- Category

- Business

How $1.1M in Banned Bearings from Slovak Firm Kinex Slipped Into Russia’s War Arsenal

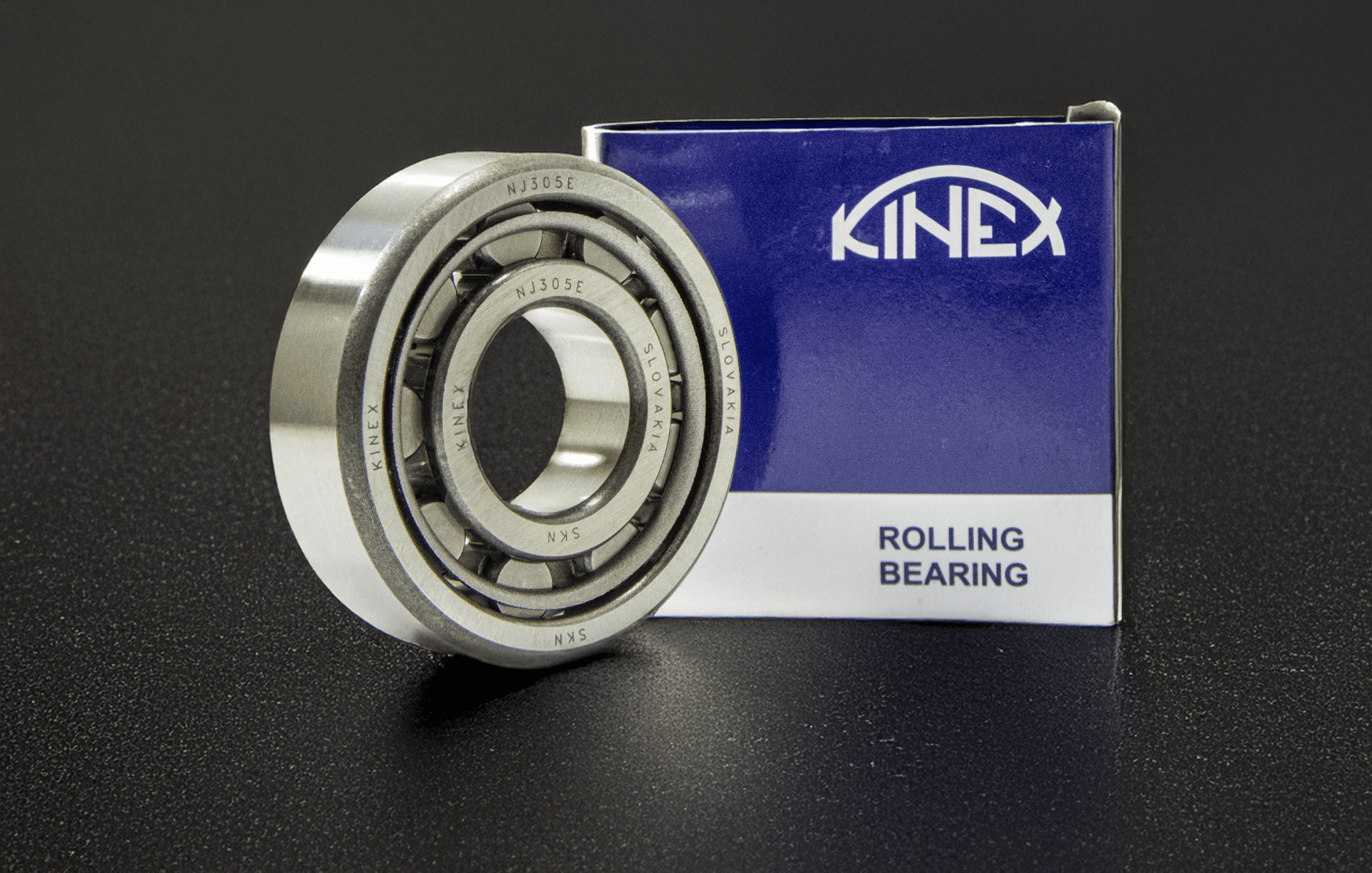

Despite an EU embargo on exporting ball and roller bearings to Russia—components small enough to fit in a palm, yet essential for keeping drones airborne and missiles on target—the Slovak firm Kinex Bearings shipped over $1.1 million worth to its Russian subsidiary in 2024.

The Slovak company Kinex Bearings A.S. exported over $1.1 million worth of ball and roller bearings in 2024 to its Russian subsidiary, Kinex Rus LLC, facilitated by Turkish intermediaries.

