- Category

- War in Ukraine

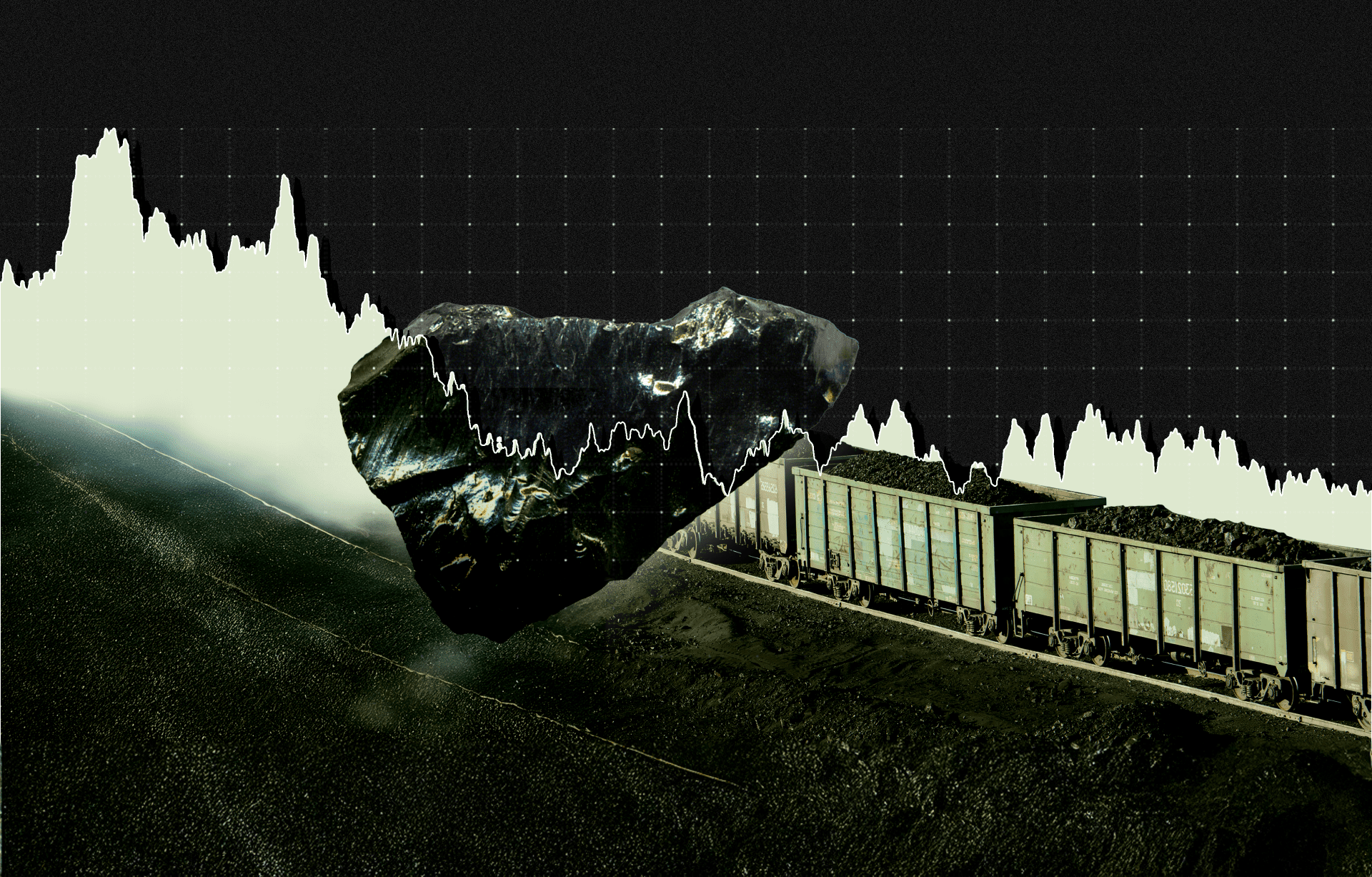

Russia’s Coal Industry Is in Deep Crisis: A Case Study on the Impact of Sanctions

Russia’s coal sector teeters on the brink, with losses approaching $1 billion in the first three quarters of 2024 and fewer than half of its enterprises remaining profitable.

