- Category

- World

Russia Is Losing Money on Jet Sales to China but Can’t Do Anything About It, Leaked Files Show

A leaked letter shows that the Russian defense industry is producing parts for Su-27 and Su-30 jets for China at a high financial cost—with component prices rising by nearly 200%—to avoid alienating Beijing and other partners.

Russia’s military and aviation manufacturing machine has been functioning throughout its full-scale invasion of Ukraine, which has surprised some. For example, the Russian defense industry has been creating and selling Su-35s to Iran and other equipment to various allies. However, according to an exclusive document we acquired, the costs the manufacturers set for some jet components are not competitive, having increased by almost 200% at a time when Russian economic stability is wavering.

The contract in question concerns China, one of Russia's larger and more reliable trading partners for military equipment. If Moscow refuses to sell these goods at the price Beijing originally expected, the China-Russia relationship could deteriorate, and Russia risks its reputation, while profits would be significantly reduced. This shows Russia is facing difficult decisions: reputation and cooperation vs profit.

What the leaked document shows

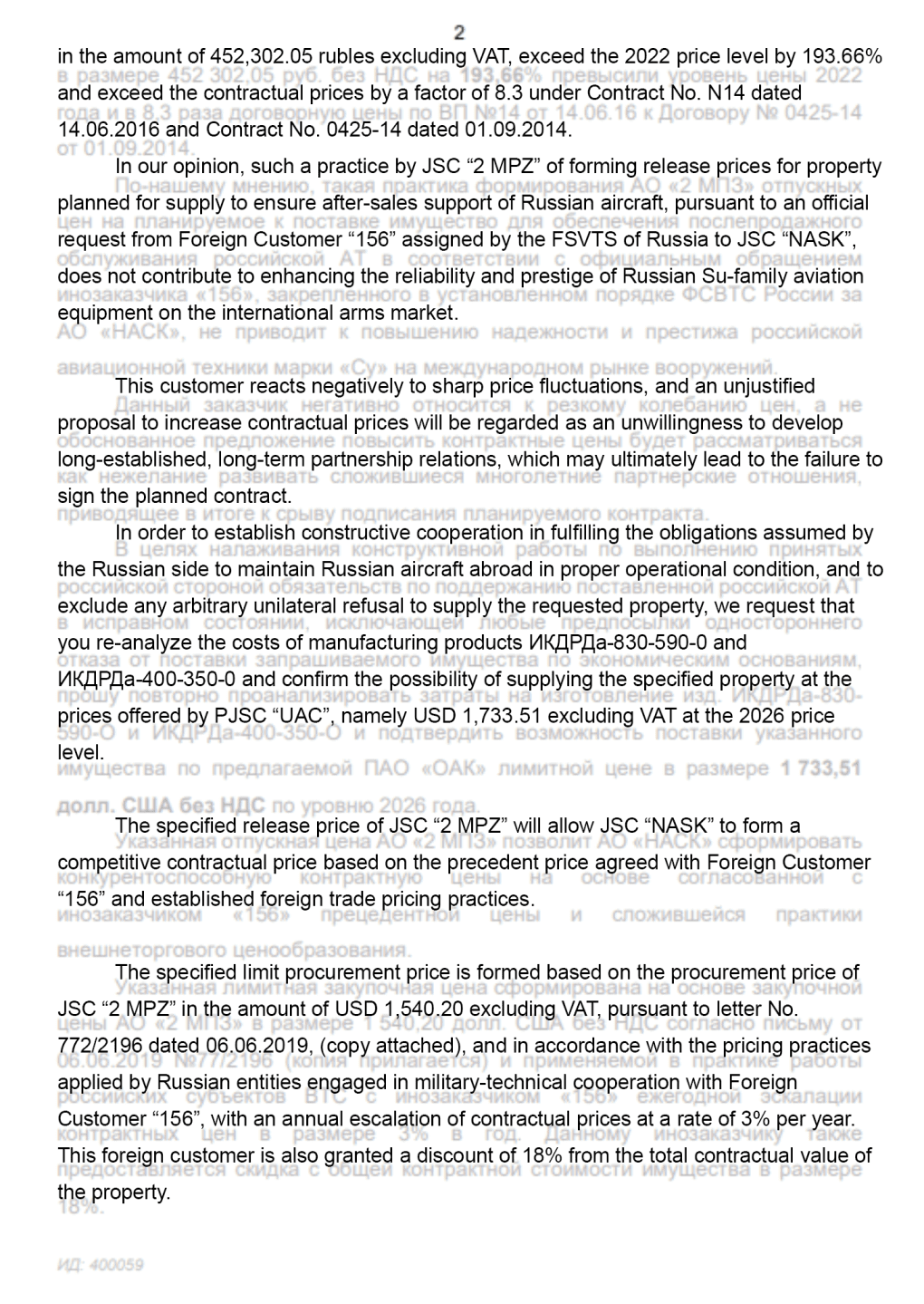

The letter we have acquired concerns a pricing dispute. It is internal correspondence, dated March 7th, 2025, from A.A. Kucherenko at the Russian state-controlled aircraft manufacturing corporation United Aircraft Corporation (UAC) to A.V. Martynenko, director of the Second Moscow Instrument-Making Plant (2 MPZ) that produces aircraft instruments and sensors.

