- Category

- War in Ukraine

Russia’s Oil Revenues Are in a Free Fall: Down $25 Billion in 2025, Crude Sells for Half Price

The sanctions imposed by Donald Trump, together with Ukrainian strikes on Russian oil refineries, are weighing heavily on the Russian economy and forcing officials to consider more drastic measures to keep it afloat.

Russian officials responsible for the budget have grown increasingly concerned in recent weeks: the country’s oil and gas sector is taking hit after hit—both literally and figuratively.

In Novorossiysk, an attack targeted port infrastructure and a terminal that handles about 2% of the world’s oil flows. Ukraine used its domestically produced Neptune missile for the strike. The next day, the Ryazan oil refinery was hit for the fifth time. Almost daily, Ukrainian long-range drones strike refineries and other oil infrastructure across Russia.

Alongside the missile and drone strikes, sanctions are hitting Russian oil as well. Over the past two months, seaborne oil shipments have dropped by 130,000 barrels per day, Bloomberg reported, while 35% of tankers loaded with Russian crude have no final destination. Roughly 350 million barrels of Russian oil are currently sitting in tankers.

Due to sanctions and logistical issues, Russian companies are being compelled to offer even deeper discounts on their crude and provide concessions to major buyers, such as China and India.

Lukoil and Rosneft face sanctions blow

US sanctions have compounded Russia’s difficulties. Following the United States' issuance of sanctions against Lukoil and Rosneft, several Chinese and Indian companies halted their purchases of Russian oil, shifting their focus toward the Middle East.

Lukoil itself is also facing trouble: the company has yet to find a buyer for its overseas assets, and Gunvor — once expected to acquire them—was blocked by the US from completing a deal due to its proximity to the Kremlin. As of now, Lukoil has no buyer, and the company risks losing assets worth roughly $22 billion (with a potential discount of 50%–70%).

Due to sanctions and continued strikes, Russia’s oil-export revenues in October 2025 fell by 320 billion rubles (about $3.94 billion), totaling 886 billion rubles (around $11 billion)—a 27% drop compared with the previous year.

In the first 10 months of 2025, the Russian budget collected 2 trillion rubles ($24.6 billion) less than during the same period in 2024 — just 7.5 trillion rubles ($92.8 billion), compared with 9.54 trillion rubles ($118 billion).

The decline is also accelerating: January-May—14%, by the end of June—17%, July—18%, August—20%, and in October—21%.

Losses are expected to deepen in November and December: Urals crude has fallen to $36.61 per barrel. Discounts on Russian crude can reach $23 per barrel compared to Brent, the largest gap since mid-2023. Meanwhile, sanctions have forced tankers to take longer Arctic routes to reach China—a detour that adds weeks to delivery times and raises transportation costs.

Debt and desperation

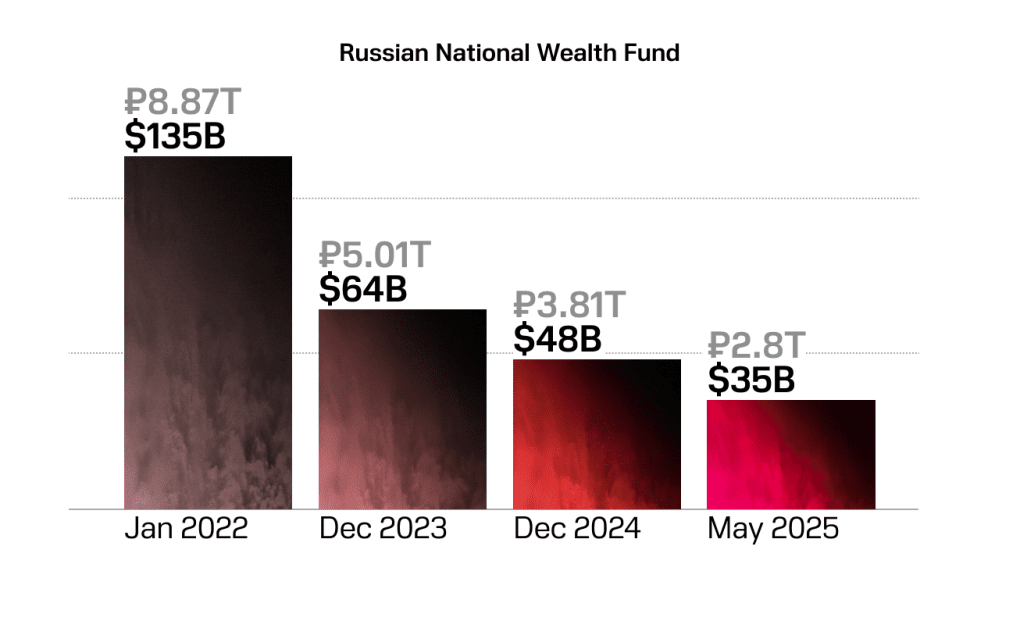

For a Russian budget built on an assumed price of $69–$70 per barrel, such a low price poses a serious threat, as raw-material revenues are the main source of funding for the war in Ukraine. Now the government must find the money elsewhere.

As the world’s most sanctioned country, Russia cannot borrow on international markets—no one is willing to lend. As a result, the country is forced to raise funds domestically, largely through its own state-owned banks.

The deficit is enormous. Initial projections for 2025 foresaw a shortfall of 1.17 trillion rubles ($14.4 billion), but by year’s end it became clear the figure would be five times higher—5.7 trillion rubles ($70.2 billion). This marks the largest budget gap in absolute terms in Russia’s history. In November alone, authorities decided to issue 2.3 trillion rubles ($28 billion) in debt during the final quarter.

Although borrowing domestically is possible, it still weakens Russia’s economy: the government plans to raise 6.981 trillion rubles (about $80 billion) in 2025, of which 1.4 trillion rubles ($13 billion) will go toward servicing existing debt — all while inflation continues to rise.

These figures do not account for the impact of Ukrainian attacks: Russian oil companies must invest in defending their refineries, allocate funds for repairs after strikes, and absorb lost profits during downtime. All of this represents revenue that does not reach the Russian budget in the form of taxes.

Sanctions and strikes on Russia’s oil infrastructure remain among the most effective tools for eroding the country’s economic capacity—limiting its ability to continue the war in Ukraine today or plan a potential offensive against Europe in the future.

-7f54d6f9a1e9b10de9b3e7ee663a18d9.png)

-29a1a43aba23f9bb779a1ac8b98d2121.jpeg)

-554f0711f15a880af68b2550a739eee4.jpg)

-f88628fa403b11af0b72ec7b062ce954.jpeg)

-605be766de04ba3d21b67fb76a76786a.jpg)

-0c8b60607d90d50391d4ca580d823e18.png)