As 2024 ends and 2025 begins, the Russian government faces a major problem: how to save its dying coal industry. With half the companies operating at a loss and no clear solutions in sight, officials are scrambling to avert a social fallout. Plans are already underway to manage bankruptcies, with the state corporation VEB.RF poised to take control of failing assets.

For Russia, the coal industry’s crisis is a significant test. Approximately 30 single-industry towns depend on coal mining and processing as their lifeline. These towns are home to 1.5 million people. In total, around 225,000 people work directly in coal mining and processing plants, while another 500,000 are employed in related industries.

Nearly all standalone companies operating outside major coal holdings are running at a loss. Currently, 52% of the enterprises in the sector are unprofitable. The driving forces behind this shift for Russia—traditionally a profitable coal exporter—a country historically reliant on coal exports—are sanctions and its failure to effectively pivot its economy eastward.

Sanctions

Following the start of Russia’s full-scale invasion of Ukraine, Europe implemented several rounds of sanctions. The fifth sanctions package, announced on April 8, 2022, included a ban on coal imports from Russia, which took effect in August 2022. This dealt a severe blow to Russia, as Europe and Japan were among its largest coal buyers. In 2021, Russia exported 51.6 million metric tons of coal to Europe alone. By 2022, this market had vanished.

Russia turned to Asia for salvation, targeting markets in China and India. However, the results have been disappointing. India has gradually reduced its coal imports from Russia due to sanctions. China, while maintaining a high demand for coal, has diversified its suppliers, working with Australia, Mongolia, and Indonesia instead of increasing imports from Russia.

Although the industry managed to stay afloat in 2022–2023, the situation became untenable by 2024.

Exports fell across major markets:

China: Down 8%

Türkiye: Down 47%

India: Down 55%

Japan: Down ninefold

Russia’s overall coal exports to all countries also continue to decline:

2021: 223 million tons

2022: 210 million tons

2023: 213 million tons

2024: 195 million tons

2025 (forecast): 180 million tons

The profitability of Russia’s coal enterprises has plummeted fifteenfold as a result, and revenues have sharply declined. The industry’s total losses for the first nine months of 2024 reached nearly $1 billion, with no resolution in sight.

A perfect storm

The crisis in Russia’s coal industry exemplifies the effectiveness of European sanctions. Beyond the refusal to buy Russian coal, the consequences have rippled through the sector.

To find new buyers in Asia, Russia had to reorient its entire logistics system to the East. Russian Railways was ill-equipped for this shift, facing shortages of railcars and inadequate infrastructure. The average speed of freight trains has dropped dramatically. Other exporters competing for the same rail routes, combined with military transport demands, have exacerbated logistical bottlenecks. Coal transport has become slower, costlier, and less efficient, further reducing profitability.

Several other factors have worsened the situation:

China’s green transition: China, Russia’s largest coal buyer, has been working for years to reduce its reliance on coal-fired power plants as part of a broader green energy transition. Other Asian countries are following suit.

Falling coal prices: Coal prices have dropped to a seven-year low, further squeezing profit margins.

Sanction-related payment issues: Russian companies face frequent delays in payments and a shrinking customer base as potential buyers fear secondary sanctions.

What’s next for Russia’s coal industry?

To survive, companies must shift focus, working more closely with buyers and prioritizing the development of new coal deposits over maintaining aging ones. However, the economic fallout is already hitting Russia’s regions. Declining revenues have slashed local budgets, crippling their ability to fund essential services, and forcing the federal government to bear the burden—already stretched thin with over a third of its income directed toward the war.

Experts predict the situation will reach a critical point in 2025. Over the next five years, only companies producing higher-value coking coal and those integrated into large holdings are expected to remain on the market. Entire regions of Russia are set to face economic decline.

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-0666d38c3abb51dc66be9ab82b971e20.jpg)