Other bodies mentioned in the documents are the Federal Service for Military-Technical Cooperation (FSVTS), which regulates arms exports and provides oversight to the export of these parts to China, and JSC “NASK,” a Russian export logistics and intermediary company.An application was started for procuring aviation parts for Su-27 and Su-30 fighter jets as part of ongoing support for previously exported jets. The order in question is related to a contract signed on November 8, 2024, for “Foreign Customer 156.” This designation is how official Russian export documentation refers to China. The parts listed include pressure-measurement and relay systems required for the aircraft's operation and maintenance.

One key excerpt addressing the core pricing issue says the following:

“JSC ‘NASK’ informed PJSC ‘UAC’ that the release prices for the specified items, calculated on the basis of the latest procurement price of JSC ‘2MPZ’ in the amount of 452,302.05 rubles excluding VAT at the 2026 price level, do not allow JSC ‘NASK’ to prepare a competitive commercial offer that can be approved by the FSVTS of Russia and objectively justified to Foreign Customer ‘156’, taking into account the established precedent contractual price level under Contract No. SU/161564121249 dated 29.06.2016.”

Essentially, this indicates that the parts for the jets are manufactured at a higher export cost than the one set in the 2016 deal, and are no longer competitive for buyers. The document states that costs have risen by 193.66% since 2022 and have exceeded contractual prices by 8.3 times. This pricing assessment was undertaken by JSC “NASK,” meaning there’s significant oversight of the manufacturing and pricing processes.

In the document, they explain that the higher prices could risk the contract altogether, and that:

“This customer reacts negatively to sharp price fluctuations, and an unjustified proposal to increase contractual prices will be regarded as an unwillingness to develop long-established, long-term partnership relations, which may ultimately lead to the failure to sign the planned contract.”

In other words, China will likely be unwilling to continue purchasing military goods from Russia given these rising costs. The letter urges the manufacturer to reanalyze the costs and to provide the products at a lower price. The requested reduction reflects a rollback from roughly 452,000 rubles ($5,700) per unit to a level comparable to earlier pricing, a 65.7% reduction.

This decrease can only be refused if there are “objectively justified reasons for a significant increase in contractual prices previously agreed with foreign customers.” If the manufacturing facility cannot provide these reasons, then the price will be rolled back to earlier levels. Otherwise, they risk frustrating China and jeopardizing future contracts, not just with China, but globally.

Overall, the Russian military-industrial complex is forced to choose between reducing profits from the sale of military goods, even as the Russian economy struggles in many different areas, or harming Russia’s reputation and geopolitical alliances by charging the necessary prices to achieve the level of profit Russia desires.

Why Russia can’t afford to lose China

China is a key partner for Russia, and the China-Russia border is long, meaning it is strategically important for them to have a positive relationship. Financially, losing China would be devastating. Many nations that trade with Russia often do so on credit and deferred payments, such as Venezuela, which received $10 billion in loans from Russia to purchase military equipment, which Russia did not get back, and a similar scheme happened with Vietnam, and another example is Russia paying in full for Nicaragua to build military bases.

China, however, has the wealth to pay fully to Russia, meaning Russia-China defense contracts are profitable, unlike with other countries. Russia’s military exports are crucial to its war machine and economy, even if they have significantly reduced since launching its full-scale invasion of Ukraine, and further issues, especially with China, could reduce its standing globally as a major weapons exporter

Finances aside, Russia cannot lose China's support, either for trade or for diplomacy. Besides China's arms sales and other military goods, such as drone components and artillery, it provides rare metals and other goods to Russia. Likewise, Russia has often supplied military goods and resources such as LNG to China. China has usually aligned with Russia in UN votes, and both have often been united against Western governments. Generally, China is one of the more powerful allies to Russia, especially since Russia has lost its ally in former Venezuelan leader Nicolás Maduro and last year with Assad in Syria.

Russia’s military-industrial complex is not above the effects of the economic issues that Moscow is facing. Russia has been impacted by sanctions, the loss of manpower in the workforce, disruptions to oil production from Ukrainian drone attacks and sanctions, which drove the price of oil extraction and refinerment up, and other economic factors and policies. The Russian war machine may be working, but if the costs are too high to export at a profit, then Russia will have even more economic worries ahead. This is particularly the case if it continues its full-scale invasion of Ukraine.

-605be766de04ba3d21b67fb76a76786a.jpg)

-206008aed5f329e86c52788e3e423f23.jpg)

-27ef304a0bfb28cb4215e5deede4a665.png)

-46f6afa2f66d31ff3df8ea1a8f5524ec.jpg)