- Category

- War in Ukraine

Are Sanctions Working? Russia’s Oil Revenue Collapse Says It All

Russia’s war machine is losing fuel—literally. Oil revenues have cratered, sanctions are tightening the noose, and unsold tankers drift aimlessly at sea.

Russia’s oil and gas revenues are set to fall to their lowest level since 2020.

We bring you stories from the ground. Your support keeps our team in the field.

For Russia, oil is the primary source of state revenue. Oil and gas revenue accounts for up to 40% of the federal budget and is the main source of funding for the war. Starting in the fall of 2025, Russia’s so-called “war chest” will be hit by several factors:

a sharp reduction in oil shipment volumes;

a prolonged decline in prices;

US sanctions;

and, for some time now, Ukrainian drone strikes on Russian oil infrastructure.

Plummet to pandemic lows

Russia’s oil and gas revenues in December are expected to be almost halved compared to December 2024. This would mark the lowest level since August 2020, when energy sales plunged due to the COVID-19 pandemic. In monthly terms, Russia is expected to earn around $5 billion (410 billion rubles) from oil exports, with weekly revenues of just over $1 billion.

The decline began in the fall:

By the end of September, Russia’s oil and gas revenues were down 32% year-on-year.

In October, they fell by 26.6% compared to 2024.

In November, the drop reached 33.87% year-on-year.

As a result, by the end of the year, Russia is expected to receive around 8.44 trillion rubles, or just over $90 billion, from oil and gas—far below the roughly $130 billion originally projected by Russia’s Ministry of Finance.

Russia is being squeezed by several factors simultaneously. On one hand, the financial system is attempting to maintain a strong ruble to project an image of stability. On the other, the price of Russia’s Urals crude has fallen to around $40 per barrel—its lowest level since the start of the full-scale invasion. Over the past three months alone, Urals prices have dropped by 28%.

Additional pressure has come from US sanctions on Rosneft and Lukoil—the largest state-owned and private oil companies in Russia. Both have faced extensive restrictions, significantly complicating their operations in international markets. It is estimated that these two companies alone are losing up to $5 billion per month.

A drifting shadow fleet

In an attempt to restore hard-currency inflows, Moscow has increased oil shipments despite falling prices. Since August, the volume of oil loaded onto seaborne tankers has risen by 28%. However, sanctions have made it more difficult to find buyers. As a result, tankers carrying Russian oil are often unable to offload their cargo, which further depresses prices.

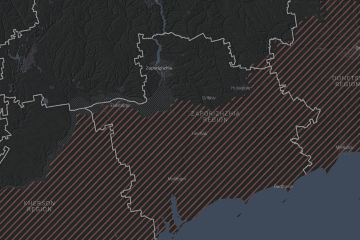

The problem is multifaceted. Shadow-fleet tankers are increasingly forced to depart from Baltic Sea ports, as the Black Sea has become too dangerous. This significantly lengthens voyages to India or China. Compounding the issue is the difficulty of securing buyers: under sanctions pressure, many countries are reluctant to confirm purchases of Russian oil, and tankers often head out to sea without confirmed destinations.

As a result, nearly 180 million barrels of Russian crude are currently afloat at sea—28% more than at the end of August. The volume of oil remaining at sea has increased by 40% since late August, and at least 20 tankers loaded at western Russian ports in September–October have yet to deliver their cargoes.

Problems are expected to become critical starting in early 2026, as India and China may further reduce their purchases of Russian oil.

Ukraine’s deep strikes

Ukraine has also inflicted significant damage on Russia’s oil industry. Over just three autumn months, at least 50 strikes were carried out against Russian refineries and related infrastructure. Since December 2025, Ukraine has intensified its attacks, reaching the Caspian Sea for the first time and striking port oil infrastructure in Russian Black Sea ports.

A refinery in the Yaroslavl region—one of the country’s largest, with a processing capacity of up to 15 million tons per year—was also hit.

These strikes reduce refining capacity and complicate Russia’s ability to export refined petroleum products. At one point during the summer, the Kremlin even banned gasoline exports due to domestic shortages.

The Kremlin is well aware of the situation with oil revenues and the looming need to find alternative sources of funding for the war. All non-military areas of budget spending are expected to suffer. This is an important signal: Russia can be pushed toward negotiations through sanctions pressure that is already yielding results. What matters now is increasing sanctions and ensuring they strike at Russia’s core resource—oil.

-29ed98e0f248ee005bb84bfbf7f30adf.jpg)

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-0666d38c3abb51dc66be9ab82b971e20.jpg)

-35249c104385ca158fb62273fbd31476.jpg)

-554f0711f15a880af68b2550a739eee4.jpg)