- Category

- War in Ukraine

Russia Keeps Freely Importing Chromium, Powering Artillery That Kills Soldiers and Civilians in Ukraine

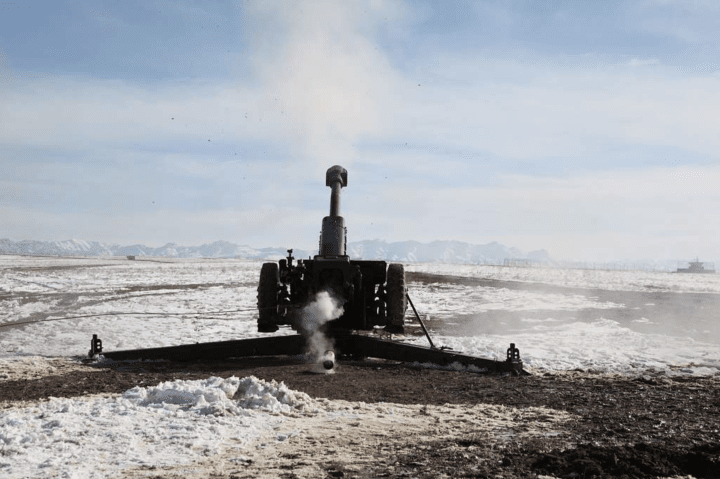

More than half of Ukraine’s casualties have been caused by Russian artillery, which relies on a crucial yet unsanctioned resource: chromium. It continues to be freely supplied to Russia, even from within the EU.

Most of Russia’s artillery barrels date back to the Soviet era, and chromium is essential for extending their lifespan. Despite its critical role in Russia’s war effort, chromium remains untouched by Western sanctions, allowing shipments to flow unimpeded into Russia—fueling the artillery responsible for devastating both Ukrainian forces and civilians.

Why is chromium critically important for the Russian military-industrial complex?

Chromium is a metal valued for its high corrosion resistance and hardness, making it a key material in Russian weapons manufacturing. Russian military enterprises rely on unsanctioned chromium for producing, maintaining, and modernizing artillery, particularly gun barrels.

Chromium plating on artillery barrels reduces the damaging effects of gunpowder combustion, significantly extending their lifespan—by 2.5 to 3 times. This is crucial for Russia, given the intensity of its artillery operations on the front lines. Chromium is used not only in newly manufactured artillery barrels but also in modernizing Cold War-era howitzers and repairing battlefield-damaged barrels.

What type of chromium does Russia need?

The main chromium products directly or indirectly involved in the production, maintenance, and modernization of Russian artillery include:

Chromite—chromium ore that is mined and then processed into pure chromium.

Pure chromium—the only material that can be used for chromium plating on artillery barrels.

Chromium compounds—combinations of chromium with other materials used for alloying steel, including ferrochrome and chromium oxides.

Alloyed steel—steel containing not only natural impurities but also specially added alloying elements (including chromium), used in artillery barrel production.

Of these materials, Russia is most reliant on external supplies of chromite ore, with 55% of its consumption coming from imports. Despite having some of the world’s largest chromium reserves, only 11 out of 22 deposits are currently being developed, accounting for just 13.3% of Russia’s total reserves. Russian ore is of lower quality compared to imported ore due to its low chromium content and is typically not used in weapons production.

Russia’s massive chromium consumption

Russia's demand for chromium reached 1.47 million tons per year in 2020, with a projected increase to 1.6 million tons by 2025 and 1.73 million tons by 2030, according to Russian sources.

Given Russia’s full-scale invasion of Ukraine, it is likely that demand for these materials has increased even further.

Providing precise data on the import of chromite ore, chromium, chromium compounds, and alloyed chromium-containing steel since the start of Russia’s full-scale invasion of Ukraine is nearly impossible, as Russia has been actively concealing information on these imports.

Data available to UNITED24 Media shows that the total volume of imported ore, chromium, and related products in 2023 amounted to at least 76,400 tons, valued at nearly $70 million. However, considering the actual need for imports (which accounts for 55% of Russia’s total requirement of 1.47 million tons per year), the real import volume could be up to ten times higher, potentially reaching at least 800,000 tons.