The shipments took place on January 9, February 15, June 3, and June 4, according to customs data obtained by UNITED24 Media, despite European Union sanctions banning the export of these types of bearings to Russia due to their potential dual-use.

Why are bearings critical for Russia?

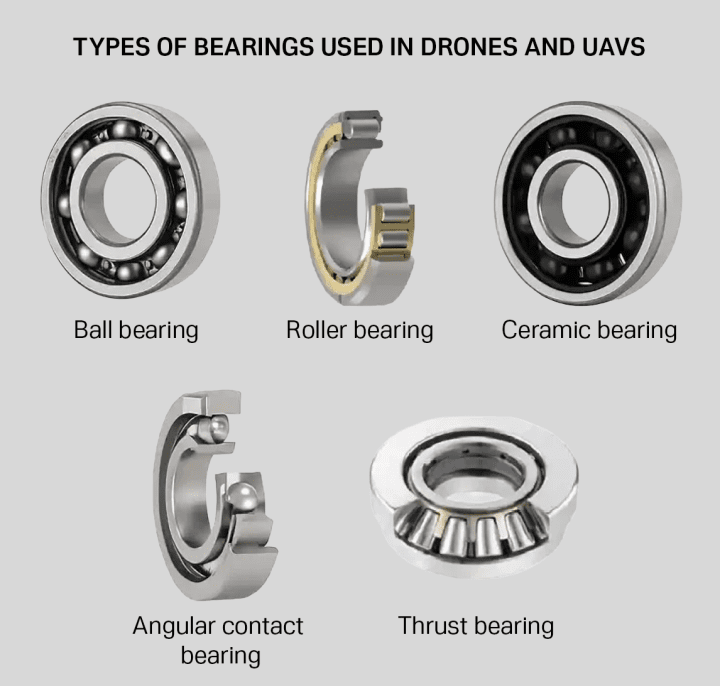

Under EU law, the export of ball and roller bearings to Russia is explicitly prohibited. The ban falls under EU Council Regulation and targets a range of bearings categorized under CN codes from basic ball bearings to more specialized tapered and cylindrical variants.

High-quality bearings are vital for tanks, armored personnel carriers, missiles, and drones—they reduce friction and wear. Poor-quality bearings cause failures in wheels, suspension damage, transmission failures, brake malfunctions, and engine overheating.

The importance of these components is well understood in the defense industry. Bearings have been included in the Common High Priority Items List , and contains several bearing types categorized under the following codes:

8482.10 (ball bearings)

8482.20 (tapered roller bearings, including cone and roller assemblies)

8482.30 (spherical roller bearings)

8482.50 (other cylindrical roller bearings, including cage and roller assemblies).

Linked to Russian Imports Through Türkiye

Kinex Bearings, headquartered in Bytča, Slovakia, is a long-established manufacturer of precision bearings used in rail, automotive, and machinery sectors. Part of CKA Birla Group—an Indian conglomerate with an annual revenue of $2.3 billion USD, its Russian subsidiary, Kinex Rus, is tasked with distributing these products domestically. Trade data shows that in 2023 alone, Kinex Rus imported over $3.4 million worth of bearings from Slovakia, and China, including a December shipment of over 19 tons of radial roller bearings via Türkiye.

The Polish Centre for Eastern Studies (OSW) report Finding our bearings: tracking circumvention of EU dual-use sanctions on Russia. Türkiye—as an established manufacturing hub—imported bearings before the war, the Russian invasion caused a significant uptick in demand, correlated with EU sanction rounds,” the report says.

Though the EU’s sanctions are clear, enforcement has become increasingly complicated as Russia reroutes supply chains through third countries. The European Commission has repeatedly warned that transit states used to bypass sanctions will be monitored closely.

“The EU, together with the US, UK, and Japan, have agreed on a common high priority list of items,” said Olof Gill, European Commission spokesperson for financial services and trade. “We have urged third countries to ban the re-export of those goods to Russia as they are almost certainly going to be used by the Russian military on the battlefield in Ukraine.”

Public trade records suggest Kinex Rus also re-exports bearings back to Slovakia, signaling a two-way commercial relationship despite growing pressure to curtail sanctioned items. The revelations come amid broader scrutiny of European companies whose products continue to appear in Russian military and industrial supply chains frequently through indirect channels.

While Kinex Bearings has not commented publicly on the shipments, its role as a critical supplier of high-precision bearings, components essential for everything from rail cars to drones—has placed it at the center of a widening debate about economic leakage and sanction enforcement.

