- Category

- Latest news

Why Russia’s Shahed Drone Program Cannot Survive Without China

Russia’s war effort in Ukraine has been supercharged by a shadow supply chain stretching thousands of miles east—to China.

Inside the Alabuga Special Economic Zone in Tatarstan, Russia has built sprawling factories churning out Iranian-designed Shahed-136 drones (locally renamed Geran-2), upgraded Geran-3s, and new Harpy and Gerbera models. What Moscow claims is “100% localized production” is in reality an assembly line of Chinese parts, Ukrainian OSINT project Frontelligence Insight reported on August 21.

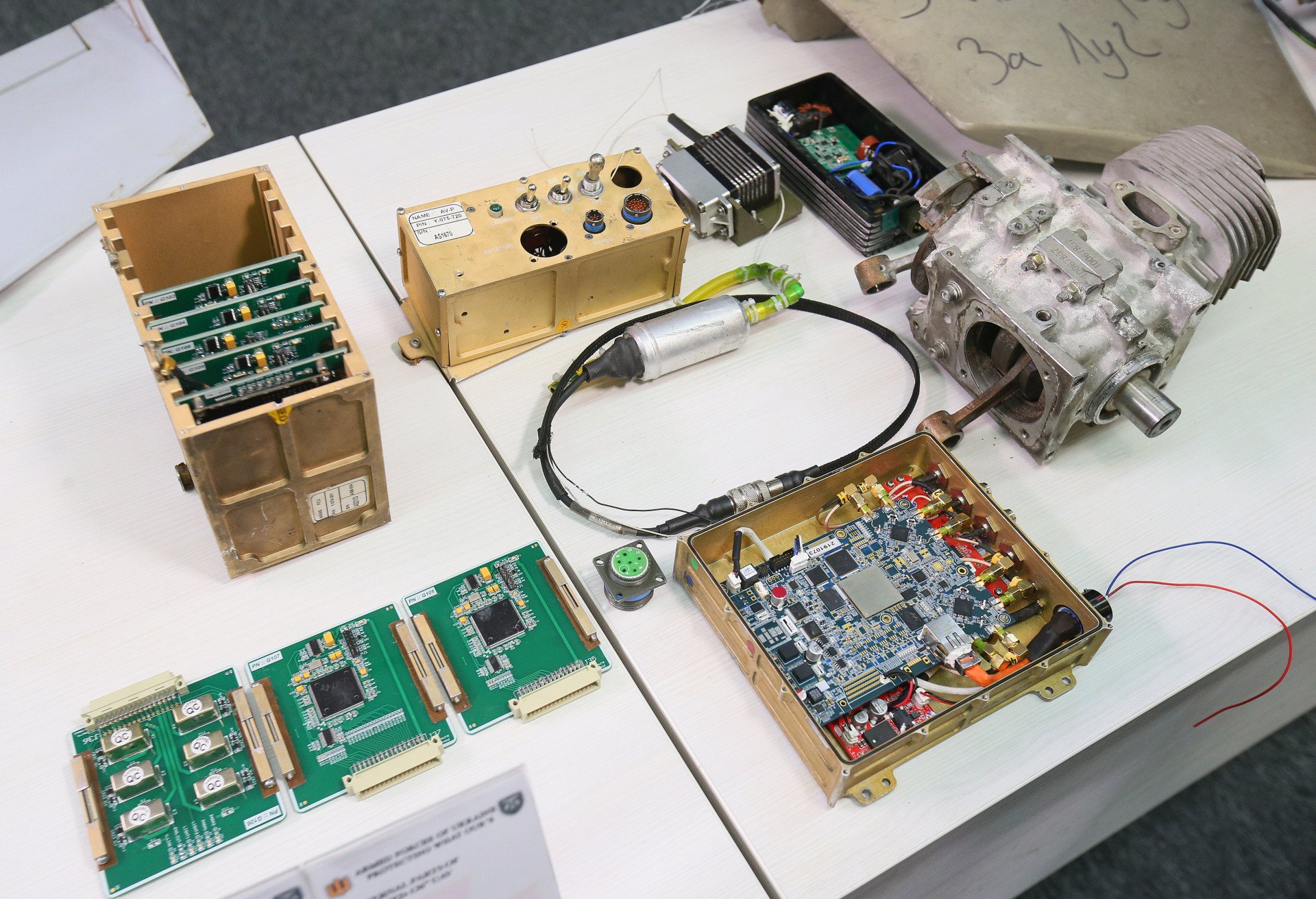

An investigation drawing on customs data, insider information, and open-source intelligence reveals that Beijing-based companies provide everything from engines to navigation systems, carbon fiber, avionics, and batteries—the essential guts of Russia’s drone fleet.

