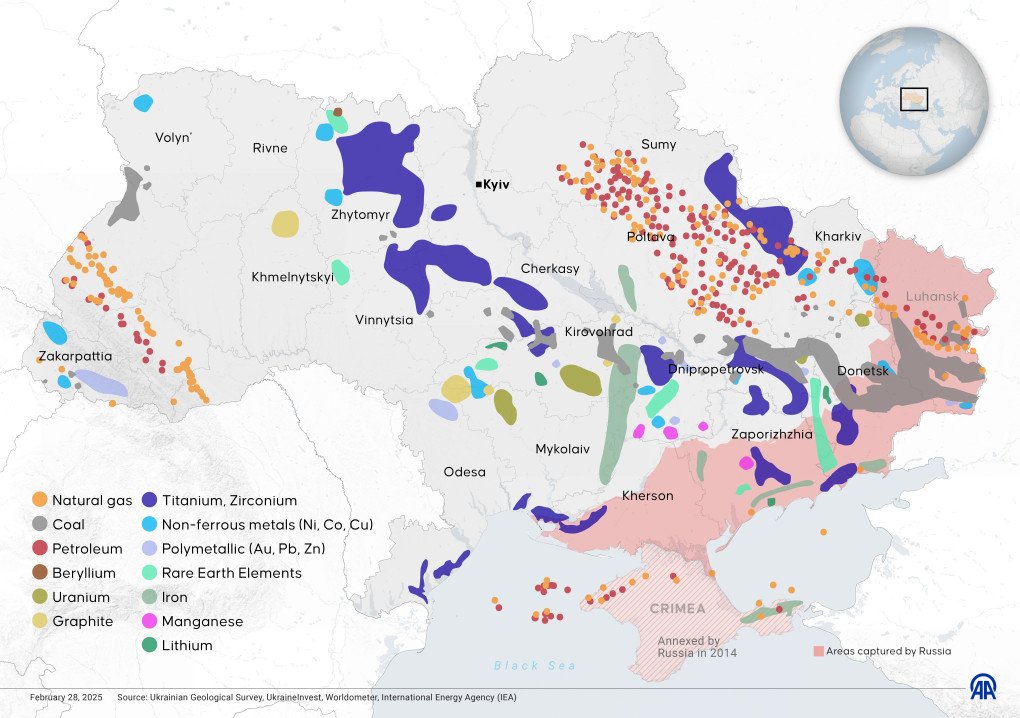

Europe has no domestic titanium sponge production, minimal ingot capacity, and almost no recycling infrastructure. However, Ukraine, the 11th biggest titanium producer in the world, could emerge as a future supplier for Europe.

Ukraine’s untapped titanium reserves

Ukraine has around five percent of global mineral resources and could possess as much as 20%, around 185 million tonnes, of the world’s titanium reserves. 65 million tonnes in the Zhytomyr region alone.

This potentially makes Ukraine a major global player in the extraction of this critical strategic metal, and one of the only European countries, including Norway, capable of producing it.

The Russians have always claimed we have just 1%, which is simply not true. The truth is, their best titanium deposit is worse than an average one of ours.

Head of the Mineral Resources Department at Ukraine’s National Academy of Sciences

Earlier, Ukraine and the US signed a landmark minerals agreement, opening the door for American investment in Ukraine’s vast untapped reserves. The deal covers 57 critical minerals—including titanium—and includes the creation of a joint investment fund aimed at accelerating Ukraine’s post-war reconstruction.

Ukraine will retain full ownership and control over its natural resources, including those within its territorial waters.

The newly created investment fund will operate as a 50/50 partnership between Kyiv and Washington, with both sides jointly selecting priority projects.

Its focus spans the extraction of critical minerals, oil and gas development, and the expansion of infrastructure and processing facilities. Revenues generated in the first decade will be reinvested directly into Ukraine’s economic recovery and industrial future.

The partnership is built on mutual benefit and equal partnership. It is designed to support Ukraine’s long-term recovery, security, and economic growth while opening new business and investment opportunities for US companies.

Ukraine has a unique opportunity to become not just a trusted ally and a model of post-war renewal, but a cornerstone of the global democratic titanium supply chain. This could cut off the flow of Russia’s titanium, stalling weapons production and diverting profits from companies fuelling its war.

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-347244f3d277553dbd8929da636a6354.jpg)

-f88628fa403b11af0b72ec7b062ce954.jpeg)

-554f0711f15a880af68b2550a739eee4.jpg)