Known for its rolling bearings, the company exports to more than 80 countries and generates roughly €60 million in annual revenue. A single Kinex miniature bearing sells for about $0.65, it’s a tiny component that adds up quickly in FPV drones, which can carry anywhere from 12 to 50 apiece.

A Critical Weak Point in Russia’s Military Supply Chain

After the full-scale invasion of Ukraine, groups such as the UK’s Conflict Armament Research began autopsying captured or destroyed Russian tanks, trucks, drones, and missiles. Inside these weapons they found a mix of Russian, Western, and Asian bearings, some of them clearly marked with Western logos and part numbers.

Bearings are a choke point in Russia’s micro-industrial battlefield because they are used in most weapons, and bad quality means bad weapons. A CSIS report confirmed that sanction-driven shortages of high‑end bearings did compel Russia to substitute with lower-quality versions, degrading weapons performance.

While the European Commission drafts and oversees sanctions policy, enforcement falls to individual EU member states. National customs and trade authorities—such as those in Slovakia, home to Kinex Bearings—are tasked with investigating breaches and imposing penalties, Gill told us.

Kines’s shipment of bearings to its Russian subsidiary suggests multiple red flags for sanctions circumvention: repeated exports of restricted dual-use bearings, routed through Turkish intermediaries, to a known Russian subsidiary.

If Slovak authorities determine that Kinex Bearings A.S. knowingly structured the shipments to bypass export controls, the company could face criminal charges, heavy fines, loss of export licenses, and EU-level blacklisting.

When asked whether it was aware of reported shipments from Kinex to its Russian subsidiary via Türkiye, the European Commission declined to comment on individual cases. However, it confirmed that the EU comission is monitoring circumvention patterns and has issued repeated warnings about the use of transit states like Türkiye to bypass export bans. The issue falls under the responsibility of David O’Sullivan, the EU’s Sanctions Envoy.

The Slovak Economy Ministry has declined to respond to a request for comment from UNITED24 Media.

“Everything in Russia becomes a Kalashnikov”

If Russia were to stop receiving Western bearings, its rail-dependent military infrastructure would suffer under the weight of cheap, bad-quality bearings. In August, 2022, Russia pulled 10,000 railcars out of service due to a bearing shortage, with another 20,000 likely to follow within two months. Repair shops are unable to fix them without new parts, sidelining up to 30% of the entire fleet.

The 17th package of EU sanctions now targets more dual-use items, including industrial-grade bearings. They hope to tighten licensing rules, closely track where parts actually end up, and impose what can be termed secondary sanctions, meaning penalties imposed not just on Russia but also on foreign companies or countries that help Russia evade restrictions.

This package adds non-Russian companies from China, Türkiye, the UAE, Vietnam, Uzbekistan, Serbia, Israel, and Belarus to the sanctions list for helping Russia’s military industry evade controls. These firms now face asset freezes and export bans, meaning the EU is directly targeting third countries that enable Russia’s war effort.

While Russia’s economy still shows headline growth (GDP rose about 3.6% in 2024), its own bearings and alternative imports are slowly lowering the quality of its war infrastructure across the board. MaintenanceWorld reported in 2023 that Russia is being forced to refurbish old tanks and scavenge for parts because good Western bearings are scarce.

Key sectors like rail transport and defense manufacturing are weakening: freight volumes have dropped to record lows, and spare locomotive parts are in chronic shortage.

“Everything in Russia becomes a Kalashnikov,” said a Ukrainian data analyst looking into sanction circumventions who chose to stay anonymous.

Russia has spent years developing weapons but has neglected quality engineering. It leans hard on imported, high-grade bearings, built with high-quality Western tech.

“The Russian military-industrial complex has been severely affected by almost a decade of international targeted sanctions and by the demands of the full-scale invasion of Ukraine,” Mathieu Boulège, a specialist in Eurasian security, focusing on Russian foreign policy at Chatham House, a leading UK-based think tank, said in a report published on 9 July 2024, “The current situation is untenable for Russia (…) Future Western policy pathways must therefore find innovative solutions to accelerate the OPK’s decline.”

This dependence cracks open a weak spot. When bearings fail or become unavailable, everything stops. Sanctions, if truly enforced, could throttle Russia’s war machine on the macro level.

-554f0711f15a880af68b2550a739eee4.jpg)

-270e13af43760897c8cb3e7f3ee9adf1.png)

-b63fc610dd4af1b737643522d6baf184.jpg)

-099180a164f53abb1128c9b5025a2b0e.jpg)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)

-4390b3efd5ecfe59eeed3643ea284dd2.png)