From Iran to China

Iran jump-started Russia’s Shahed program by transferring blueprints, software, and know-how. But within months, Moscow hit a wall: mass production required advanced engines and electronics that Iran couldn’t supply at scale. That’s when Chinese firms filled the gap.

Ukrainian officials estimate that in the future, Russia could launch tens of thousands of Shaheds each month—a surge made possible by Beijing. Investigators traced at least 41 critical components back to Chinese suppliers.

Who’s supplying what

A network of Chinese companies has quietly become integral to sustaining Russia’s drone production. The following examples illustrate the scale and diversity of this supply chain:

Beijing Micropilot UAV Control System Ltd. has marketed MD550 engines identical to Germany’s Limbach L550 series. Insider data show it’s more reseller than manufacturer — the real engines are built by Limbach Aircraft Engine Co., a company controlled by China’s Fujian Delong Aviation Technology;

Juhang Aviation Technology (Shenzhen) shipped $58.4 million in goods to Russia between 2022 and 2024, including L550e engines later found in downed drones;

Jinhua Hairun Power Technology sent piston kits and cylinders used in Geran drones;

Mile Hao Xiang Technology exported more than $1.5 million worth of DLE-series UAV engines, one of which was recovered from a Gerbera drone shot down in Ukraine in July 2025;

Suzhou ECOD Precision Manufacturing shipped aluminum parts that Ukrainian forces recently recovered from wreckage;

Shenzhen Jinduobang Technology supplied thousands of lithium batteries and chips — some shipments explicitly labeled for Russia’s “special military operation;”

Carbon fiber worth over $21 million arrived via Alabuga-Volokno LLC, a Rosatom subsidiary, from suppliers in China’s Jilin province.

![Inside Russia’s Secret Shahed Drone Factory Fueling the War on Ukraine]()

Russian front companies

According to Frontelligence Insight, to mask procurement, Moscow relies on intermediaries inside Alabuga:

Drake LLC imported $972,000 in engine parts and carburetors in 2024.

Morgan LLC funneled $4.8 million in goods, including batteries and GNSS antennas, through Chinese exporters.

Sollers Alabuga LLC and Alabuga Machinery LLC provide domestic manufacturing muscle, including equipment for producing Iranian-designed Nasir navigation systems.

![“Stalin Lives in Your DNA”: Russian Teens Forced to Build Drones at Shahed Factory]()

Sanctions lag, supply flows

Western sanctions have so far been patchy. Some firms are blacklisted by the US but not the EU, or vice versa. Russia exploits these gaps, routing imports through shell companies and intermediaries.

China, meanwhile, tightened UAV export rules in 2024, banning engines above 16 kW power. But loopholes remain. The MD550/Limbach L550 engine—the workhorse of Russia’s Shahed fleet—produces 37 kW, yet slipped through due to misclassified customs codes.

The Bigger Picture

Shaheds—cheap, mass-produced, and deadly—have become a cornerstone of Russia’s campaign against Ukraine’s power plants, cities, and infrastructure. Their monthly launches grew from dozens in 2022 to thousands.

China’s involvement, though often obscured, has been decisive. “Without Chinese engines and electronics, Russia’s Shahed program would collapse,” said one Ukrainian defense official familiar with the findings.

Frontelligence Insight analysts warn that unless sanctions are unified and export loopholes closed, Russia’s drone assembly lines will keep humming — sustained not by Iranian blueprints alone, but by Chinese factories.

Earlier, a Russian Shahed-136 attack drone with the serial number “Ы30000” was shot down, marking a new milestone in the scale of drone production at Russia’s Alabuga facility in Tatarstan.

The drone belonged to the Geran-2 line—Russia’s designation for Iranian-designed Shahed drones. The Cyrillic letter “Ы” in the serial number identifies it as manufactured at the Alabuga Special Economic Zone.

-111f0e5095e02c02446ffed57bfb0ab1.jpeg)