- Category

- War in Ukraine

Russian Railways Spiral Into $45 Billion Debt Amid Freight Collapse

Once the iron artery of Russia’s economy, the state-run railway giant is now bleeding billions in debt, hemorrhaging freight volumes, and dragging industrial towns down with it.

The debt of the state-owned Russian company Russian Railways (RZD) has grown to 4 trillion rubles ($45 billion). To stabilize the company, the state urgently needs to allocate 1.3 trillion rubles, or more than $10 billion. This is unfolding against the backdrop of a deep crisis in one of RZD’s most profitable segments—freight transportation.

We bring you stories from the ground. Your support keeps our team in the field.

Railways are also the main transportation artery for the Russian army. Throughout its history, Moscow has used rail as a primary means of delivering supplies to the front. This is why Russia built a railway along the land corridor to Crimea and why it prioritizes the capture of railway hubs in Ukrainian territory.

At the same time, rail transport is critical for Russia’s civilian industry. The country’s vast geography makes rail the only viable option for moving goods over long distances. This includes, for example, coal, which is delivered to ports almost exclusively by rail. In sum, the railway sector is one of the key indicators of the health of Russia’s non-military economy—and it is in poor shape.

Declining utilization

Almost immediately after the start of the full-scale war, utilization of Russia’s rail network began to decline. The initial drivers were sanctions and the exit of Western businesses from Russia. This was followed by reduced demand for certain Russian resources, such as coal and oil, which in some regions had also been transported to ports by rail tank cars.

Authorities attempted to offset the decline with military shipments, sending tanks, weapons, and artillery to the front. The latest data suggests that roughly 19,000 containers have been shipped by rail from North Korea to Russia.

However, the war did not become a lifeline for Russian railways. Broader economic problems, labor shortages, falling living standards, and stagnation have taken their toll.

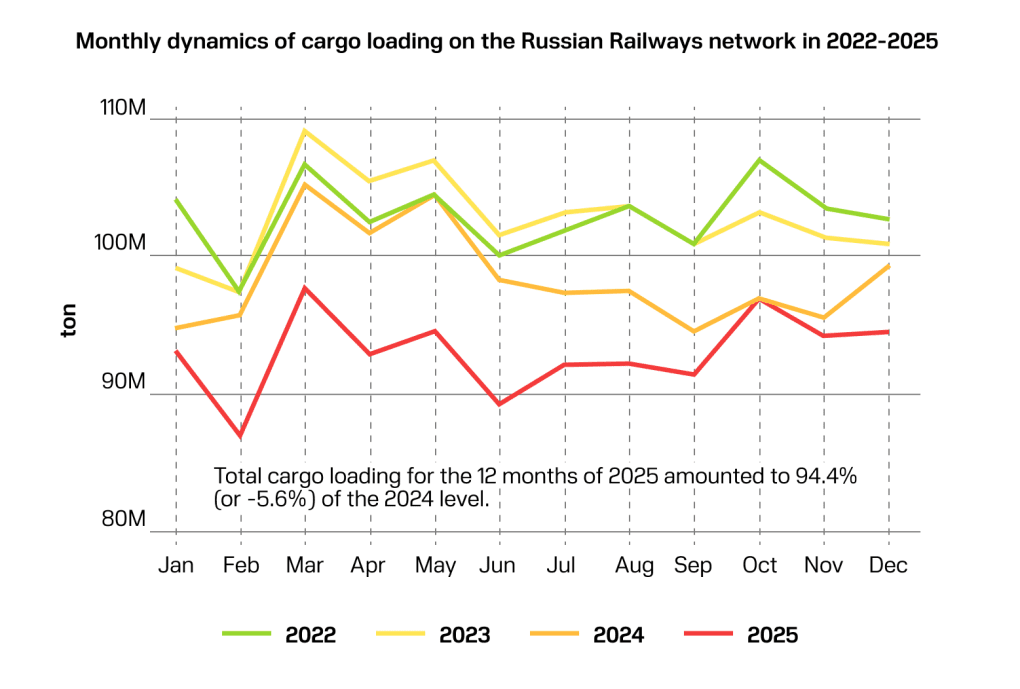

In 2025, freight volumes fell by 9.4% compared with 2024.

Since 2022, the cumulative decline has exceeded 15%.

Monthly dynamics show that, on average, each day in the first half of 2025 saw 5% fewer freight loads than in 2024.

Russia is producing less and exporting less, creating significant challenges for the country’s rail industry and dealing a severe blow to single-industry regions. We have previously written about the catastrophic decline in coal production. Coal mines and processing facilities underpin 30 mono-industrial towns, where coal enterprises form the backbone of local economies. These towns are home to 1.5 million people. Up to 225,000 people work directly in mines and plants, with another 500,000 employed in related sectors. Exports to other countries have already fallen by a quarter. As a result, the railway sector—one link in the logistics chain for this raw material—is also suffering.

A challenge for RZD

Russia’s rail monopoly RZD is in extremely poor financial condition. Over four years of the full-scale war, the company’s debt has surged from 1.5 trillion rubles to nearly 4 trillion rubles (from $11 billion to $45 billion). Net profit for the first nine months of 2025 fell by a factor of four.

The state’s main objective now is to prevent the company from sliding into a debt crisis so deep that recovery would be extremely difficult. Authorities are cutting back the investment program, seeking ways to optimize costs, and launching initiatives to reduce the debt burden—effectively shifting it onto banks.

The workforce will also be affected. In 2026, wages are slated to be indexed by just 0.1% against inflation of around 10%. Some employees will be transferred from Moscow to regions with lower pay levels. At the same time, tariffs for transportation services were raised earlier than originally planned in an effort to boost revenue.

Notably, RZD is even considering selling its office tower in the prestigious Moscow City district, which it purchased only last year for 170 billion rubles—around $2 billion. The sale would be at a loss, but it would provide access to at least some liquidity. The company also plans to sell railcars and other infrastructure assets.

At the same time, the government is demanding that top management increase freight volumes, even though this is impossible under current conditions: to transport goods, something has to be produced.

Sanctions pressure—one of the key drivers behind RZD’s predicament—is having a tangible impact. More than 850,000 company employees will not receive a pay raise in 2026, while prices are set to rise by at least 10%, if not more. The economic growth touted by the Kremlin is a fiction with no real foundation.

-7f54d6f9a1e9b10de9b3e7ee663a18d9.png)

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-347244f3d277553dbd8929da636a6354.jpg)

-f88628fa403b11af0b72ec7b062ce954.jpeg)

-554f0711f15a880af68b2550a739eee4.jpg)