The low import figures found in customs databases are attributed by a UNITED24 Media source to the inability to analyze supplies from Kazakhstan. Kazakhstan, with its significant reserves and extraction capabilities (around 5 million tons of chromium ore per year from 2018 to 2022), is likely a key exporter of chromium to Russia. Kazakhstan also operates within a single customs space with Russia, making it impossible to analyze customs data that would indicate the supply of such products.

Russia’s top chromium supplier and producer is deeply tied to the military-industrial complex

A large portion of Russia’s imported chromite ore can also be explained by the fact that Russia can process it domestically. The leading producer and supplier of chromium products, Polema JSC metal powders production company, plays a key role in this, with strong ties to the Russian military-industrial complex.

Based on data from the Russian public procurement portal, from 2015 to 2018, Polema supplied pure chromium and compounds worth 400 million rubles ($4.1 million) to Russian military enterprises, including manufacturers of naval missiles, firearms, artillery, air defense systems, as well as the "Iskander" and "Tochka-U" systems.

Subsequent contracts became classified, but the continuation of cooperation is evident through other factors. For instance, a 2021 article mentioned a collaboration between Polema and a Russian aircraft engine manufacturer, UEC Saturn.

A 2023 investigative report by the publication “Proekt” revealed multiple connections between the Polema company and various other firms tied to Russia’s military-industrial complex.

This includes the supply of tungsten parts and molybdenum rods by NII Stali JSC, which in turn provided tank casings and dynamic protection elements to the KBP Instrument Design Bureau, one of the largest enterprises in Russia’s defense industry.

Another example involves the supply of molybdenum sheet blanks produced by Polema to the Pribor JSC state corporation, named after S.S. Golembiovsky, which produces armor-piercing tracer shells ZUBR. These shells are equipped in BMD-2 tanks that were observed in Bucha during the invasion of Ukraine.

EU’s role in supplying chromium to Russia

The EU’s overall share in chromium production is small. In 2023, Russia imported chromium products worth just $439,129 from Germany, Italy, the Netherlands, France, Slovenia, Finland, and Belgium. However, EU countries still rank among the top suppliers of chromium to Russia.

The Netherlands has emerged as the second-largest source of chromium shipments to Russia, acting as a re-export hub. In 2023, the Netherlands re-exported around $18 million worth of chromite ore, primarily mined in South Africa, along with a smaller portion from Pakistan. Bulgaria was also a key re-exporter, shipping chromium-containing materials worth $1.7 million to Russia. Seven other EU member states contributed to the total supply, amounting to $1 million.

The largest supplier of chromium-containing products to Russia in 2023 was the European entity EK Company AG, based in Germany. Owning chromium mines in South Africa, it supplied chromite to Russia valued at $18.3 million. EK Company AG also has a Russian subsidiary that, between 2016 and 2017, fulfilled contracts for Uralvagonzavod, a key Russian defense enterprise.

Actions to take

“Before the full-scale invasion, Russia was described as an artillery army with many tanks,” said Denys Hutyk, Executive Director of the Economic Security Council of Ukraine (ESCU), a Kyiv-based organization that investigates Russia's dependence on imported raw materials. “In 2023, 70% of Ukraine's casualties were caused by Russian artillery.”

Despite this, Moscow's access to chromium, critical for the durability of Russian artillery pieces, remains relatively overlooked by Western partners. In 2023, chromium was actively re-exported through European ports, with a German company among the largest suppliers of chromium to Russia.

“The dependence of the Russian defense industry on imports of critical minerals and raw materials, including chromium, should be utilized by the sanctions coalition as a tool to undermine Russia's military capabilities,” said Hutyk.

There are several urgent steps that EU member states can take to curb Russia’s continued access to chromium, the ESCU experts say, including:

Prohibit European entities from exporting and re-exporting key chromium-containing products to Russia, as well as directly or indirectly facilitating such exports or re-exports.

Expand the Common High Priority List (CHPL) by adding relevant HS codes for chromium-containing products.

Impose EU sanctions on all foreign and Russian entities involved in supplying key chromium-containing products to Russia’s sanctioned military enterprises.

Impose EU sanctions on all Russian producers of chromium-containing products.

Investigate the supplies of chromium by the German company EK Company AG and its Russian subsidiary.

Take necessary diplomatic measures to reduce exports of key chromium-containing products to Russia from Kazakhstan and South Africa.

-206008aed5f329e86c52788e3e423f23.jpg)

-554f0711f15a880af68b2550a739eee4.jpg)

-ca1a63b87c648c14784932e034e42964.jpg)

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)